Postpublished at 21:30 BST 13 October 2016

That's your lot on the Live Page for today. We can all sleep soundly knowing our supplies of Marmite are safe.

Please join us again from 06:00 tomorrow.

Tesco and Unilever resolve product dispute

Young could get early access to pension

MPs to vote on Sir Philip Green knighthood

Lord Wolfson offers £250,000 prize for solution to congested roads

Russell Hotten

That's your lot on the Live Page for today. We can all sleep soundly knowing our supplies of Marmite are safe.

Please join us again from 06:00 tomorrow.

US stocks slipped on Thursday, led by declines in financial shares and following weak Chinese economic data. But a late-day rebound in oil prices limited the day's fall, and the Dow Jones and S&P 500 recovered after coming close to three-month lows.

The Dow ended 0.25% down at 18,099.35 points, and the S&P lost 0.31% to 2,132.59. The Nasdaq dropped 0.49% to 5,213.33.

Technical analysts at HSBC are getting gloomier about the future of US share prices. There's now a high chance of a "severe fall".

In a new research note, Murray Gunn writes: "With the US stock market selling off aggressively on October 11, we now issue a RED ALERT. The possibility of a severe fall in the stock market is now very high."

He sees similarities between recent trading patterns and those just prior to the 1987 Black Monday stock market crash.

Image source, Getty Images

Image source, Getty ImagesVerizon Communications says Yahoo's massive data breach could have a "material impact" on its plans to buy internet search company.

Verizon's general counsel Craig Silliman told reporters the hacking could trigger a clause in the deal that would allow it not complete the $4.83bn takeover.

"I think we have a reasonable basis to believe right now that the impact is material and we're looking to Yahoo to demonstrate to us the full impact. If they believe that it's not then they'll need to show us that," he said.

Yahoo disclosed last month that some 500 million email accounts were hacked.

According to a Reuters report, a Yahoo spokesman said on Thursday: "We are confident in Yahoo's value and we continue to work towards integration with Verizon."

BBC sports editor tweets:

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Image source, PA

Image source, PAThe bells at York Minster have been silenced until 2017 after the volunteer ringers were told their services were no longer required.

A spokesperson said a fully-trained professional team would be recruited to start in the new year.

The Dean of York, the very reverend Vivienne Faull, explained what she hoped the new team would bring: "Fresh blood, and impetus and energy and a determination to work with all of us to make sure that the bells are sounding wonderful, are maintained wonderfully, as they have been."

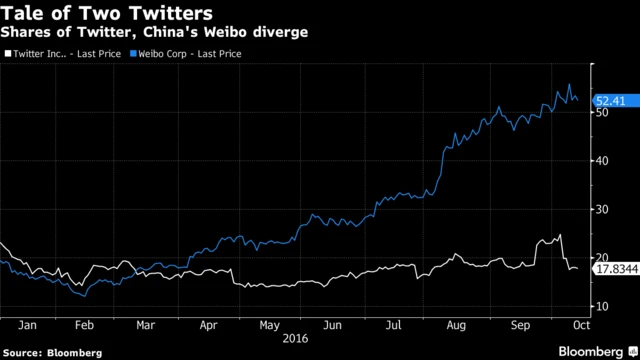

Twitter is being outpaced by its Chinese equivalent

Image source, Bloomberg

Image source, BloombergWhile Twitter's stock has fallen 20% this year, its Chinese equivalent Weibo has soared 175%, Bloomberg reports, external.

What's more, at about $11bn, the Beijing-based social media platform’s market capitalisation is now fast approaching Twitter’s $12.6bn.

The reason? While both micro-blogging sites make their money from advertising, Weibo enjoys unrivaled dominance in the Chinese market, while Twitter faces growing competition from the likes of Snapchat, Instagram and Facebook.

In addition, foreign players can’t easily enter the Chinese market due to strict censorship laws, which further benefits Weibo's growth.

The S&P 500 and the Dow Jones indexes touched three-month lows on Thursday, dragged down by weak Chinese economic data and a potential US interest rate hike by the end of the year.

Shares are recovering in late-afternoon trading, but were initially hurt after data showed China's exports fell 10% in September, far worse than the markets had expected, while imports unexpectedly shrank, reviving concerns about the health of the world's second-largest economy.

The Dow is currently down 0.16% at 18,115.5 points, having earlier fallen below 18,000. The S&P 500 is 0.2% lower at 2,134.9.

A spokesperson tells the BBC...

Image source, Getty Images

Image source, Getty ImagesQuote MessageWe always put our customers first and we’re pleased this situation has been resolved to our satisfaction

Unemployment benefit claims in the US held at a 43-year low last week, while price deflation eased, Reuters has reported, external.

The statistics show the gathering strength of the US labour market and inflation, and support the expectation of an interest rate hike in December.

It comes after minutes from the last US Federal Reserve meeting, published yesterday, showed its decision to keep interest rates unchanged in September was a "close call".

According to the memo: "It was noted that a reasonable argument could be made either for an increase at this meeting or for waiting for some additional information on the labour market and inflation."

US stocks have recovered slightly but are still down on the day after nearing one-month lows earlier. Weak economic data from China and the prospect of an interest rate hike by December have spooked investors, market watchers said.

In early afternoon trading, the S&P 500 was down by 9.74 points, or 0.45%, to 2,129.63, while the Nasdaq was down 33.76 points, or 0.64%, at 5,205.26.

