Good night!published at 21:30 GMT 12 January 2017

That's all we have time for today on Business Live, but fear not - we are back bright and early at 06:00 Friday. Do join us then and thanks for reading.

Get in touch: bizlivepage@bbc.co.uk

FTSE 100 scrapes another higher close

M&S beats Christmas sales forecast

Tesco hails 'strong progress'

Lloyds suffers online banking problems for a second day

Chris Johnston

That's all we have time for today on Business Live, but fear not - we are back bright and early at 06:00 Friday. Do join us then and thanks for reading.

Image source, Getty Images

Image source, Getty ImagesFlats now make up a quarter of all housing in the UK after a big increase in recent years, according to a "study" by the Royal Mail. It finds there was an 18% rise in "multiple residencies" added to its postcode address file last year.

London has the most flats with 1.8 million, followed by Scotland with 971,000 and the South East with 824,000, according to the report.

Kensington and Chelsea in west London has the most expensive multiple residencies, with the average flat costing £1.16m - more than 26 times the UK's lowest average in Blaenau Gwent, south Wales, the study found.

Image source, Getty Images

Image source, Getty ImagesAll three of the main US share indexes ended lower on Thursday.

The Dow Jones closed at 19,891.00, a fall of 63.28 points or 0.3%.

The S&P 500 was down 0.2% or 4.88 points at 2,270.44.

And the tech heavy Nasdaq finished at 5,547.49, a fall of 16.16 points or 0.3%.

It seems investors were disappointed by the lack of detail on economic policy in President-elect's Donald Trump's big speech on Wednesday.

They had been hoping for some clues as to any economy boosting tax cuts or infrastructure spending he might be planning, but he gave nothing away.

A restaurant run by Levi Roots, a former Dragons' Den winner, is the latest to be accredited as a Living Wage employer, with staff being paid above the statutory rate.

About 50 employees of the Levi Roots Caribbean Smokehouse in east London will receive the voluntary wage of £9.75 an hour - well above the National Living Wage of £7.20.

Living Wage Foundation director Katherine Chapman said nearly 3,000 organisations now want to pay more than the legal minimums because they recognise the value their staff add to the organisation, and the difference the real Living Wage makes to people's lives. "We hope Levi Roots' example will encourage many more restaurants to sign up," she said.

Roots, who won the TV competition in 2007, said he planned to open more restaurants.

Image source, Getty Images

Image source, Getty ImagesLily, the company behind an autonomous camera drone that had amassed $34m (£27m) in pre-orders, has announced that it is shutting down.

In an email to customers the start-up said it had failed to raise additional funds to start production of the drone.

It promised to reimburse all pre-order customers within the next 60 days.

A foreign exchange dealer who specialised in central and eastern European, Middle Eastern and African currencies has pleaded guilty to conspiring to fix currency prices, the US Department of Justice said.

It identified the trader as Christopher Cummins, but said only that his employer was a New York-based financial institution.

He is the second trader to admit guilt in the probe. The first was Jason Katz, a former trader at Barclays who later worked at BNP Paribas, who pleaded guilty on 4 January.

Image source, Getty Images

Image source, Getty ImagesThe pound has lost ground against the dollar after Downing Street said Theresa May will give a speech next week on her Brexit plans. There are fears the prime minister is charting a course for a "hard Brexit" from the EU.

Sterling is down just over 0.3% at $1.2170.

"If you were to look back at recent performances, it's rare that [May] has said anything that's been taken positively, so the risk - if you had to go one way or another - is that she again pushes the market in the direction of a relatively hard exit, which is not a positive for the currency," said RBC Capital Markets currency strategist Adam Cole.

Back to the Fiat Chrysler story for a moment courtesy of business correspondent Theo Leggett:

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Image source, Getty Images

Image source, Getty ImagesM&S shares finished 1% higher at 343.75p after its reasonably good Christmas trading.

But Phil Dorrell, partner at consultants Retail Remedy, says the focus on a strong performance in general merchandise at M&S has distracted from less stellar growth.

"Fortunately for M&S, with the big clothing and home headline, attention has been diverted from food. A soft growth in food stands out after some excellent progress from Tesco, Morrisons and the discounters.

"Other food retailers have taken inspiration and are challenging M&S for its position on food. To retain its position M&S will need to reassert its quality and innovative range. One to watch in the next quarter."

Image source, Getty Images

Image source, Getty ImagesJapan's Takata is expected to agree to plead guilty to fraud charges as early as Friday as part of a $1bn settlement with the US Justice Department to resolve the government's investigation into deadly air bag ruptures, according to Reuters.

The settlement is also expected to include compensation to some victims and car makers, which have been forced to recall vehicles with the defective inflators.

Takata air bag inflators have been linked to at least 16 deaths worldwide, including 11 in the US.

Regulators have said recalls would eventually affect about 42 million US vehicles, with nearly 70 million Takata air bag inflators, making it the largest safety recall in US history.

