Good night!published at 21:30 GMT 6 February 2018

Thanks for tuning into Business Live. We'll be back at 6am tomorrow, hope to see you then.

Get in touch: bizlivepage@bbc.co.uk

European markets end lower amid global sell-off

Wall Street volatility continues

Ex-Carillion boss takes blame for collapse

BP profits climb 139%

GM earnings hit by tax charge

Daniel Thomas

Thanks for tuning into Business Live. We'll be back at 6am tomorrow, hope to see you then.

Snapchat's daily active users rose to 187 million in the three months to 31 December - a rise of 18%.

The company posted a net loss of $350m, cpmpared with a loss of $170 million a year earlier.

It was Snap's fourth quarterly earnings as a public company.

Sales rose 72% year on year.

Image source, Getty Images

Image source, Getty ImagesGold demand rallied in the closing months of 2017, gaining 6% year-on-year in quarter four to reach 1,095.8 tonnes, the World Gold Council reports.

However, overall demand for the full year fell by 7% to 4,071.7t, compared with 2016.

Alistair Hewitt, Head of Market Intelligence at the World Gold Council, said: “It’s not surprising to see overall gold demand down given the backdrop of monetary policy tightening and strong equity markets in 2017, but the market is not in bad shape."

He said that jewellery demand picked up as economic conditions improved in China and a policy change in India removed a barrier to demand, while next-generation smartphones "boosted gold demand from technology companies.”

Walt Disney, which is buying some of Fox's film and TV businesses, reported a 78.4% leap in quarterly profit on Tuesday as it saw a $1.6bn (£1.1bn) gain due to recent changes to the US tax law.

Profits rose to $4.42bn, up from $2.48bn.

Disney's sales rose 3.8% to $15.35bn in the first quarter ended 30 December, up from $14.78bn a year earlier.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Image source, Getty Images

Image source, Getty ImagesHaving opened down by about 2% and having endured a turbulent day, all three key US stock indexes have finished the day well ahead.

The Dow Jones closed at 24,912.59, that's up 566.84 points or 2.33%.

The S&P 500 was at 2,686.65, a rise of 37.71 points or 1.42%.

And the tech-heavy Nasdaq was at 7,115.88, 148.36 points or 2.13% higher.

Image source, Reuters

Image source, ReutersIndustrial workers in south-western Germany have won the right to reduced working hours as part of a deal that could benefit millions of employees across the country.

Workers will be able to reduce their weekly hours from 35 to 28 for up to two years to look after their families.

The deal covers almost one million workers in Baden-Württemberg state and also gives them a pay rise.

It could be extended to the 3.9 million workers in Germany's industrial sector.

Image source, Getty Images

Image source, Getty ImagesProfits at Toyota are picking up steam.

The Japanese carmaker has raised its annual profit guidance by 10% to 2.2 trillion yen ($20.23bn), thanks to a weaker yen and strong sales at home. That's up from the 2 trillion yen previously forecast.

The upbeat outlook came as Toyota said sales in Japan and Europe rose in the nine months to December.

But sales in North America - its biggest market - took at hit. Operating profit there plunged more than 50% as increasing marketing costs and tough competition knocked earnings.

BBC business correspondent Kim Gittleson explains...

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

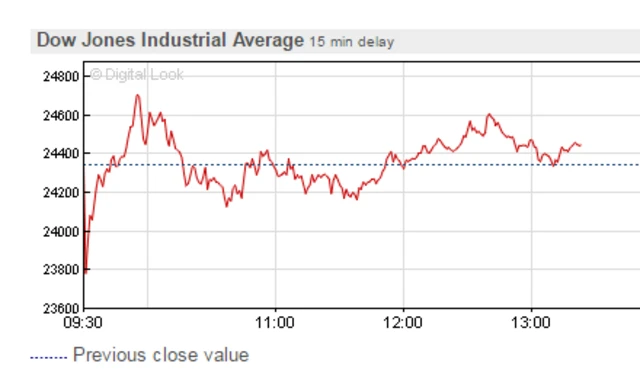

The Dow Jones is now up by 1.6%, but is it finally out of the doldrums? The S&P 500 and Nasdaq are up too, by 1% and 1.6% respectively.

Image source, Google

Image source, Google Image source, Shazam

Image source, ShazamEuropean Union regulators are to examine Apple's plan to buy the song recognition app, Shazam, to see whether it would hamper competition.

Shazam - a British company - allows people to use their smartphone or computer to identify music through a snippet of sound, as well as providing the option to buy it.

Apple had reportedly offered four-hundred-million pounds for the app, which it said would be a natural fit with with its music streaming device. Seven European countries urged the competition regulator to investigate the bid.

Image source, Getty Images

Image source, Getty ImagesUS stocks continue to oscillate wildly following a global sell-off that has wiped trillions of dollars off share markets.

Currently Wall Street is climbing again, with the Dow Jones up 0.6% or 145.94 points at 24,491.69.

The S&P 500 is 0.2% higher at 2,654.16 points and the Nasdaq has gained 0.7% to 7,018.10.

Image source, Getty Images

Image source, Getty ImagesRichard Hunter, head of markets at Interactive Investor, notes that the recent falls in the FTSE 100 mean that over the past 12 months the index is flat, while it's about 6% lower in the year to date.

However, he suggests there are reasons to be optimistic.

"Corporate earnings continue to justify [stock] valuations, the general synchronised economic recovery is still in tact, and even an aggressive increase in the interest rate across the pond would still likely leave [US rates] at relative historic lows.

"Providing that the current situation of letting some air out of the tyres does not result in a puncture, this reset could be seen as a justified reaction to recent exuberance."

Image source, Getty Images

Image source, Getty ImagesUS regulators may need enhanced powers to oversee crypto-currencies, the head of the US Securities and Exchange Commission has said.

Jay Clayton told the Senate Banking Committee that his agency was coordinating with the Treasury Department and the Federal Reserve and together they could call on Congress to pass legislation strengthening their remits.

“We may be back with our friends from Treasury and the Fed to ask for additional legislation,” Mr Clayton said.

It comes amid fears about the fluctuating value of crypto-currencies and a series of damaging hacks into exchanges.

Image source, Getty Images

Image source, Getty ImagesChina has said it wants to be compensated for US tariffs imposed on imported solar panels and washing machines, according to World Trade Organization filings.

China said it was asserting its rights as a major exporter and called on the US to hold talks. It also said it believed the US measures broke numerous WTO rules.

The White House approved the tariffs last month in a bid to protect US manufacturers from foreign competition.

China, Taiwan and South Korea have reacted angrily to the move and all three have called for compensation.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Image source, Getty Images

Image source, Getty ImagesTwo former employees of Google and Facebook have launched a campaign to fight what they see as the addictive nature of the technology they helped to create.

The Center for Human Technology aims to "reverse the digital attention crisis" and "realign technology with humanity's best interests".

It warns that technology is currently "hijacking our minds and society".

Facebook said it is "is a valued part of many people's lives".

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Image source, Getty Images

Image source, Getty ImagesIt's been a roller coaster day for Wall Street markets, which since opening lower have fluctuated between positive and negative.

Stocks are now heading higher, with the Dow Jones advancing 0.9%, the S&P 500 up 0.5%, and the Nasdaq 1% higher.