Postpublished at 21:30

That's it from the Live page today. Set your alarms so you can tune in again from 06:00 tomorrow.

Hinkley Point nuclear project in southern England approved

China and France will finance the new power station

UK government will take 'special stake' in nuclear plants

France's EDF and China's CGN welcome new deal

Unions back decision, but Labour and climate groups are critical

Bank of England upgrades UK growth

Russell Hotten

That's it from the Live page today. Set your alarms so you can tune in again from 06:00 tomorrow.

Image source, AFP

Image source, AFPWall Street ended sharply higher, buoyed by Apple's best four-day run since 2014, higher oil prices, and mixed economic data that further dimmed expectations for an interest rate rise next week.

At the closing bell the Dow Jones was up 178.47 points, or 0.99%, to 18,213.24 points, the S&P 500 had gained 21.52 points, or 1.01%, to 2,147.29, and the Nasdaq had added 75.92 points, or 1.47% to 5,249.69.

Apple shares rose 3.8% and are up 12% this week.

Fiat Chrysler is recalling 1.9 million cars for a problem that could prevent the airbags from deploying, a defect tied to at least three deaths.

The cars comprise 1.4 million in the US, 143,000 in Canada, and the rest in other countries. Models involved include the Chrysler Sebring, Chrysler 200, Dodge Caliber and Avenger, and Jeep Patriot and Compass from varying model years between 2010 and 2014.

The recall also includes models marketed in other countries as the Chrysler Cirrus and Lancia Flavia. The company said a fault in the "occupant restraint-control module and a front impact sensor" could cause the airbags to not deploy and seat-belt tensioners to malfunction in an accident.

Rob Young

Rob Young

Business presenter

The US banking industry has written to US Treasury Secretary Jacob Lew asking him to talk to the UK and EU Brexit negotiators before substantial talks begin.

The letter says: “US policymakers have a legitimate stake in how the process is managed and the outcome to which it leads."

It adds that Brexit's “consequences are likely to be significant and far-reaching”. The letter is signed by the American Bankers Association, Financial Services Forum SIFMA, and Financial Services Roundtable.

It says: "The relationship between the EU and the UK therefore is of critical importance to the US which has a strong interest in how the future relationship is redefined and in the certainty, stability and transition components of the path to implement the new trade and investment relationship.”

The signatories call for “a transition period that will provide firms with ample time to navigate and adapt to any institutional or legal changes underpinning well- established inter-EU/UK trade and investment relationships".

Image source, VW

Image source, VWInvestment giant Blackrock has joined a lawsuit of Volkswagen shareholders demanding €2bn over the German carmaker’s diesel emissions scandal.

Some 80 investors are expected to file a case against VW in the company's home state, Lower Saxony.

It was revealed last year that diesel engines had software that could lower emissions data during tests.

Blackrock, one of VW's top ten biggest shareholders, said in a statement: "On behalf of their investors, a number of BlackRock-managed collective investment schemes are pursuing, alongside other institutional investors, legal action against Volkswagen AG in connection with Volkswagen's failure to disclose to investors its use of "defeat devices" that manipulated emission tests.

"In light of the ongoing legal proceedings we cannot comment further on the matter at this point."

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Image source, AFP

Image source, AFPIt's the battle of the bureaucrats.

European Commission President Jean-Claude Juncker has hit out at his predecessor Jose Manuel Barroso's (above) decision to work for Goldman Sachs because of the firm's role in the global financial crisis.

Barroso's appointment in July as a non-executive chairman at the US investment bank caused a furore in the EU. French President Francois Hollande deemed it "morally unacceptable", and 140,000 people have signed a petition.

Juncker said in an interview on a YouTube channel that he had "no problem for him to take a job in a private bank, but not that one".

"Goldman Sachs," he said "was one of these outfits which contributed, wittingly or unwittingly, to the emergence of this enormous financial and economic crisis during the years 2007, 2008 and 2009."

According to the AFP news agency, Barroso has written to Juncker accusing Brussels of discrimination and deplored claims that "the mere fact of working with Goldman Sachs raises questions of integrity".

With apologies to Jan (see previous post)

Image source, Getty Images

Image source, Getty ImagesA Live page reader, Peter Brooks, argues that Hinkley C may be a good financial deal.

"It is interesting how many people latch on to the tariff of £92 per MWh agreed between the government and EDF yet do not mention the current tariff of £100 + "system price" given to offshore wind farms."

"This week with long periods of hot weather the "system price" exceeded £200 per MWh due in part to the inability of wind generation to supply the grid.

"In this context the price for nuclear power (which is not affected by weather) seems a bargain," he says.

A disgruntled reader called Jan fires the Live page a quick email: "For goodness sake give Hinkley a rest! The business pages today have been rubbish because of it!"

We apologise most humbly and deeply.

The Guardian newspaper is reportedly cutting 30% of its news jobs in the US, amounting to about 50 staff at its online operation there.

According to the Politico website, external the cuts are due to low advertising sales and the fact that income would not be enough to cover current costs.

