'Doubt' UK is heading for recessionpublished at 11:22 BST 10 July 2019

Image source, ONS

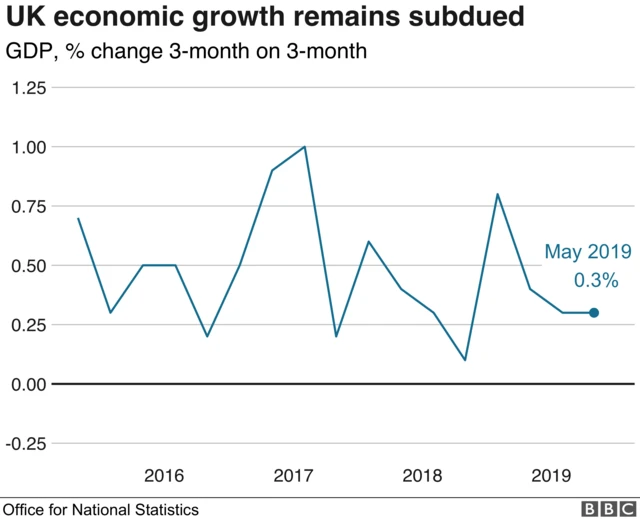

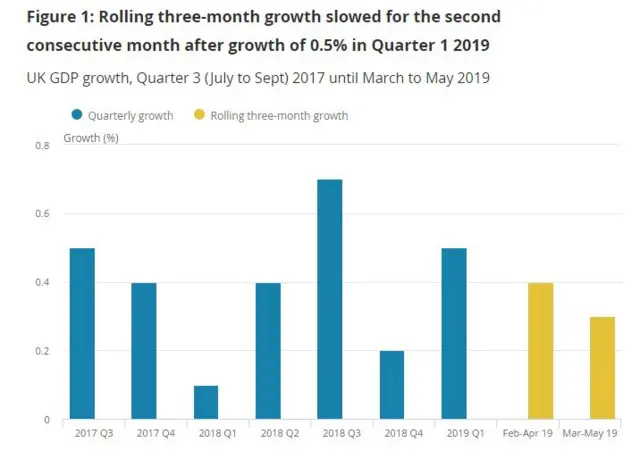

Image source, ONS"Despite the rebound in monthly GDP in May, the economy may have contracted in Q2 as a whole. But it’s going to be close and we doubt we’re heading for a recession as GDP will probably rise in Q3 anyway".

That's the view of Paul Dales, chief UK economist at Capital Economics who has been looking at that data showing the economy grew by 0.3% in May.

"We suspect GDP probably fell in June... That would raise the risk of a recession (two consecutive quarterly contractions), but we’re not expecting one," he said.

This because the weakness in the second quarter was caused by shifting activity in to the first quarter ahead of the original Brexit deadline of 29 March, he said.

"Just as the GDP data for Q1 suggested the economy was stronger than it really was, the data for Q2 will suggest it’s weaker than it really is. As the truth lies somewhere in between, GDP will probably rise in Q3," he added.