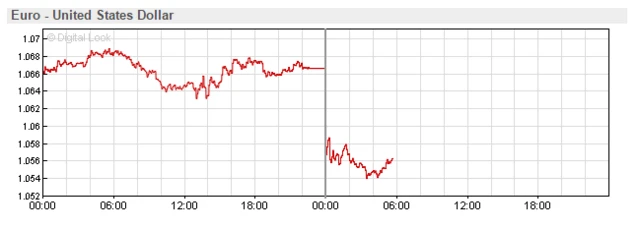

‘No’ vote 'already priced in'published at 08:25 GMT 5 December 2016

Neil Wilson of ETX Capital says that, so far, it’s been a "fairly orderly response from the markets to Italy’s referendum result".

Quote MessageThe FTSE MIB opened over 2% lower but is still well within its recent trading range. Italian banks are sliding 4-5% as they come under the most pressure, as expected. A ‘No’ vote had already been priced in although the scale of the defeat for Matteo Renzi has surprised and leads to the prospect of fresh elections next year. A new election brings with it the prospect of anti-EU, anti-Eurozone parties coming to power and all that could mean for the single currency. At present however it doesn’t look like the markets are seriously considering Italy’s future in the Eurozone is in any doubt.