Good nightpublished at 21:30

That's it for this week on Business Live - thanks for reading. We'll be back bright and early at 06:00 on Wednesday.

Do join us then for all the latest breaking news and analysis.

Get in touch: bizlivepage@bbc.co.uk

Jamie Oliver's restaurant group in administration

Tesco Bank scraps mortgage lending

Nationwide profits falls

WH Smith chief to leave

Tom Espiner

That's it for this week on Business Live - thanks for reading. We'll be back bright and early at 06:00 on Wednesday.

Do join us then for all the latest breaking news and analysis.

Image source, Getty Images

Image source, Getty ImagesMajor US stock indexes have closed higher after the US temporarily eased curbs on China's Huawei Technologies, raising expectations that the two countries would work towards a trade deal.

The Dow Jones Industrial Average was up 197.4 points at 25,877.33. The S&P 500 was up 24.3 points at 2,864.48 and the Nasdaq Composite was up 83.4 points at 7,785.72.

Laura Kuenssberg

Laura Kuenssberg

BBC political editor

Image source, Getty Images

Image source, Getty ImagesDid the prime minister just make it worse? It hardly seems that would have been possible.

Her agreement with the EU had been sharply kicked out several times by MPs. She'd promised that she would quit and get out of the way if that bought more support. Then she took the risk of talking to the political enemy to try to get a different deal.

But those measures failed - leaving her hope this time to dangle a bauble to each of Parliament's different Brexit tribes in the much more extensive plan of how she'd actually put our departure into law.

But even before she started talking, many MPs simply weren't listening.

Image source, Getty Images

Image source, Getty ImagesThe chief executive of Sainsbury's Mike Coupe has written a column for Retail Week., external

In it he speculates about what we might be eating in the future.

"In five years’ time, we could be eating insect carbonara and drinking algae-milk lattes as we incorporate more sustainable forms of protein into our diets," he said.

"In 30 years’ time, we could be eating jellyfish for dinner given its richness in vitamins and nutrients."

Image source, Getty Images

Image source, Getty ImagesMarks and Spencer publishes full year results tomorrow, it is expected to make around an underlying pre-tax profit of £520m, down 10% on the previous year.

How shares react to those results could help determine if M&S remains in the FTSE 100 index.

At the moment M&S is in danger of falling out of the UK's main share index, where it's been since 1984.

"A demotion from the FTSE 100 wouldn’t directly affect the department store’s business performance, but it would be a hugely symbolic moment for M&S, and for the retail sector as a whole. In a sign of the changing of the guard, Ocado, with whom M&S recently went into partnership, is now nestled safely in the top half of the FTSE 100, after being promoted to the index just last year," said Laith Khalaf, senior analyst at Hargreaves Lansdown.

"M&S profits actually peaked in 1998, though its share price hit a high in 2007. Shares are now trading around 10% lower than at the start of the millennium, but even so investors have still doubled their money over this period through those all-important dividends," he said.

Image source, AFP

Image source, AFPNadege Dubois-Seex

A French woman whose husband died in the crash of a Boeing 737 Max airliner in Ethiopia has filed a US lawsuit against the planemaker, seeking at least $276m in damages.

The crash of Ethiopian Airlines flight 302 in March killed all 157 passengers and crew aboard and followed the death in October of 189 people on a Lion Air 737 Max which crashed into the ocean off Indonesia in similar circumstances.

Dozens of families have sued Boeing over the Lion Air crash, and several lawsuits have been lodged over the Ethiopian crash near the capital Addis Ababa, which led airlines around the world to ground the Boeing 737 Max.

The lawsuit on behalf of Nadege Dubois-Seex, whose husband Jonathan Seex was a Swedish and Kenyan citizen and chief executive of the Tamarind Group of companies, was filed in a US District Court in Chicago, her lawyer said on Tuesday.

"Our family has lost its shining knight and the world has lost a brilliant entrepreneur," Mrs Dubois-Seex said.

