Getting stories...published at 21:30 BST 22 September 2016

BBC business reporter Jamie Robertson - signing off

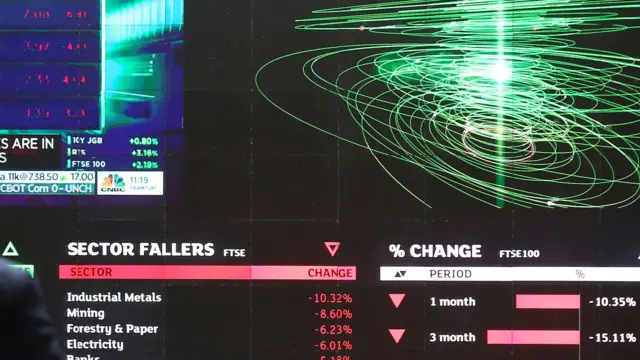

Been a busy afternoon getting business stories: Airbus getting a beating from the WTO, Yahoo getting hacked, the Brazilian former foreign minister getting arrested and the FTSE getting close to 7,000 - oh,and Jack Lew getting upset about the EU taxing what he thinks the US ought to be getting. Anyway I'm getting tired - what's more I meant to be getting in at 6 am tomorrow for Business Live on the News Channel. So - I'm. well, I'm getting out of here....