Bedtime readingpublished at 21:00

That's all from us on a busy day of tax and spend from Philip Hammond. And for those who can't get enough of this Budget, you can find all the official documents here, external.

Goodnight.

Get in touch: bizlivepage@bbc.co.uk

BUDGET KEY POINTS

"Era of austerity is finally coming to an end," he says

New UK digital services tax on revenues of tech giants from 2020

Predicts meeting his structural borrowing target three years early

2018 growth forecast upgraded from 1.3% to 1.6%

Budget deficit forecast for 2018/19 cut to £25.5bn from £37.1bn forecast in March

Tax on import of plastic packaging which contains less than 30% recycled plastic

Government abolishes use of Private Finance Initiative

Extra £1bn in defence spending to boost cyber capabilities

Extra £420m to repair potholes

Additional £500m set aside to prepare for a no-deal Brexit

Annual Investment Allowance increased from £200,000 to £1m for two years

Personal allowances and higher rate threshold raised - a tax cut for 32 million people, he says

An extra £160m for counter-terrorism police

Confirms an extra £20.5bn for the NHS over the next five years

£60m for planting trees in England

A further £500m for the Housing Infrastructure Fund

Duties: Fuel, beer, cider, spirits tax frozen

1.2% annual average growth in departmental spending promised

Hammond finishes Budget speech after 1hr 12mins

Chris Johnston, Katie Hope, Simon Read and Russell Hotten

That's all from us on a busy day of tax and spend from Philip Hammond. And for those who can't get enough of this Budget, you can find all the official documents here, external.

Goodnight.

Image source, PA

Image source, PAPaul Johnson, director of the Institute for Fiscal Studies, says only if you consider "a very tight definition" of what austerity means.

"Arguably he's just about got to the absolute minimal definition of ending austerity but it's certainly nothing like a bonanza for the rest of the public services," he told the BBC.

He adds that "most of the planned welfare cuts are still on the books".

Image source, PA

Image source, PAPhilip Hammond was, perhaps uncharacteristically, in a very jovial mood. Not known for humour - in public, at least - the chancellor managed to raise a few laughs during his Budget speech.

Here's his best gags, courtesy of the Press Association.

The last Budget to be held on a Monday was in 1962 and Mr Hammond said: "I was six years old, tensions between Russia and the United States were rising and a former foreign secretary turned chancellor delivered a Budget amid Cabinet revolt... I could swear I remember my parents turning to me and saying: 'Philip, one day, that can be you'."

By holding the statement on Monday rather than the usual Wednesday, the chancellor said he avoided a Halloween Budget which could have produced "Hammo House of Horrors" headlines. But "I have not avoided the blood-curdling threats, the anguished wailing, and the strange banging of furniture that's usually associated with Wednesday - I have kindly been invited to a special meeting of the 1922 Committee this evening".

In a display of toilet humour, the chancellor promised that councils can "relieve themselves" with a tax break on public lavatories, although he did not want to get "bogged down" on the subject. It was, he noted, one of the few announcements that had not "leaked".

In a nod to Mr McDonnell's recent accident, suffered tripping over fly-tipped waste, the chancellor promised cash to deal with the issue "although I cannot guarantee that £10m is going to be enough to stop him falling flat on his face in the future".

After announcing plans for a £400m digital services tax, Mr Hammond also managed a quick jibe at Sir Nick Clegg, who has taken a senior role with Facebook, joking that "I am already looking forward to my call from the former leader of the Liberal Democrats".

Image source, Gateway

Image source, GatewayHidden in the Budget Red Book, external (on page 80!) is news of a new prize-linked saving scheme for credit unions.

The Budget document said: "Credit unions play an important role in facilitating savings and offering affordable borrowing to their members.

"To help people increase their financial resilience while boosting awareness and membership of these community organisations, the Budget commits to launching a pilot of a new prize-linked saving scheme for credit unions."

More details will follow - such as timings and amounts - but the Treasury presumably hopes it could be a boost for the sector.

Matt Bland of the Association of British Credit Unions told the BBC: "We're excited by the announcement. Credit unions are all about encouraging people to save and prize-linked savings is an interesting way to encourage savers."

