Business warns against too many rate risespublished at 11:30 BST 23 May 2018

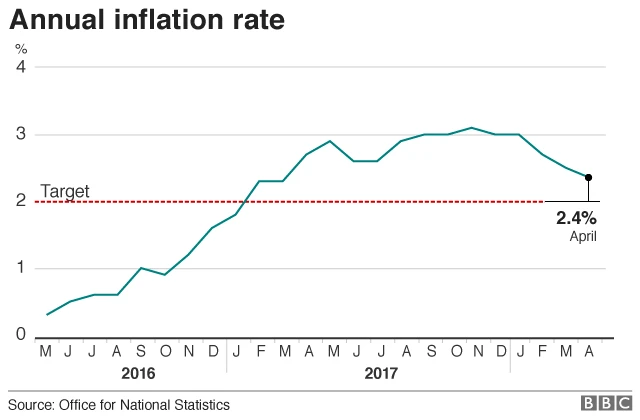

Commenting on the new inflation data for April, Suren Thiru, head of economics at the British Chambers of Commerce, says: "The increase in producer prices may lead to a short-term uptick in inflation over the coming months, but it is likely to be a temporary rise with the rate continuing its overall trend back towards the Bank of England’s 2% target.

"While we think that interest rates will rise again before the end of the year, we would caution against the sort of sustained tightening in monetary policy recently implied by some Monetary Policy Committee members, as it could dampen business and consumer confidence and further subdue UK economic growth.

"Instead more needs to be done to lift the UK out of its current low growth trajectory, including incentivising long-term business investment.”