Image source, Getty Images

Image source, Getty ImagesCan you name the UK's most consistent hitmaker of the last decade?

It's actually Jamie Scott, at least according to music investor Merck Mercuriadis, founder of Hipgnosis Songs fund, external, who has just snapped up Scott's catalogue for the fund.

The figures are impressive: Scott is responsible for 84 number ones, 188 top fives and 247 top 10s across the world although his main claim to fame is being the man behind 29 One Direction songs.

The fund raised £140m of equity capital last month to help it continue to acquire music catalogues such as Scott's.

'They're all quite scared'

Unite says British Steel workers at Scunthorpe are anxious to find out if they still have jobs.

Image source, Getty Images

Image source, Getty ImagesTheresa May has told MPs they have "one last chance" to deliver Brexit, as she set out a "new Brexit deal".

MPs will get a vote on whether to hold another referendum if they back the EU Withdrawal Agreement Bill, she said.

But Adam Marshall, director general of the British Chambers of Commerce, said:

"Businesses need concrete outcomes to plan for the future. In the absence of parliamentary consensus on either the withdrawal agreement or any other proposition for the future, both businesses and investment remain in limbo.

"Companies across the UK are frustrated, but most are still concerned about the prospect of a messy and disorderly exit from the EU. The date may have changed, but the practical questions businesses face remain the same - and the real-world impacts of parliamentary indecision and delay are growing each and every day."

Image source, Getty Images

Image source, Getty ImagesJohnson & Johnson has been ordered to pay at least $25m in damages to plaintiff Donna Olson and her husband as part of a lawsuit alleging its talcum powder caused cancer, Bloomberg reports, external.

The New York jury will return next week to consider punitive damages, the article said.

Image source, Getty Images

Image source, Getty ImagesReports of suspicious financial activity in the Vatican reached a six-year low in 2018, an internal watchdog report has said.

"I think it's fair to say that a fully functioning system has been implemented and achieved," said Rene Bruelhart, a Swiss lawyer and anti-money laundering expert who has headed the the Vatican's Financial Information Authority (AIF) since 2014.

The report showed that 56 Suspicious Activity Reports (SARs) were filed with the authority in 2018, down from a peak of 544 in 2015.

Eleven were passed on to the Vatican's investigating magistrate. They involved suspicion of international fraud, fiscal fraud or market abuse.

The trial of a former head of the Vatican bank and an Italian lawyer on charges of money laundering and embezzlement began last year and is still in progress.

For decades before reforms were implemented, the bank, officially known as the Institute for Works of Religion (IOR), was embroiled in numerous financial scandals as Italians with no right to have accounts opened them with the complicity of corrupt insiders.

Pope Francis, who has made cleaning up Vatican finances a priority and given Mr Bruelhart wide powers, considered closing the IOR when he was elected in 2013.

Hundreds of accounts have been closed at the IOR, whose stated purpose is to manage funds for the Church, Vatican employees, religious institutes, or Catholic charities.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

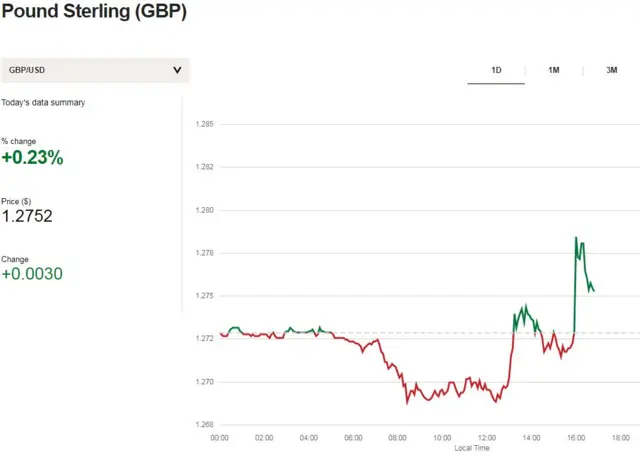

Sterling jumped more than 05% against the euro and the dollar after Bloomberg, citing sources, reported that Prime Minister Theresa May had proposed a free vote on a second Brexit referendum.

