Coronavirus: How the Bank rate cuts affect youpublished at 16:23 GMT 19 March 2020

Two cuts in the Bank rate within days will immediately reduce the mortgage bill of some homeowners.

Read MoreGet in touch: bizlivepage@bbc.co.uk

Sunak pledges £30bn to help "British people, British jobs and British businesses"

Fuel duty remains frozen for another year

Planned rise in beer, cider and wine duties cancelled

£5bn for gigabit-capable broadband into the hardest to reach places of the UK

UK growth forecasts updated: 1.4% for 2020 and 1.6% for 2021

Government to abolish business rates for small shops this year

Karen Hoggan, Tom Espiner and Dan Ascher

Two cuts in the Bank rate within days will immediately reduce the mortgage bill of some homeowners.

Read More

That's it for Budget Live.

We're off to take advantage of the freeze on alcohol duty but we'll be back bright and early at 06:00 tomorrow morning with Business Live.

Thanks for reading.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Budget 2020: 'This is two Budgets in one'

Patrick Burns

Patrick Burns

Political editor, Midlands

"What's in it for us?"

That's the question thousands of Midlanders are entitled to ask of today's Budget, especially those Labour voters who broke the habits of several lifetimes by switching to the Conservatives in areas of the Black Country and North Staffordshire where, until recently, any such thing would have seemed unthinkable.

Remember this Budget is not only the first to be presented on behalf of a new government by a very new chancellor. It's also the first after Brexit and the first after our own flooding emergency along the Rivers Severn and Wye which has left local communities facing long and relentless battles to rebuild their their lives and their livelihoods.

What's in it for them, too?

Image source, Getty Images

Image source, Getty ImagesIn non-Budget news: insurer LV has stopped selling travel cover as a result of the spread of coronavirus.

LV said: “In light of the impact that Coronavirus (Covid-19) is having globally, we’ve made the difficult decision to pause the sale of travel insurance to new customers.”

The company has seen a doubling in the number of policies sold over the last couple of weeks, as travellers rush to protect themselves against having to cancel holidays or being stuck overseas.

The move comes after another leading insurer, Aviva, restricted the level of cover in new policies by cutting out a clause covering travel disruption.

The Institute for Fiscal Studies tweets

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Tom Burridge

Tom Burridge

Transport correspondent

The owner of British Airways has reacted angrily to the fact that Air Passenger Duty will rise in line with inflation next year.

International Airlines Group, which also owns Aer Lingus and Iberia, said “given the acute pressure on business, the hike in APD will make it even harder for UK firms to trade overseas. This costs UK jobs and growth.”

Airlines have long campaigned for APD to be scrapped. However the aviation industry is being hit hard by the drop in passenger demand because of the coronavirus outbreak.

The budget says APD will increase in line with the Retail Price Index measure of inflation for 2021-22, meaning rates on short-haul flights will remain frozen at £13.

Long-haul economy will increase by £3 per passenger. The government will carry out a consultation on reforming APD in the spring.

Use our Budget calculator to find out how your pocket may be affected by the latest tax measures.

Read More Image source, Getty Images

Image source, Getty ImagesShare markets in the US were sharply lower on Wednesday on another day of jittery trade, driven by fears about the economic impact of coronavirus.

The Dow Jones was down nearly 5% at midday trade in New York, while the S&P 500 and Nasdaq fell more than 4%.

The falls come as countries rush to approve spending to shield economies from reduced activity due to the virus.

In the last hour, the World Health Organization has formally declared the outbreak a pandemic.

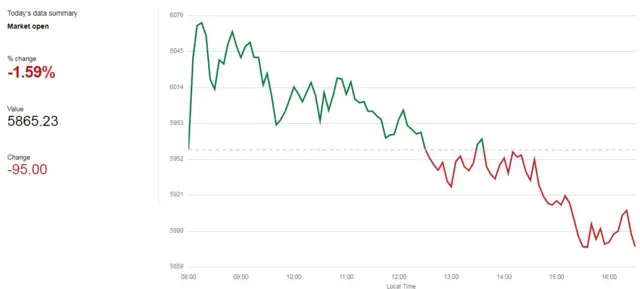

It's been a turbulent day on the FTSE 100, which closed 1.6% lower after the Bank of England unexpectedly announced an emergency stimulus package and Chancellor Rishi Sunak unveiled a Budget that has been described as the "biggest sustained giveaway" in almost three decades.

The index edged into the red as Mr Sunak took to his feet in the Commons and largely continued on a downward trend to close the day 95 points lower at 5,865.

The FTSE 250 finished the day 1.2% lower at 17,339.

Mark Broad

Mark Broad

BBC Business digital and deployments editor

Image source, Getty Images

Image source, Getty ImagesNumber 10 has confirmed that executives from the major tech firms have been called to a meeting this evening with Prime Minister Boris Johnson.

Amazon, Google, Microsoft, Apple and Facebook will also be having a meeting with the Chief Medical Officer for England Prof Chris Whitty, Simon Stevens, the head of the NHS, and Health Secretary Matt Hancock.

Downing Street said the talks were due to focus on how to "inform the public" about coronavirus and also look at "modelling the spread of the disease".