The Dow Jones meanwhile had shed 78.82 points, or 0.43%, at 18,065.38.

Bank's still performing badly, with Wells Fargo down by around 1.8%, JPMorgan Chase down 1.5% and Goldman Sachs down 1.7%.

BBC journalists tweet:

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Unilever has just released this statement: "Unilever is pleased to confirm that the supply situation with Tesco in the UK and Ireland has now been successfully resolved. We have been working together closely to reach this resolution and ensure our much-loved brands are once again fully available. For all those that missed us, thanks for all the love."

No word yet from Tesco.

BBC business presenter tweets:

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Tom Espiner

Business reporter

Image source, Getty Images

Image source, Getty ImagesDavid Miller, a brand manager for Marmite in the 1970s, says he's very surprised Marmite has been one of the products at the centre of the wholesale price negotiations between Unilever and Tesco.

Back in the day, Marmite's gross margin (the revenue minus the cost of the goods sold) was 80%, he says. "It was always the most enormously profitable [product]."

The main constituent of Marmite is brewers' yeast. The reason the Marmite factory is located in Burton-on-Trent is because there used to be a vibrant beer industry there, he says.

Although the beer industry is no longer as big, there are still plenty of brewers in the UK, Mr Miller says. "I can't believe they [Unilever] are importing brewers yeast," he added.

Image source, Getty Images

Image source, Getty ImagesThe benchmark FTSE 100 index closed down 46.27 points to 6,977.74, with miners among the biggest casualties.

Shares in Rio Tinto fell 4.8% and BHP Billiton slid 4.4% after Citi cut its rating on both companies to "sell" from "neutral".

But there was better news for housebuilders. Persimmon rose 1.9% and Barratt gained 1.9% after a survey from the Royal Institution of Chartered Surveyors suggested demand had seen a modest recovery.

Tesco and Unilever, in a dispute over product prices, fell 3% and 3.4% respectively.

The pound remained under pressure on the currency markets as worries over the UK's Brexit strategy persisted. Against the dollar, the pound was 0.3% lower at $1.2204, and 0.3% lower against the euro at €1.1055.

Image source, Getty Images

Image source, Getty ImagesFootball club Chelsea has agreed "a partnership" with Nike from next year in a deal that media reports suggested could be worth £60m a season. Without giving financial details, Chelsea said it represented the largest commercial deal in the Premier League club's history.

"Nike will produce strips for the first team, academy and ladies teams, as well as a full range of clothing for Chelsea's millions of supporters around the world," the club said in a statement.

Chelsea's current kit is produced by Adidas, which said in May it had reached a mutual agreement to end its deal on 30 June next year, instead of in 2023 as originally agreed.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Caroline, Cumbria:

Household staples? Ben & Jerry's and Pot Noodles? Brexit or not, prices change, and OK there may be an impact but surely these are things we can live without or consider as treats or luxuries. Plus, for the many other products there are alternatives. I am a big believer of buy British and buy local. Staples to me is the food we put on the table. We get meat from a butcher and veg from a grocer, etc. Often it can be slightly more expensive but they taste a lot better and we waste very little.

Paul Illingworth:

I do think a lot of this regarding the "brexit" is a bit of a scapegoat to raise prices, as everywhere else in the world manages perfectly fine without EU and prices are lower than UK. I think the EU-inners need to stop scaremongering and everyone needs pull together and get on with it. This another example of companies' greed! Nothing more.

Chris Gravett , Arlesey:

Marmite - 100% produced (Burton) and ingredients sourced in UK. Cost not impacted by £ exchange rate. Unilever profiteering on false Brexit fears.

John Wilkinson, Kettering

Other brands are also available for most of these products. Looks like Unilever needs to review its supply chain strategy to put more of the value-add in the UK.

Keith Davis, Evesham:

Great to see a retailer standing up for our interests rather than just passing on price increases and blaming foreigners, migrants, bankers or whoever else is unpopular at the time. Obviously, as consumers we should do the same when prices increase or the same price buys you less. Only then are companies forced to look for the productivity increases which ultimately are responsible for any increased standard of living.

Andy Ross, New Malden:

What's all the fuss about? I run my own shop and more or less every supplier has informed me of price increases since the Brexit referendum. I can't refuse to stock their products (as I have to sell something), but do have to compete with Tesco's, who already hold suppliers to ransom over the pricing of their products. Price increases are an inevitable part of business, be it supply and demand related or pure cost of manufacture and shipping. Why are we promoting Tesco's yet again. They have put more than enough nails in High Street coffins over the years and now want to cry about not getting their way. I hope Unilever stand by their brand principles and pricing structure!

Jamie, Hull

The simple way is to examine the product label, if it has Unilever on then just put it back on the shelf. Or, pay the increase and feed the fat cat(s). Democracy is yours to exercise as you see fit.

Rebecca Wilson, Birmingham

Good for Tesco for standing its ground and not giving it to the demands of Unilever.

Lord Wolfson, Next's chief executive, says the decline in the pound "inevitably" means there will be some inflation in the UK next year.Speaking at the launch of the Wolfson Prize, which is looking at ways to solve the problem of the UK's overcrowded roads, he told the BBC's economics editor Kamal Ahmed the key thing was to come up with ways to counter inflation.