Good nightpublished at 21:30 BST 24 May 2017

Thanks for tuning in, we'll be back tomorrow from 6am.

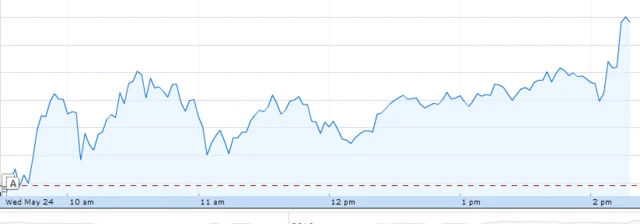

US stocks climb after release of Fed minutes

Ikea and B&Q appoint new bosses

M&S profit tumbles as revamp costs bite

Shares in M&S hit 12-month high

Get in touch: bizlivepage@bbc.co.uk

Daniel Thomas

Thanks for tuning in, we'll be back tomorrow from 6am.

More on the news that the longest criminal trial in the history of the Irish state collapsed after a judge ordered the acquittal of former Anglo Irish Bank chairman Sean FitzPatrick.

Mr FitzPatrick was accused of misleading the bank's auditors about millions of euros in loans made to him. Newshour, on BBC World Service, has been asking why.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Image source, PA

Image source, PACar giant Ford says new chief executive James Hackett is eligible for an annual pay package of at least $13.4m, according to Reuters.

Mr Hackett was named on Monday as the replacement for Mark Fields.

Hackett will earn a $1.8m annual salary. As chairman of the Ford unit developing self-driving cars he was on $716,000.

He will also receive $7m in shares and get a $1m bonus for becoming chief executive.

He is also eligible for an annual bonus of up to $3m, as well as pay from his time at Ford's mobility unit.

Image source, Getty Images

Image source, Getty ImagesAll three key US stock indexes ended the day's trading ahead on Wednesday, following the release of minutes from the May meeting of the Federal Reserve's interest rate setting committee.

They seemed to indicate a more gradual approach to interest rate rises than had previously been expected.

The Dow Jones finished at 21,012.42, that's a rise of 74.51 points or 0.36%.

The S&P 500 was up 5.97 points or 0.25% at 2,404.39.

And the tech-heavy Nasdaq closed at 6,163.02, that's up 24.31 points or 0.40%.

Image source, Getty Images

Image source, Getty ImagesNew research from the ONS has provided further evidence of London's outsized impact on the UK economy, and of the yawning North-South divide that still exists in the country.

According to the study, , externalin 2015/16 the city ran a £26.5bn budget surplus which was redistributed by the government to help less well-off parts of the country.

Every Londoner provided £3,070 more in tax revenues than they received in public spending, it added. By contrast, spending exceeded tax revenues by £5,440 per head in Northern Ireland, £3,820 in the North East, and £2,830 in Scotland.

Only two other regions - the south-east and the east of England - ran a budget surplus in the 2015-16 financial year, the latest year for which figures are available.

Image source, Reuters

Image source, ReutersWhite House budget director Mick Mulvaney told Congress on Wednesday that he went through the budget "line by line"

The White House has denied the president's budget proposal contains an "egregious" maths error.

Former US Treasury Secretary Larry Summers pointed out the spending plan double-counts $2 trillion (£1tn).

But White House budget director Mick Mulvaney told reporters: "We stand by the numbers."

Unveiled on Tuesday, the budget proposes deep cuts to welfare programmes.

Shares in Intuit have jumped as much as 7.5% after the accounting software provider posted better than expected earnings for the third quarter.

The company, which also raised its outlook, attributed the growth to demand from the self employed and freelancers, a group it has been targeting.

“We entered the tax season with a clear plan to extend our lead in the do-it-yourself category," said Brad Smith, chairman and chief executive.

Sales in the quarter ending 30 April rose 10% year on year to $2.54bn, while net profit fell 6% to $964m, with both results ahead of expectations.

Image source, Dubai Media Office

Image source, Dubai Media OfficeNow for some light relief from all that talk about interest rates,

Dubai Police have revealed their first robot officer, giving it the task of patrolling the city's malls and tourist attractions.

People will be able to use it to report crimes, pay fines and get information by tapping a touchscreen on its chest.

Data collected by the robot will also be shared with the transport and traffic authorities.

The government said the aim was for 25% of the force to be robotic by 2030 but they would not replace humans.

The prospect of having lower rates for longer never pleases currency investors, which perhaps explains why the dollar has slipped after the release of minutes from the Fed's last monetary policy meeting.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

The Federal Reserve's monetery policy committee appears to be taking a more dovish tone in the light of weaker recent data on the economy.

US economic growth slowed sharply in the first quarter - something that concerned committee members - while a key measure of inflation also fell further below the bank's 2% target.

In the minutes from May's meeting, external, officials made clear they expect a return to stronger economic growth.

