Good nightpublished at 21:29 GMT 22 February 2017

That's it for today. Business Live will be back from 6am tomorrow, hope to see you then.

Fed hints at rate rise 'fairly soon'

Lloyds posts best profits for 10 years

UK economy grows faster than initially thought

Airbus sees costs rise on troubled A400M project

Get in touch: bizlivepage@bbc.co.uk

Daniel Thomas

That's it for today. Business Live will be back from 6am tomorrow, hope to see you then.

Image source, Getty Images

Image source, Getty ImagesThe Dow Jones achieved its ninth successive record closing high, despite fresh fears of a sooner-than-expected rate rise from the Federal Reserve.

The index closed 0.16%, or 32.60 points higher, at 20,775.60, following strong performances from EI du Pont de Nemours and Co, Nike and 3M.

The S&P 500 and Nasdaq ended slightly lower, down 0.11% and 0.09% respectively.

Analysts blamed minutes from the Fed's last meeting, published this afternoon, which gave mixed messages about the possibility of a rate rise "fairly soon".

"We're back to figuring out what very ambiguous terms mean," JJ Kinahan, chief market strategist at TD Ameritrade told CNBC.

"For today, the market is interpreting this as not much has changed."

Image source, Getty Images

Image source, Getty ImagesElectric car maker Tesla boosted sales and narrowed its losses in the fourth quarter of 2016.

Total revenue jumped to $2.2bn from $1.2bn a year earlier, while its loss was $2.2m compared with $3.1m. Full year revenue was $7bn, up 73% from 2015.

The firm said orders for its Model S and X cars had reached "record highs" in the quarter, and that its Model 3 would go into production in July.

It said: "We expect to deliver 47,000 to 50,000 Model S and Model X vehicles combined in the first half of 2017, representing vehicle delivery growth of 61% to 71% compared with the same period last year."

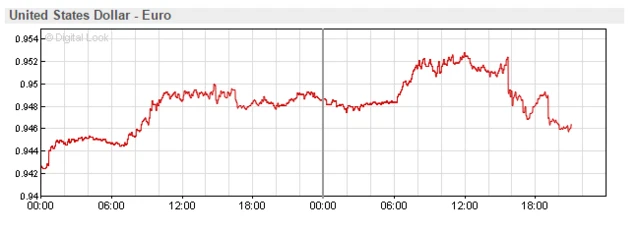

The dollar has fallen against the euro after minutes from the Federal Reserve's last meeting showed some members saw the possibility of a rate rise "fairly soon".

The currency is now trading 0.36% lower at 0.94580 euros.

According to Reuters, the drop reflects a lack of urgency to raise rates among voting members, many of whom saw only a "modest risk" inflation would increase significantly.

The euro has also strengthened on news that a rival to centrist French presidential candidate Emmanuel Macron will drop out of the race and back him.

This has lessened anti-euro candidate Marine Le Pen's perceived chances of winning.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Image source, Getty Images

Image source, Getty ImagesCar maker PSA has promised Theresa May that it will "develop" the Vauxhall brand if its plan to take it over succeeds.

In a phone conversation with the Prime Minister, chief executive Carlos Tavares "expressed his willingness to develop further the iconic Vauxhall brand for the benefit of its faithful customers", PSA said in a statement.

Ms May, meanwhile, "highlighted the historical importance of the automotive industry in (the) UK," it said.

It comes amid concerns the Peugeot and Citroen-maker would close plants in Germany and the UK following the acquisition of General Motors' Opel and Vauxhall.

Earlier on Wednesday, German Chancellor Angela Merkel backed the takeover after talking with Mr Tavares.

Image source, Getty Images

Image source, Getty ImagesWall Street weakened slightly after the release of minutes from the Federal Reserve's latest meeting showed many of the bank's policymakers said it may be appropriate to raise interest rates again "fairly soon".

The S&P 500 and the Nasdaq remained in negative territory, down 0.12% and 0.16% respectively.

The Dow Jones Industrial Average held its slight gains to trade 0.07% higher.

Image source, Getty Images

Image source, Getty ImagesParis's financial district, La Défense, is to build seven new skyscrapers in a bid to lure London banks after Brexit.

The organisation that manages the district is confident of attracting a "significant number" of international businesses seeking a "new base within the European Union".

Spokesperson Marie-Célie Guillaume said: “With only a few weeks to go until Article 50 is triggered, we want to send a powerful message to businesses that are uncertain about their future in London."

HSBC, which already has offices in La Défense, has said it will move 1,000 jobs to Paris after the UK quits the EU.

Image source, Getty Images

Image source, Getty ImagesPeugeot's planned takeover of GM's European operations will lead to combined sales of five million vehicles by 2022 and save as much as €2bn annually, as the talks advance towards a likely deal in early March, Reuters reports.

That would be 16% higher than last year's combined 4.3 million sales by PSA and Opel.

PSA also plans to make swift progress on technical convergence with GM's European arm, bringing new Opel models such as the popular Corsa onto the Paris-based manufacturer's own platforms to cut duplication, sources said.

