Carney: Bank will defend inflation targetpublished at 12:51 GMT 8 February 2018

By the BBC's Szu Ping Chan

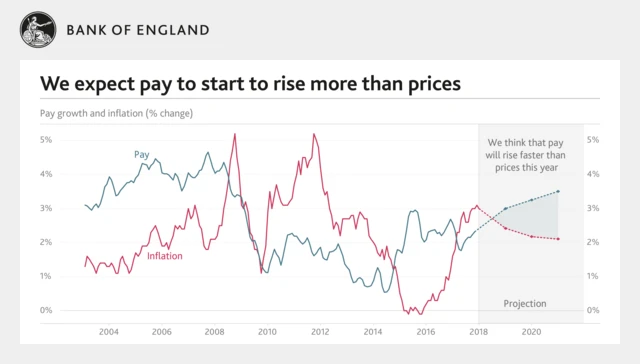

The Bank has had a tricky balancing act since last year, as its task is to support growth and jobs while also keeping a lid on inflation.

The Brexit vote raised the prospect that unemployment could rise, while the fall in the value of the pound has also pushed up inflation.

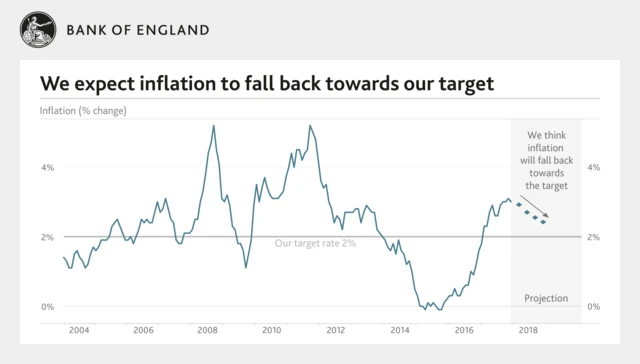

While it chose to support jobs in the wake of the Brexit vote last June, Mr Carney says that its focus is moving towards keeping a lid on inflation as the economy starts to run at its medium-term speed limit.

While this might mean more interest rate rises are on the way, he says that rates could go up and down depending on how the outlook evolves and will be limited and gradual: "Whatever happens, the committee will monitor developments closely to ensure inflation returns to the 2% target."