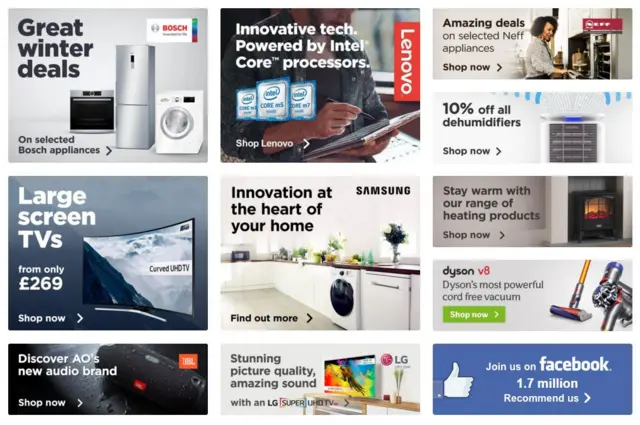

Image source, AO World

Image source, AO WorldNot a good day for AO World. Shares in the online electrical goods retailer ended almost 12% lower after telling investors it was "cautious" about the final quarter, "given the uncertain UK economic outlook, currency impacts on supplier pricing and the possible effect on consumer demand".

Verdict Retail analyst Zoe Mills remains optimistic about its prospects, however: "While growth has slowed considerably since last year, AO is still gaining significant market share in a sector that has been in decline for the majority of 2016."

A new savings product has been branded a "dangerous distraction" that could undermine pensions, in the Lords.

Tory former pensions minister Baroness Altmann said the government was "on the cusp of a major success" in extending pensions coverage to millions of people. However, it risked "snatching defeat from the jaws of victory" with plans for a Lifetime ISA, (Lisa), she warned in second reading debate on the Savings (Government Contributions) Bill.

The Bill, which has already cleared the Commons, includes the new product, which will give people saving for their first home or retirement a 25% bonus on up to £4,000 a year.

Lady Altmann said she feared the Lisa could "derail" the auto-enrolment pension scheme, introduced to encourage more to save for their retirement. "It is a dangerous distraction that could undermine pensions and increase future poverty," she said. By "masquerading as a pension" the product risked becoming "a new mis-selling scandal" in the coming years.

More than 500 jobs are to go at Kwik Fit Insurance Services in North Lanarkshire, after attempts to find a new operator failed.

Staff at the Uddingston contact centre were told it will close on 31 March.

Owner Ageas said it had suffered the consequences of a change in the way people buy insurance.

After closure plans were set out in November, a team involving the council and government agencies sought to find a way of keeping the workforce intact.

The FT's Peter Campbell has been listening the Fiat Chrysler boss explain why his company's diesel engines did not break any US laws.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

So that's why shares in Johnston Press, owner if the i newspaper and the Scotsman, jumped 13% today. That means the company is now worth a princely £18m - although the figure is somewhat lower if you include its debt mountain.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

One-sixth to one-seventh of the 104,000 vehicles in question will be in Europe, Sergio Marchionne says, given that diesels are more common there.

He adds that the US Department of Justice has worked with the Environmental Protection Agency on the emissions issue.

Image source, Reuters

Image source, ReutersSergio Marchionne tells the press conference "it would be sheer speculation on my part" to predict how the incoming Trump administration will handle the emissions allegations.

He also declines to speculate as to why the outgoing Obama administration's EPA made today's announcements.

Image source, Getty Images

Image source, Getty ImagesFiat Chrysler chief executive Sergio Marchionne is holding a press conference in the wake of the EPA allegations.

He says the car maker did not cheat on diesel emissions tests and rejects comparisons to Volkswagen.

"We have done nothing that is illegal," he says, adding that the EPA's report has been "blown out of proportion".

Mr Marchionne adds that the company plans to keep selling the models affected by the claims.

Fiat Chrysler US has issued a statement saying it is "disappointed" with the EPA's decision to issue a "notice of violation" about the technology used in its diesel engines.

The company "has spent months providing voluminous information in response to requests from EPA and other governmental authorities and has sought to explain its emissions control technology to EPA representatives", it says.

"FCA US looks forward to the opportunity to meet with the EPA’s enforcement division and representatives of the new administration to demonstrate that FCA US’s emissions control strategies are properly justified and thus are not “defeat devices” under applicable regulations and to resolve this matter expeditiously.

By the barest of margins, the FTSE 100 has ended the day higher at 7,292.37 (for once the decimal places actually matter). That's a rise of just 1.88 points.

Primark owner ABF holds the wooden spoon with a 4.4% fall, with Dixons Carphone, Next, Shire and Carnival the other biggest fallers.

Mondi - one of those companies you've never heard of - was the biggest riser, up 5.6%, while another firm that is not quite a household name, Smurfit Kappa, was up 3.8%.