Good night!published at 21:33 BST 2 September 2016

That's all for another day of Business Live - thanks for reading. We'll be back bright and early at 06:00 on Monday - do join us then and have a lovely weekend.

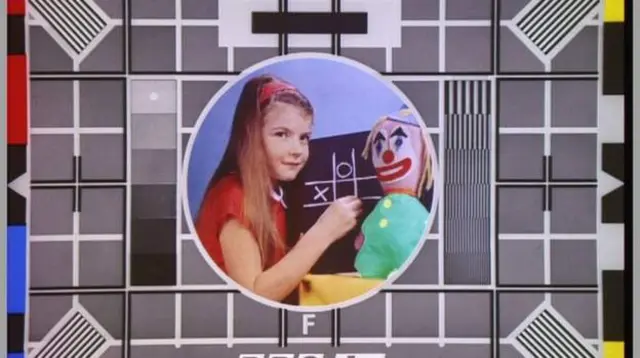

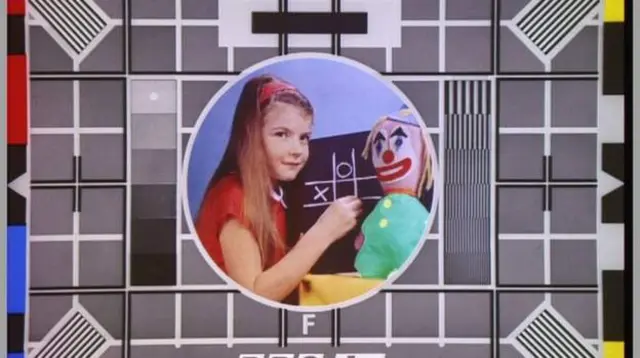

Image source, BBC ITC and Brema

Image source, BBC ITC and BremaFTSE 100 closes nears 6,900 point level

Samsung suspends Galaxy Note 7 sales

Irish government to challenge Apple tax ruling

Go-Ahead shares soar despite Southern disruption

Chris Johnston and Dearbail Jordan

That's all for another day of Business Live - thanks for reading. We'll be back bright and early at 06:00 on Monday - do join us then and have a lovely weekend.

Image source, BBC ITC and Brema

Image source, BBC ITC and BremaAllow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

The Dow Jones ended the day 72 points higher at 18,491 despite new jobs figures for August falling short of a forecast 180,000.

Stocks rose despite the number of jobs created last month reaching 151,000. Analysts predict that the US Federal Reserve will delay interest rate rises in September, possibly until December.

The Nasdaq also finished higher, up 22.69 points at 5,249 while the S&P 500 closed up 9 points at 2,179.

Image source, Bacardi Limited

Image source, Bacardi LimitedAre you extraordinarily lazy? Then, Martini has just the thing for you.

The spirits group has invented the Smart Cube, a device that is popped into a drink and, through the power of Bluetooth, lets bar staff know when you're running low and ready for a re-fill.

The ice cube-shaped gizmo also keeps tipples cool using NASA technology Aerogel.

Rather sensibly - or annoyingly - customers can only order two drinks with the Smart Cube so it looks like people will have to get up and go to the bar after all.

The device will make its debut at this weekend's F1 Gran Prix at Monza.

Bottoms up!

It has been a tough week for both Apple and Samsung. Still, there is light at the end of the tunnel for one of the smartphone giants, at least according to City commentator David Buik.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Image source, Getty Images

Image source, Getty ImagesAdel al-Jubeir, foreign minister of Saudi Arabia, the world's biggest oil producer, appeared upbeat before a meeting later this month between members of Opec.

Members of the oil producing cartel are due to meet at the International Energy Forum in Algeria where they will discuss freezing output.

He said: "We are beginning to have a meeting of the minds but it is a work in progress and we'll see what happens in the meeting in Algeria. And I'm hopefully optimistic."

Brent crude rose by 3.1% on Friday to $46.89 a barrel, reversing four days of falls. US oil prices also rose, by 3.2% to $44.54.

The US dollar staged a recovery of sorts on Friday afternoon after weaker than expected new jobs data for August weighed on the greenback.

The speculation that the US Federal Reserve will raise interest rates in December instead of September sent the dollar up 0.2% against sterling.

Image source, Getty Images

Image source, Getty ImagesBad timing or just incredibly ironic?

Samsung was demonstrating the waterproof wonders of its S7 smartphone at the IFA consumer electronics trade fair in Berlin.

The South Korean electronics giant announced earlier on Friday that it was recalling its Galaxy Note 7 after battery problems where causing the phone to catch fire.

Looks like the company was having much more fun in Germany.

Image source, Getty Images

Image source, Getty ImagesThe Dow Jones industrial average remained in positive territory despite disappointing new jobs data.