However, they said: "Members generally judged that it would be prudent to await additional evidence indicating that a recent slowdown in the pace of economic activity had been transitory before taking another step in removing accommodation."

Nearly all policymakers at the May 2-3 meeting also said they favoured starting the wind-down of the Fed's massive holdings of Treasury debt and mortgage-backed securities this year.

Image source, Google

Image source, GoogleUS stocks have jumped on news that the Fed may wait to raise interest rates.

The view, which the minutes said was "generally" shared by the nine officials who have a vote on policy this year, casts some doubt on Wall Street bets for a hike at the June 13-14 policy meeting.

The Dow Jones index (pictured) is now up 0.31%, the S&P 500 is up 0.2%, and the Nasdaq is 0.25% higher.

Image source, Getty Images

Image source, Getty ImagesUS central bankers say the time will "soon" be right to once more raise the benchmark interest rate, minutes, external of the Federal Reserve's last monetary policy meeting show.

However, policymakers may wait to see signs that the weak growth recorded early this year was merely temporary, they also showed.

Fed officials said planned spending by President Donald Trump's administration could boost the economy more than currently forecast, although the details and timing of the projects "remain highly uncertain".

The Fed kept interest rates on hold in May, in a range of 0.75-1%, many analysts have been expecting a hike in June.

BBC political editor tweets....

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

US stocks are slightly higher as investors await the release of minutes from the Fed's last meeting in May (due in about half an hour).

The Dow Jones index is up 0.18% at 20,974.93, the S&P 500 has gained 0.04% to 2,399.32, and the Nasdaq is up 0.08% at 6,143.47.

Image source, Getty Images

Image source, Getty ImagesMore good news for Aston Martin. The firm has been voted the "ultimate dream car brand" by motorists, according to a Close Brothers survey of 1,200 drivers.

The luxury car maker, which has just posted its first Q1 profit in a decade, beat competition from the likes of Audi and BMW, as well as other quintessentially British brands such as Rolls-Royce.

According to the survey, the car brands the nation aspires to own are as follows:

1. Aston Martin

2. Audi

3. BMW

4. Jaguar

5. Mercedes

6. Land Rover

7. Ferrari

8. Lamborghini

9. Porsche

10. Bentley

Image source, Getty Images

Image source, Getty ImagesThe University of Birmingham's plan to open a campus in Dubai is the latest example of universities expanding with international branches.

Birmingham's new base will be in Dubai International Academic City, a purpose-built campus opened a decade ago, which already houses 26 universities from nine countries, with 25,000 students.

The first phase will open in the autumn, but most of the undergraduate and graduate courses will run from autumn 2018.

Students coming to the new university will be able to get a full University of Birmingham degree from courses taught in English, without having to leave the Gulf.

Image source, Getty Images

Image source, Getty ImagesFrench bank BNP Paribas has been hit with a $350m fine for failing to stop misconduct in its foreign exchange business.

According to regulators in New York, traders at the bank colluded to fix foreign exchange prices, executed fake trades and shared confidential customer information.

The bank should have spotted the ruse but failed to supervise its staff properly, they said.

In a statement BNP Paribas said it "deeply regrets the past misconduct" which occurred between 2007 and 2013, and has since strengthened its systems of compliance and sacked or disciplined those involved.

Here at Business Live towers we are not going to pretend Linde and Praxair - industrial gases groups from Germany and the US respectively - are household names.

We mention them because the two firms have now agreed in principle the details of their proposed $70bn merger, Linde said today.

The all-share merger, intended to create a market leader that will overtake France's Air Liquide, had fallen behind schedule due to complex talks formalising the deal.

The agreement still needs the approval of Praxair's board, as well as Linde's management and executive boards, however, meaning the air could still seep out.

Image source, Getty Images

Image source, Getty ImagesFollowing its China downgrade, Moody's has now cut Hong Kong's credit rating citing headwinds from the mainland.

The ratings agency lowered the island's rating from Aa1 to Aa2, the third-highest level of investment grade, which is still above China's rating of A1, the sixth-highest.

"The economic and financial linkages between Hong Kong and China are close and broad-based," it said.

"Combined with political linkages, this means that any erosion in China's credit profile, such as that reflected in the 24 May downgrade of China's rating to A1 with a stable outlook, will ultimately affect Hong Kong's credit profile and will be reflected in the Special Administrative Region's rating."

China accounts for more than half of Hong Kong's exports of goods, three quarters of tourist arrivals and 40% of exports of services in general, said Moody's.

Image source, PA

Image source, PALondon's stock market was slightly ahead at the close of trade on Wednesday after sliding on Tuesday.

The benchmark FTSE 100 gained 29.6 points or 0.4% to 7,514.90

Retailer Kingfisher was the worst hit, down 7%, after reporting a first-quarter drop in revenues of 0.6% on the back of weak trading in France.

But High Street retailer Marks and Spencer recovered from a fall at the start of trading and was up 1.47%.