Reality Check

Reality Check

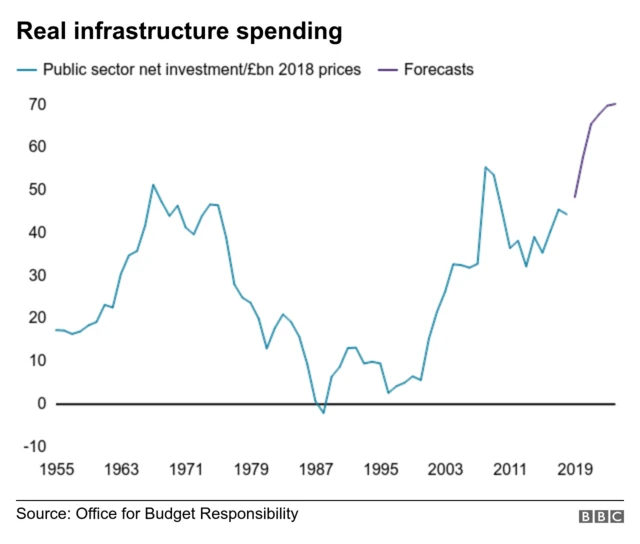

The government is going to raise infrastructure spending (which is money for things like building roads and hospitals) to unusually high levels, even after taking into account rising prices.

There have been various numbers used, but this chart of public sector net investment, adjusted for inflation, shows the planned increase.

The only time we have got close to these levels was in 2008-09 and 2009-10, when the government brought forward spending to help boost the economy during the financial crisis.

But governments have found it very difficult over the years to spend as much as they've planned to on infrastructure, as Reality Check explained in this piece.

Image source, Getty Images

Image source, Getty ImagesHumanitarian organisation the British Red Cross, which among things campaigns on loneliness, has said the government should commit to a funding plan to tackle isolation.

"Better connected communities are more resilient communities," says Zoë Abrams, executive director of the British Red Cross.

"Whether floods or an epidemic, in a crisis people who are lonely or socially isolated are hit the hardest.

"Whilst loneliness wasn’t mentioned in the Budget, we urge the government to commit to a meaningful funding plan to tackle loneliness in the forthcoming spending review," she added.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Faisal Islam

Faisal Islam

BBC Economics Editor

There were two Budgets here. And both were huge. The first, the priority, was the immediate coronavirus challenge and the threat of a recession, identified by the Office for Budget Responsibility.

The numbers were substantial. A £30bn plan that would, for the first time, see the state fund statutory sick pay for small and medium sized enterprises, some cash handouts, and a one-year suspension of business rates. And boost health spending. The measures complemented the emergency rate cut from the Bank of England, and provide a powerful bridge built on the assumption that the outbreak will be temporary.

But the government also enacted its central manifesto offer, rather spectacularly - borrow a huge amount of money to fund public services. The numbers were eye-watering, historic. Rishi Sunak was not even 10 years old when we last had a Budget that pumped so much money into the economy. There is £175bn extra in spending, not just on infrastructure, as expected, but also on current spending. In fact, most of the extra spending is on day-to-day departmental spending – including on tens of thousands of nurses and police officers etc.

Much of the fine detail of where this money will actually go, in terms of department, region, type of public service is not settled. Even the Treasury “Green Book” equation that diverts spending towards places like London, is being reviewed.

How is all this paid for? The answer, basically, is around £130bn of extra borrowing over this Parliament, and not really tax rises. Whereas deficits were being phased out under existing Conservative plans, under this one, they become permanent. A structural change on economic policy that seeks to take advantage of historic lows in the interest rates that governments pay to borrow.

But this is a government with a lot on its plate: coronavirus, post-Brexit negotiations and running a significant deficit of almost 3%.

But this is one of the most consequential Budgets in a generation.

For those coming fresh to the BBC's live coverage of Rishi Sunak's first Budget, here are some of the key points you may have missed.

The chancellor promised:

Image source, Getty Images

Image source, Getty ImagesThe cost of a packet of hand-rolling tobacco is due to rise by 67p, considerably more than the 27p additional tax that will be added to a pack of 20 cigarettes.

That's because, under a higher "tobacco escalator" policy, the tax on rolling tobacco increases at 6% ahead of the retail price index.

Simon Jack

Simon Jack

BBC Business Editor

This was two Budgets in one: a core Budget with big borrowing and spending plans for the years ahead and an emergency coronavirus budget.

Although it’s primarily a health emergency, the next few weeks and months could be a life or death moment for many small businesses which are dealing with the virus and, more importantly, the response to it.

Business rates relief for small firms, an offer to give companies more time to pay tax and the promise of a cash grant of £3,000 to virus-affected small firms will be welcomed. But many will feel the criteria is too prescriptive and a more general hardship fund would have been more appropriate for a situation whose impacts are hard to predict.

But perhaps more important was the messaging that the government wants to unlock the potential of business.

That is a warmer tone to the private sector than the one business has been used to.

The government has acknowledged that business faces financial distress on top of the Brexit preparation that could substantially add to the cost and administrative burden that business will face at the end of this year.

BBC Radio 5 Live

BBC Radio 5 Live

BBC Radio 5 Live has been speaking to business owners to get their reaction to the Budget...

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.