Stocks rose 45.89 points to 18,465 with energy giants Chevron and Exxon Mobil among the best performers after weaker than expected jobs growth for August weighed on the dollar to make commodities cheaper.

The Nasdaq was trading up 11.9 points at 5,239 while the S&P 500 rose 5.9 points at 2,176.

Image source, Getty Images

Image source, Getty ImagesIt is all go in Hangzhou as the City readies itself for the arrival of the leaders from the G20 nations for the start of the summit.

The meeting in China is Theresa May's first as the UK's prime minister and comes at a interesting juncture in Sino-British relations.

The government decided in July to conduct a review of a plan to build an £18bn nuclear reactor at Hinkley Point in Somerset.

The Chinese are providing a third of the financing of the reactor which is being built by France's EDF. The review could cause further delays to the project which, when first mooted in 2007, was supposed to be producing energy by 2017.

World leaders will also use the summit to grill Ms May on Brexit and its implications.

Even the BBC makes mistakes sometimes. Lots of readers got a breaking news alert in Bengali late this afternoon, sparking fears that the site had been hacked.

Predictably, the explanation is somewhat more mundane: human error. The article was about a police raid on militants in Dhaka, by the way.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Image source, Reuters

Image source, ReutersThe number of privately owned TV networks in Greece has been halved to four after a government auction of new licences.

A public auction of just four licenses has raised €246m (£206m) for the government, led by Alexis Tsipras.

Only two existing broadcasters, Skai and Antenna, have survived, while the Star and Alpha TV stations failed in their bids.

The new licences start in 90 days following the controversial auction.

Markets on the continent have also enjoyed a strong end to the week, with the CAC in Paris jumping 2.3%, while the Dax in Frankfurt added 1.4%.

Meanwhile in New York things aren't quite as rosy, with the Dow 0.2% higher, the S&P 500 and the Nasdaq both up 0.25%.

Image source, Getty Images for Paramount Pictures

Image source, Getty Images for Paramount PicturesThe Competition and Markets Authority (CMA) has announced that it is taking a look at Cineworld's acquisition of five cinemas from the Empire chain.

Cineworld's additions include the Empire Leicester Square, which was recently overrun with "Trekkies" at the UK premiere of Star Trek Beyond (pictured).

The deal was completed last month, but the CMA wants to give it the once over, presumably to make sure film lovers are getting value for money.

The initial assessment should take place within 40 days. If the CMA has any concerns, it may then decide to do an in-depth investigation - although they are rare these days.

Business correspondent Joe Lynam tweets:

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Image source, Getty Images

Image source, Getty ImagesJawaid Afsar, senior trader at Securequity, says: "Today's jobs data has raised expectations that a US rate hike could be delayed. A weakness in the dollar following the payroll numbers has helped commodities, which have a heavy weight on the benchmark FTSE 100 index."

Commodities shares were in demand after prices of gold, oil, copper and nickel advanced following a fall in the dollar after the US jobs data. A weaker US currency generally makes dollar-priced commodities cheaper for other currency holders and in turn raises demand.

The UK mining index rose 2.5 percent, boosted by rallies of between 2% and 3.8% in Fresnillo, Anglo American, Randgold Resources and Glencore. The UK oil and gas index was up 1.9% as Shell and BP both added about 1.6%.

The FTSE 100 has posted a storming end to the week with its 150 point rise. The London market was aided by disappointing job figures in the US that send the dollar lower.

Punters also turned to companies that are considered "good dividend payers", according to Augustin Eden, analyst at Accendo Markets, including Hikma Pharmaceuticals, which led the FTSE 100 gainers to close up 4.8% at £21.78.

Cruise operator Carnival, on the other hand, led the fallers to end the day down 4.3% at £35.08 after a downgrade by Morgan Stanley.

Housebuilders also made up the main fallers on the FTSE 100 following a dire outlook by McCarthy & Stone.

The London blue-chip index has ended the week 2.2% higher at 6,894 points.

The pound is also having a decent day, up 0.25% to $1.3299.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Image source, Getty Images

Image source, Getty ImagesHow exciting - a new perfume range! Scent obsessives have the house of Louis Vuitton to thank for a new olfactory delight.

But perhaps what is more interesting is what this says about Louis Vuitton-owner LVMH. The company, which also owns brands including Christian Dior and Givenchy, is trying to balance falling demand for high-end luxury products by appealing to middle income customers without tarnishing its lofty reputation.

It is Louis Vuitton's first perfume since the merger in 1987 that created LVMH. It has given star "nose" Jacques Cavallier-Belletrud four years to come up with the goods.

However, at €200 a pop the new scent, which is called nonsense like "turbulences" and "matiere noire", remains something of a luxury. The rest of us will have to settle with stealing surreptitious squirts of the scent in department stores.