Good night!published at 21:30

That's all for another day of Business Live - thanks for reading. We are back as ever at 06:00 tomorrow - do join us then.

Apple facing €13bn bill for unpaid taxes

Ireland and Apple to appeal EU tax ruling

US anger over 'unfair' rulings by EU Commission

FTSE and Wall Street finish with mild losses

ARM shareholders back Japanese takeover

Dan Macadam

That's all for another day of Business Live - thanks for reading. We are back as ever at 06:00 tomorrow - do join us then.

Image source, Getty Images

Image source, Getty ImagesIn the end it was more of a nibble than a bite out of Apple's shares. They finished 0.8% lower as investors digested the EU hitting Apple with a €13bn ($14.5bn) tax bill, a ruling the company says it will appeal.

The muted response from investors might have something to do with Apple's vast cash pile, which analysts estimate is close to $200bn.

"The €13bn tax bill landing on its doormat is not one to fret about," said Neil Wilson at ETX Capital. "While most companies would baulk at such a hefty charge, Apple can afford it from petty cash."

US stock markets finished with mild losses after having spent most of the day in negative territory.

Clothes retailer Abercrombie & Fitch was among the biggest fallers - plunging 20% in its worst one-day fall since 2000.

Shares in confectioner Hershey sank 11% after Mondelez - which owns Cadbury chocolate - said it was no longer interested in buying the company.

However, financial stocks did well as they stand to gain if the US Federal Reserve pushes ahead with an early rate rise. Shares in Goldman Sachs, Bank of America and Morgan Stanley rose by about 2%.

The Dow Jones finished 49 points lower at 18,454.30.

The S&P 500 index was down 4 at 2,176.12, while the Nasdaq index fell 9 points to 5,222.99.

The Financial Times leads with the suggestion that the EU has "opened the door" for European and US tax authorities to claim a share of its €13bn recovery order from Apple.

The European Commission's ruling also sets the stage for a transatlantic political tussle over the taxation of US multinationals and the EU's alleged targeting of Silicon Valley giants, it adds.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Image source, Getty Images

Image source, Getty ImagesIn other Apple-related news, a judge has dismissed the key claims in a case involving its Beats headphones business, according to Associated Press.

The lawsuit alleged that Beats co-founders Dr Dre (pictured) and Jimmy Lovine double-crossed a former partner before the business was sold to Apple for $3bn two years ago.

The allegations, filed last year, had been scheduled to go to trial next week.

Now the trial will be limited to Beats' effort to force Monster - the business of Dr Dre's former partner - to pay its attorney fees and other costs.

Image source, Waze

Image source, WazeGoogle is driving in Uber's rearview mirror with plans for its own ride-sharing service, according to the Wall Street Journal.

Starting in the autumn, the search giant plans to allow all users of its Waze navigation app in San Francisco to connect with fellow commuters.

It's already trialling the system among workers at specific firms and has hopes of expanding the service further if the upcoming scheme goes well.

In case you missed it, here's the European Commission's understanding of how Apple's European profits moved through Ireland and attracted very little tax in 2014.

Apple and Ireland have made it clear they don't think the arrangements were illegal and intend to appeal the commission's ruling.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Image source, AP

Image source, APHouse Speaker Paul Ryan is the latest senior US figure to focus on the supposed commercial impact from the Apple tax ruling.

He has called the EU's decision "awful", saying it sends the wrong message to companies on both sides of the Atlantic.

"This is precisely the kind of unpredictable and heavy-handed taxation that kills jobs and opportunity," he told CNBC.

The Republican congressman added the ruling should spur the US to fix its tax code so that American companies invest more money at home.

Image source, Reuters

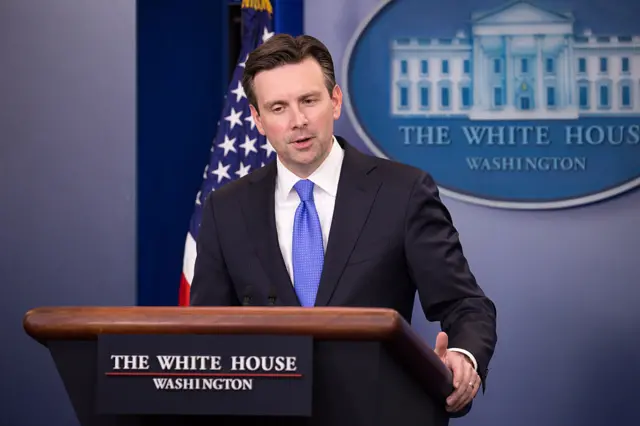

Image source, ReutersA bit more from the White House press briefing earlier.