Image source, AP

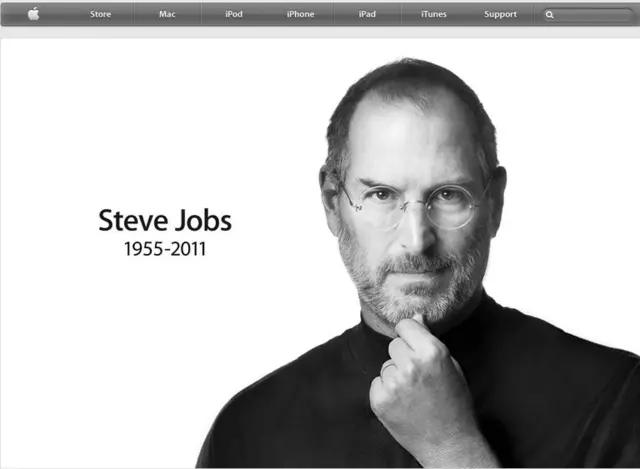

Image source, APApple's sprawling new campus, dubbed "Apple Park", will open in April, the iPhone maker said today.

Although the first employees will begin moving into the new headquarters in Cupertino, California, this spring, it will take about six months for all of the 12,000-plus workers to move, Apple said.

The 1,000-seat theatre at its new headquarters will be named after its late co-founder, Steve Jobs, who helped design the 175-acre campus before his death in 2011.

The minutes of the Fed meeting, at which the central bank voted to keep rates unchanged, also showed the depth of uncertainty over the lack of clarity on the new Trump administration's economic policies.

"Many participants expressed the view that it might be appropriate to raise the federal funds rate again fairly soon if incoming information on the labor market and inflation was in line with or stronger than their current expectations," the Fed said in the minutes.

Last week, Fed Chair Janet Yellen said waiting too long to raise rates again would be "unwise" and gave a strong indication that the central bank remains on track to consider raising rates again by the summer.

Image source, Getty Images

Image source, Getty ImagesUS Federal Reserve officials earlier this month discussed the need to raise a key interest rate again "fairly soon" - especially if the economy remains strong.

Minutes of the discussions showed that while Fed officials decided to keep a key rate unchanged at their 31 January-1 February meeting, there was a growing concern about what could happen to inflation if the economy out-performed expectations.

"Several'' Fed officials expressed concerns that there could be a "sizable undershooting'' of the Fed's 4.8% unemployment goal, which may force the Fed to raise rates at a faster pace than financial markets expect.

Economists are not expecting a rate hike until June. However, the discussion in the minutes might raise the possibility of an increase as soon as March.

Senior market strategist at LPL Financial tweets...

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Simon Jack

Simon Jack

BBC Business Editor

Image source, PA

Image source, PAThink of Kraft Heinz's assault on Unilever as a slap in the face for management. It was short-lived, shocking, and will smart for a good while yet.

It's a slap that says "we think we can do a better job for your shareholders than you". That is not a message you want to get lodged in shareholders minds if you are Unilever's management and today the company acknowledged the sting.

"Unilever is conducting a comprehensive review of options available to accelerate delivery of value for the benefit of our shareholders. The events of the last week have highlighted the need to capture more quickly the value we see in Unilever."

That is the sound of a company cheek smarting.

As we reported earlier, Whirpool has warned millions of owners of potentially lethal tumble dryers not to use them until the machines have been repaired.

A fault in the machines has led to fires, with one of the biggest happening at a block of flats in Shepherd's Bush last August (pictured).

Jill Paterson, a lawyer for families affected by the Shepherd’s Bush blaze, said: “This advice from Whirlpool is long overdue, there should have been more urgent action taken to protect consumers. It should not have taken enforcement action by Trading Standards for this to happen.

"Manufacturers have a responsibility to their customers and consumers have a right to expect that what they are buying is safe and will not cause damage or injury.

"The product recall regime in the UK needs a complete overhaul and we continue with our calls for the Government to implement the recommendations set out in the independent review led by consumer champion Lynn Faulds-Wood.”

BBC business editor tweets...

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Image source, Getty Images

Image source, Getty ImagesFrench bond yields have fallen after an influential French centrist politician dropped out of the presidency race to form an alliance with independent candidate Emmanuel Macron.

According to reports, the announcement by Francois Bayrou could tip the odds in favour of Mr Macron reaching a run-off against the far-right leader Marine Le Pen - one polls suggest he would win.

French bond yields have risen in recent weeks as Ms Le Pen has narrowed the gap with her opponents in the polls.

She has pledged to lead France out of the euro, something investors fear would drive up France's debt costs and cut the value of its bonds.

Bayrou's announcement also pushed the euro up against the dollar: it's currently trading 0.17% higher at $1.05540.

Image source, Getty Images

Image source, Getty ImagesMillions of owners of potentially lethal tumble dryers have been warned not to use them, while they await repair.

Tumble dryers sold under the Hotpoint, Creda and Indesit brands have been behind a series of fires.

Their owner Whirlpool had previously said they were all right to use, providing someone was in attendance.

But following advice from Trading Standards, the new guidance is not to use them until they are repaired.

Chris Johnston

Chris Johnston

Business reporter

John Roberts, the founder of online electricals retailer AO World, has stepped down as chief executive, but will remain on the board in a new executive role.

The company said Mr Roberts would be succeeded by Steve Caunce, the chief operations officer.

AO shares floated at 285p in February 2014 but have had a torrid run, ending today at 147p.

Image source, Getty Images

Image source, Getty ImagesFollowing assurances from the Prime Minister, the government has promised measures in the Budget for firms facing the "steepest increases" in business rates.

Communities Secretary Sajid Javid said it was "clear to me that more needs to be done to level the playing field and make the system fairer".

A fierce campaign has been waged against rises, which ministers say will affect a quarter of business in the UK.

Labour said the government had allowed a "crisis" to develop. The rate change is due to happen on 1 April.