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Torsten Bell, director of think-tank The Resolution Foundation, points out that the NHS' spending boost will impact other government departments.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Image source, Tomatin

Image source, TomatinThe Scotch Whisky Association said the Chancellor's decision to continue the freeze on spirits duty was a "welcome show of support" for the industry.

The measure means the price of a typical bottle is 30p lower than if it had risen by inflation, according to the Treasury.

The duty rate on spirits remains £28.74 per litre of pure alcohol.

Of the £14.15 average price of a bottle of Scotch whisky, £10.41 is collected in tax through excise duty and VAT, the SWA said.

Hundreds of thousands of private-sector contractors face higher tax and National Insurance (NI) bills from April 2020, after today's Budget.

The crackdown is the biggest revenue-raising measure in this year's budget.

Ian Hyde, partner at law firm Pinsent Masons, says it's a "huge cost burden" and a "significant shift of risk" for businesses which rely on contractors.

“Many contractors have highly specialised skills and it is crucial that these skills can be easily circulated amongst businesses. However, these new rules may result in businesses scaling back their use of contractors, slowing this transfer of skills from one business to another.

“The ultimate winner from these new rules is HMRC which will now have thousands of businesses doing their policing for them, but at what cost?," he asks.

Simon Jack

Simon Jack

BBC Business Editor

Image source, Getty Images

Image source, Getty Images2018 has been an annus horribilis for the high street. Many high street retailers have cried foul in the face of new competition from online firms that employ fewer staff and pay far lower business rates.

There are two ways you can level the playing field. Cut charges for the traditional retailers or increase them for online traders. Mr Hammond has done a bit of both.

He has spent £900m knocking a third off the business rates bill of 500,000 small retailers. Very welcome to those who have premises with a rateable value below £51k.

Second – he unveiled a new £400m digital services tax to be levied on the tech giants on the money they make on digital services like advertising and streaming entertainment (but not online sales).

So will these two measures save the high street? Probably not – at least not on their own.

Image source, PA

Image source, PAMark Stokes at Deloitte has more exclusive analysis of today's Budget for the BBC:

The Government will extend the stamp duty relief for first-time buyers to purchases of shared ownership properties worth up to £500,000. That means qualifying purchasers will pay no stamp duty on the first £300,000 paid on the purchase of their home and 5% on the remainder up to the cap of £500,000.

In welcome news for taxpayers who have bought homes that would have qualified since the last Budget in November 2017, the rules will be backdated with taxpayers able to claim a refund.

A consultation will be published in January 2019 on the potential introduction of a further 1% stamp duty charge on purchases of residential property by non-UK residents. This follows significant changes to the taxation of non-residents investing in UK residential real estate over recent years to align their tax position with UK residents.

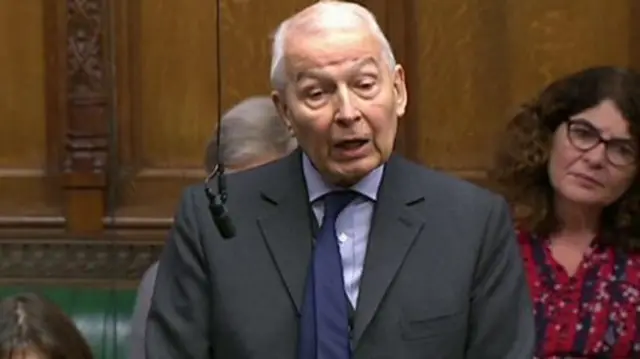

The Budget offered nothing for those "massacred" by the Universal Credit welfare reforms, according to Frank Field, chair of the Commons' Work and Pensions Committee.

He told the Commons cuts for families would get "worse next year and worse the year after and worse the year after that".

He added: "The Chancellor did make some very important additions to the Universal Credit Budget and I'm grateful, as all of us must be who've seen our constituents massacred by this benefit.

"But there are four big changes he has yet to announce if we are to be satisfied that the rollout of Universal Credit can roll out safely to every one of our constituents."

Stephanie Flanders, former BBC economics correspondent and now a senior editor at Bloomberg, says the Prime Minister wanted "a really big Budget".

But she points out that with the UK preparing to leave the EU on 29 March, that simply wasn't possible.

"It can't really be a watershed Budget, because we are months before this big question," she says.

