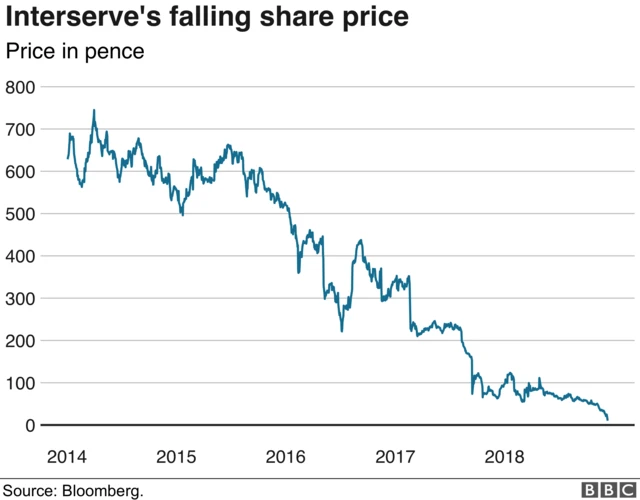

Interserve shares plungepublished at 08:17 GMT 10 December 2018

Interserve share price: From a high to a low

Interserve's share price plummeted by 59.18% to 10p after the company announced at the weekend that it was in talks to restructure its debt pile.

The public services outsourcing group re-issued a statement which said it was "making good progress" on a long-term recovery plan.

Details of the plan are expected to be announced next week.