President Obama's press secretary Josh Earnest said it's important for the US and Europe to work collaboratively on tax evasion rather than taking a unilateral approach.

On the separate issue of a massive US-EU trade deal, he said the White House still hoped to wrap up negotiations by year's end, after France and Germany called the pact into question.

Image source, Getty Images

Image source, Getty ImagesThe sale of Pinewood film studios - home to the James Bond movies - has received the go-ahead from UK financial regulators, external.

The Financial Conduct Authority waved through the offer from private equity fund PW Real Estate for the north London film studio, which was used to film parts of Spectre and Skyfall as well as some of Star Wars: The Force Awakens.

Pinewood shareholders will vote on the £323m takeover on 19 September.

Image source, Victor Martinez/Warner Bros

Image source, Victor Martinez/Warner BrosAway from the Apple story, there's some sad news on the set of the Blade Runner sequel.

A construction worker on the movie, which is filming in Budapest, has been killed in an accident. The film's production company said the worker was "underneath a platform, upon which the set was constructed, when it suddenly collapsed".

The untitled sequel, which will star Ryan Gosling, Harrison Ford and Jared Leto, is due to be released next autumn.

Chris Johnston

Chris Johnston

Business reporter

Image source, Getty Images

Image source, Getty ImagesWe warned you earlier that there could be a bloodbath when Abercrombie & Fitch shares started trading in New York.

Heading into the final couple of hours now, the retailer's shares have crashed more than 20% to $18.10 after A&F - famous for its scantily clad models - said it no longer expects like-for-like sales to improve this year.

The formerly fashionable chain reported a 4% slide in like-for-like sales - the 14th consecutive quarter of falling sales.

It also had "minor disruption" to footfall and sales at UK stores around the time of the EU referendum.

Tax specialist Jo Maugham tweets a comment from an Irish counterpart:

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Image source, Apple

Image source, AppleSurely it's mere coincidence that Apple sent out invitations to what can only be the launch of the iPhone 7 on the same day that the European Commission dropped its tax bombshell...

Image source, Getty Images

Image source, Getty ImagesWhite House spokesman Josh Earnest says it is possible that the EU order to make Apple pay €13bn in back taxes could be unfair to American taxpayers because the company might be able to claim the cost as a tax deduction in the US.

"We are concerned about a unilateral approach ... that threaten to undermine progress that we have made collaboratively with the Europeans to make the international taxation system fair," he told reporters.

Some more reaction to the Apple decision, this time from former Finnish finance minister Alexander Stubb:

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Turkey's deputy prime minister makes a play in case Apple decides to leave Cork...

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Chris Johnston

Chris Johnston

Business reporter

Image source, Getty Images

Image source, Getty ImagesIt was a good bank holiday weekend for retailers in London's West End, where footfall was 1.9% higher than last year.

Jace Tyrrell, head of the New West End Company, says the rise was largely driven by a 9.1% surge on Monday as shoppers flocked to seasonal sales.

But despite the good news, he sounds a warning: “Whilst tourists have help buoy retailers over the summer, we are seeing that domestic consumer confidence has been dented by the Brexit result. This could have a long-term impact on our retailers, which are facing increasing pressure from rising business costs such as business rates.”

Image source, AFP

Image source, AFPA quick summary of today's events in the Apple tax ruling:

Business Live reader Rob Nichols has this riposte to the comments from US Senator Charles Schumer on the EU's Apple tax ruling...

"Seems pretty rich from the Senator to call it a money grab, given the heavy handedness that non-US based finance institutions have found themselves under after the Financial Crisis, with some pretty arbitrary fines going out with little to no chance of successful appeals.

"Meanwhile the US banks effectively have state backing under "too big to fail". And let's not get started on BP and whether a US company would be paying out in the same way..."