Image source, AFP

Image source, AFPIn Canada, a public row between the giant supermarket chain Walmart and the Visa credit card company has escalated.

Walmart Canada says it will stop accepting payments via Visa credit cards at its 16 stores in the province of Manitoba, starting from 24 October.

The two sides have been in dispute for some months about the fees that Visa charges to Walmart for using its cards.

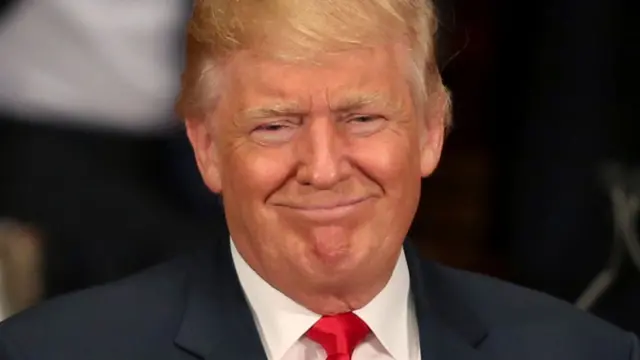

Image source, AP

Image source, APDonald Trump has decided to take part in the financial world's most tedious guessing game: when will the US central bank (the Federal Reserve) raise interest rates?

The Republican presidential nominee told the New York Economic Club that "I think you're going to have low interest rates until the end of the year, maybe no increase at all."

"And the market will stay artificially high and we'll have to see what happens," he added.

Now we know.

A block of flats in Poundbury village in Dorset, the architectural project of Prince Charles, is attracting attention.

The block of luxury flats is called Strathmore House and some locals and newspapers have compared it to Buckingham Palace.

So what? Well, the eight flats in the block sold out soon after the building was completed.

Image source, Reuters

Image source, ReutersSome academics at University College London suggest that building Hinkley C will probably be a waste of money, external.

They say that it will be be "outpaced by cheaper, lower-carbon energy sources that will render it largely obsolete within a decade of opening".

Why, exactly?

"The analysis, based on National Grid’s own energy scenarios, shows that by 2030 wind and solar energy sources will, for increasing periods of the year, be meeting all the UK’s electricity needs," they say.

"With Hinkley not expected to being operating until well into the 2020s, the plant is likely to be directly competing with more environmentally-friendly, and often much cheaper, energy sources," they add.

Laura Kuenssberg

Laura Kuenssberg

BBC political editor

What was the delay to Hinkley really all about? Those close to the deal that was originally agreed say you can hardly tell the difference between the two.

Image source, Getty Images

Image source, Getty ImagesDonald Trump says he would set a national goal to achieve 4% annual economic growth if he wins the US presidential election in November, Reuters reports. Trump said in a speech in New York that his economic team believes his plans to cut taxes and regulations would allow the economy to grow at a rate of 3.5% and create 25 million new jobs over a decade.

He also proposed cutting non-defense spending each year by 1% of the previous year's total. He said the plan would not touch programs like social security and medicare.

It's been a good day for Morrison's shares, with the supermarket's turnaround continuing to boost profits and sales. The share price, up 7.49%, was the FTSE 100's main riser. It also boosted Tesco, which finished 4.9% up.

The FTSE 100 closed up 56.99 points, or 0.85%, at 6,730.3. Next fell 4.86% after reporting a profits dip. That hit Marks & Spencer, down 2.6%.

Government approves Hinkley Point deal

Former energy minister Lord Howell says worries about whether China will be a good nuclear partner are overdone. It's France's EDF we should worry about, he tells the BBC.

"Chinese technology is going to be a part of our life, Chinese ownership and assets are already present in this country in quite a large way. That's the future, we can't escape that.

"The real risks are that EDF's financial affairs are wobbly, its supplier's affairs are wobbly, the design has never yet worked anywhere, it's a design that's unproven. And we are going to be really in unknown territory as we build this thing."

BBC business presenter tweets:

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Image source, Reuters

Image source, ReutersStart and stop buttons in the turbine hall inside EDF Energy's Hinkley Point B Power Station

Some of our readers take a very dim view of the approval for the Hinkley project in Somerset.

"£6,000 per kW is a ridiculous amount of money to spend building a power station", says Bill Bullen from energy firm Utilita Energy.

Derek Ruskin calls it a "gob-smackingly, short-sighted, incompetent decision".

Jim Rosser, from Witham Friary in Somerset (too close for comfort, he says), is "very sad at this terrible decision which will cost every taxpayer dearly for 50 years and more".

John Bailey foresees four possible outcomes: "The project will go so over budget and late both EDF and the Chinese will pull out and it will not be completed. EDF could go broke before it is completed.

"The reactor will not pass safety standards (as in France), so will not go into operation. If it works the British public have been sold the worst possible deal by George Osborne and will be paying over the odds for years."

And Alex Beer, who lives in the South West, says: "This project is a complete waste of money, which could have been better spent on renewable energy projects. By the time this is built Theresa May will be happily spending her retirement. Our children will be footing the bill and our grand children clearing up the mess."