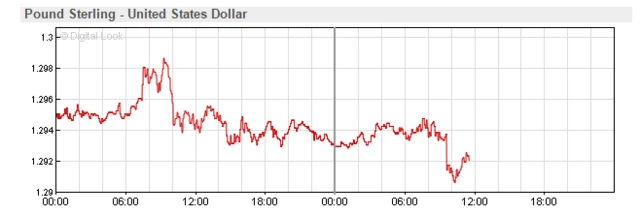

Sterling slips after interest rate decisionpublished at 12:05 BST 11 May 2017Breaking

Sterling has slipped below $1.2910 after the Bank of England held interest rates.

Retail shares drag down Wall Street

Snap's shares fall by more than 20%

Bank of England cuts GDP forecast

Inflation expected to outpace wage growth

BT to cut 4,000 jobs

Snapchat shares plunge

Get in touch: bizlivepage@bbc.co.uk

Karen Hoggan

Sterling has slipped below $1.2910 after the Bank of England held interest rates.

Bank of England holds rates at at 0.25%. Policymakers voted 7-1 to maintain the bank rate.

Dan Macadam

BBC business reporter

Image source, Getty Images

Image source, Getty ImagesWith summer holidays approaching, there will be more than a few people in the UK hoping the pound goes up in the next few weeks.

The pound has risen this year against the dollar and other currencies, but it's still struggling to break through $1.30, largely due to uncertainty about how the Brexit talks will go.

We might see it go through that barrier today, though, if there are signals from the Bank of England that interest rates could go up soon, according to traders.

The Bank is expected to leave rates unchanged at 0.25% for now, but the markets are watching for any hints that policymakers could be persuaded to raise them later this year.

Image source, Getty Images

Image source, Getty ImagesIn March UK exports did not make the most of the slump in the pound, says Samuel Tombs of Pantheon Macro:

"March’s simply dreadful trade figures demonstrate that Britain is failing to capitalise on sterling’s depreciation. The trade deficit was the largest since September," he says.

There is just half an hour to go before the Bank of England goes for the triple - an interest rate decision, minutes from the Monetary Policy Committee and its Inflation Report.

The pound has come back a little after the shock of poor UK economic data earlier today but remains 0.12% lower against the dollar.

Image source, Getty Images

Image source, Getty ImagesBBC business editor Simon Jack has taken a closer look at Labour's draft manifesto:

"So how radical is Labour's draft manifesto really?

"On the face of it, it looks like the root and branch reversal of 40 years of government policy. But let's take a moment to see how radical, how do-able, these proposals really are from a business, rather than a public finance, perspective."

Image source, Getty Images

Image source, Getty ImagesSiemen's chief executive Joe Kaeser

German IT giant Siemens is undergoing a massive reorganisation,

It has just announced that it will cut 1,700 job and transfer an additional 1,000 staff in its enterprise IT, digital factory and mobility businesses.

However, it will also hire 9,000 people.

It is part of chief executive Joe Kaeser's strategy to improve profitability by selling a number of consumer businesses, stripping out layers of management and making large acquisitions in industrial software and energy.

Image source, Getty Images

Image source, Getty ImagesToday's opinion by the European Court of Justice - that Uber is a transport company not a digital platform - will not make much difference to how the business is regulated, it says.

"Being considered a transportation company would not change the way we are regulated in most EU countries as that is already the situation today.

Uber adds: "It will, however, undermine the much needed reform of outdated laws which prevent millions of Europeans from accessing a reliable ride at the tap of a button."

The Economist, like the publication's name suggests, is no slouch when it comes to, well, economics.

But that was before it interviewed US President Donald Trump...

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Image source, Getty Images

Image source, Getty ImagesThe Financial Reporting Council (FRC) has fined accountancy firm PwC £5m for misconduct in relation to the 2009 audit of FTSE 250 social housing business that went into administration in 2010.

The FRC also said that it has fined Stephen Harrison, a retired PwC audit partner, £150,000 also for misconduct.

BT's various scandals and fines "have come back to bite those on its top table", says George Salmon, and equity analyst at Hargeaves Lansdown.

"While there is no suggestion of any wrongdoing by CEO Gavin Patterson, he will not be getting a bonus this year, and some of his previous rewards have been clawed back.

"This is probably little consolation to the 4,000 who will be losing their jobs as part of a strategic review of the Global division, which has suffered from the scandal in Italy. BT is looking to save £300m from the changes," he says.

Dan Macadam

BBC business reporter

Image source, Getty Images

Image source, Getty ImagesIt's the pound that traders are focusing on the most here, and they've seen it fall back to near $1.29 - having come close to the $1.30 mark on Wednesday.

Richard Wiltshire, chief dealer in foreign exchange at ETX Capital, says: "Yesterday sterling went higher on expectations there might be a more hawkish tone from the Bank based on recent strong data for the UK.

"But it promptly came back down again this morning because we've had some slightly disappointing data and that's taken some of the shine off it."

In case you're wondering, a "hawkish tone" would suggest the Bank might raise interest rates soon - something which would make sterling a more attractive investment for traders.

Image source, Getty Images

Image source, Getty ImagesUber has been found to be a transport service rather than a digital platform by the Court of Justice of the European Union (ECJ), opening it up to stringent regulation.

"The Uber electronic platform, whilst innovative, falls within the field of transport: Uber can thus be required to obtain the necessary licences and authorisations under national law," the court said.

Kevin Peachey

Kevin Peachey

Personal finance reporter

Image source, Getty Images

Image source, Getty ImagesUK and EU consumer groups are discussing the implications of Brexit at a conference in London.

Matthew Upton, of Citizens Advice, says that there is already anecdotal evidence of Brexit being used erroneously as an excuse to deny people employment or refunds.

There are, however, lots of warm words about the UK's progressive consumer protection rules.

Image source, Getty Images

Image source, Getty ImagesConstruction output fell again in March, dropping 0.7% compared with the previous month, after a slowdown in repair and maintenance work, according to the Office for National Statistics, external.

But there was strong growth in the building of new homes, with output rising 3.8% compared with February, the ONS said.

Dan Macadam

BBC business reporter

To mark "Super Thursday" - when the Bank of England gives an update on the health of the economy as well as its latest interest-rates decision - I've swapped Business Live Towers for a trading floor in the City of London.

Walk into the offices here, and you're struck by the wall of computer screens. Each trader has four of them - flashing up figures, charts and breaking news - plus a giant fifth screen showing their clients' latest trades.

Others are on the phone, talking at breakneck speed about oil prices, pound-dollar trades and the chances of President Donald Trump being impeached.

But as we get closer to the Bank's announcement at midday, there will be only one big story. Attention will turn to the British economy and how the Bank's announcement affects the pound and UK stocks.

UK department store chain House of Fraser has appointed Alex Williamson, the current boss of the Goodwood Estate, as its new chief executive, it says.

Mr Williamson has been chief executive of Goodwood since 2012 and before that was head of finance for TUI Travel and worked for Ernst & Young.

He will start his new job on 31 July.

The 168-year-old House of Fraser business has 59 stores in the UK and Ireland. Since 2014 it has been owned by China's Nanjing Cenbest.

Sterling dipped against the dollar and the euro after data showed UK industrial output data was much weaker than expected in March while the trade deficit widened sharply.

Sterling, which was trading at $1.2938 earlier, fell to $1.2914 after the data, down nearly 0.2% on the day. It also fell 0.3% to 84.26 pence per euro from 84.19 pence before the data.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

UK industrial output shrank for a third month in a row in March - by 0.5%, the Office for National Statistics says, external.