However, after Mrs May's speech opening the door to a second referendum, the pound started to decline again after Mrs May indicated there would not be a free vote and as traders again weighed up the likelihood of a second referendum.

Simon Gompertz

Simon Gompertz

BBC personal finance correspondent

Metro Bank chair Vernon Hill, pictured with dog Duffy, founded the bank in 2010

Metro Bank’s chairman, Vernon Hill, has survived the Annual General meeting of the bank’s shareholders, despite a precarious few months.

Investors representing 12% of the shares voted to eject him from his post, and there was a 20% vote against directors’ pay.

A leading fund manager, Legal & General Investment Management, had warned that it would vote against him, citing "continuing concerns following the recent announcements on accounting errors and the significant share price underperformance."

Metro Bank shares have regained some ground from the low of 475p last week.

Then it was raising £375m in emergency funds after admitting earlier that it hadn’t been holding enough capital against its loans.

The shares now stand at 698p, up 6% on the day but still nearly 80% down on a year ago.

"This fiasco should never have happened," one shareholder Dharmendra Shah said, "If you are a prudent businessman you should be able to anticipate events."

Theresa May says MPs will get vote on whether to hold another referendum if they back EU Withdrawal Agreement Bill.

The Labour Party has called on the government to take a stake in British Steel "to protect jobs and support the UK’s infrastructure and renewable energy systems."

Labour leader Jeremy Corbyn said:

"The collapse of British Steel would have a devastating impact on thousands of jobs in Scunthorpe, and could have major knock on effects on wider supply chains...

"Britain’s proud steel industry has a major role to play in ushering in a Green Industrial Revolution, securing British manufacturing for a sustainable, green future. It needs support, not a death warrant."

Image source, Getty Images

Image source, Getty ImagesUS stock indexes are rising in a broad-based rally as Washington's decision to temporarily ease curbs on China's Huawei Technologies allayed concerns over a further escalation in trade war between the two countries.

Chipmakers, which bore the brunt of a sell-off on Monday, rose after the US granted the Chinese telecoms equipment maker a license to buy US goods until 19 August.

The Dow Jones Industrial Average was up 181 points at 25,861. The S&P 500 was up 25 points at 2,864 and the Nasdaq Composite was up 87 points at 7,789.

Image source, AFP

Image source, AFPFree market think tank the Adam Smith Institute has called for the government to stop "throwing any more cash into a burning furnace to prop up the business of two super-rich brothers".

"Greybull Capital demanding taxpayers' put money on the line to save their business while limiting their own exposure is the worst of crony capitalism.

"Money funnelled from your pockets to Westminster and onto Mayfair, with the pretense of saving Scunthorpe just prolongs the inevitable," the think tank says.

"It’s not the government’s role to bailout collapsing businesses," it adds.

Image source, British Steel

Image source, British SteelBritish Steel is on the verge of administration as it continues to lobby for government backing.

However, manufacturer industry body UK Steel says comments by business minister Andrew Stephenson earlier to leave "no stone unturned" to support the steel industry brought a "glimmer of hope".

"This does provide some breathing space for the company, its employees, and the wider steel sector, providing a potential route towards a stable and sustainable future," said UK Steel director general, Gareth Stace.

Administrators for Jamie Oliver's restaurant group have said there will be approximately 1,000 redundancies and that all but three of the chain's 25 restaurants have closed.

Will Wright, partner at KPMG and joint administrator, said: "The current trading environment for companies across the casual dining sector is as tough as I’ve ever seen."

After an unsuccessful sale process, the group's directors decided the call in administrators, he said.

"Unfortunately, with insufficient funds available to be able to trade the business in administration, all but the Gatwick airport restaurants have now closed," Mr Wright added.

"Our priority in the coming hours and days is to work with those employees who have been made redundant, providing any support and assistance they need."