Philip Hammond didn't mention any negatives from Brexit, even going to far as to talk about a Brexit dividend, Ms Flanders adds.

Sam Coates from The Times makes this observation:

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Rory Cellan-Jones

Rory Cellan-Jones

BBC technology correspondent

Image source, PA

Image source, PAFaced with public anger over the low tax paid in the UK by the likes of Google, Amazon and Facebook, the government has talked time and again of imposing some kind of levy on the tech giants.

The problem has been designing it so that it doesn't stifle innovation from new firms and coordinating action with other countries so that businesses aren't put off investing in the UK.

The Chancellor’s solution is to target a Digital Services Tax at a narrow set of what are described as digital business platform services - specifically search engines, online marketplaces and social media firms. Which sounds like Google, Amazon and Facebook.

He also makes it clear he hopes that by 2020 when the tax is due to be introduced, a global agreement on a tax on digital turnover will have been agreed.

That may be optimistic according to the trade body techUK, which warns that going it alone would be costly.

But there is in any case still plenty to be sorted out about how the new tax will work - and whether it can be as precisely targeted as the Treasury seems to think. The Chancellor will be hoping that an international agreement rides to his rescue before the UK tax has to be imposed.

BBC Radio 5 live

BBC Radio 5 live

Frank Jay owns a chilli shop in Leeds city centre. He tells BBC Radio 5 Live he is interested in the business rate relief announced by the chancellor for small retailers in England:

"I was pleasantly surprised. When I started the chilli shop, when we hit business rates, wow that was a big chunk of our income. And we were not getting anything from it - it was the difference between making the rent and not making the rent sometimes.

"So this has come as a big relief. I'd prefer them to go further for small businesses to protect our high street, and go all the way and have [no business rates] for a couple of years, but yeah I'm much happier."

Anne Redston, professor of tax law at King’s College London, details two important changes in today's Budget relating to insolvent businesses:

The Budget announced two important changes when businesses are insolvent. HM Revenue and Customs (HMRC) is an unsecured creditor of an insolvent business, so is in the same position as anyone else who is owed money by that business.

But from April 2020, HMRC will be first in the queue, with a priority right to recover any PAYE, employee national insurance contributions (NICs), VAT and deductions made under the Construction Industry Scheme (CIS).

The government’s reasoning is that VAT, PAYE, employee NICs and CIS are all money deducted from customers and employees, and held in trust by the business. This new preferential creditor rule therefore does not apply to corporation tax or employer NICs.

The new rules will mean money is more likely to be recovered from insolvent businesses than has been the case - but it also means that other creditors will receive less. So if a business goes bust which owes you money, you are likely to get back a lower amount, or even nothing at all.

And if it is your business that has gone bust, and you have been involved in tax avoidance or evasion, or if you simply set up a new business to replace the old (known as "phoenixism") HMRC will have the power to collect the missing tax, NICs or VAT from you personally.

Image source, Getty Images

Image source, Getty ImagesIt includes announcements on wages, mental health and universal credit. Here's what it means to you.

It includes announcements on wages, mental health and universal credit. Here's what it means to you.

Read More Image source, ICAEW

Image source, ICAEWWhat were the chancellor's most-used words in today's speech?

The Institute of Chartered Accountants in England and Wales has produced a rather handy word cloud to tell us.

Unsurprisingly, deputy speaker, people and British all feature prominently.

But rather oddly austerity doesn't seem to have made the cut.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

It's the all-important question - just how will this Budget affect you? Fear not: we have the answer.

Just put in your details into our freshly updated Budget calculator and you'll find out.

Kamal Ahmed

Kamal Ahmed

BBC economics editor

Image source, AFP

Image source, AFPThe chancellor said that public spending would increase by 1.2% a year over five years from 2020.

Public spending will rise by £30bn by 2023-24 - a significant stimulus to be spent on the NHS and on raising the amount people can earn before they start paying tax.

That is in sharp contrast to the five-year "austerity" plan announced in 2010, which saw cuts of 3% a year, and 2015, which included cuts of 1.3% a year.

To pay for that, Mr Hammond will allow borrowing to to be sustained at about £20bn a year.

Little talk today of "balancing the books" or the risk of a bad Brexit deal.