UK heading for recessionpublished at 13:42 BST 4 August 2022

The Bank of England has predicted the UK will fall into recession this year. Here’s what it means.

The Bank of England has raised interest rates again from 1.25% to 1.75% as it battles to curb rising prices

The increase is the biggest in 27 years and will increase pressure on households already struggling with the cost of living

Andrew Bailey, the Governor of the Bank of England, blamed Russia for the high energy prices which are pushing up inflation

It makes mortgages and loans more expensive but increases the return on savings

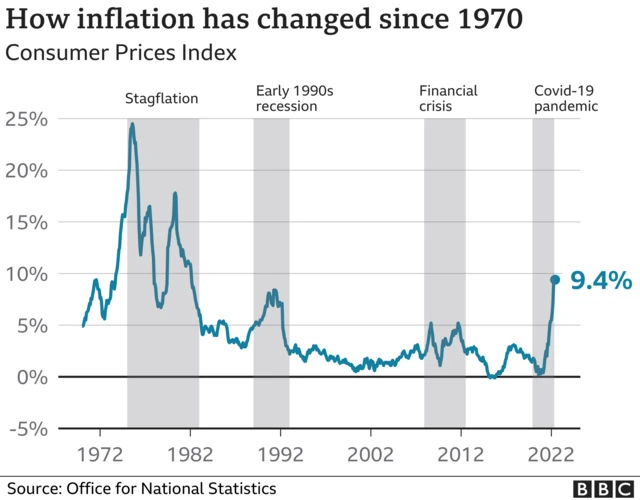

Inflation, the rate at which prices grow, is expected to rise even further this year, peaking at 13% in October

The UK is expected to fall into recession - which means the economy is shrinking - in the final three months of this year

Edited by Chris Giles

The Bank of England has predicted the UK will fall into recession this year. Here’s what it means.

Image source, Getty Images

Image source, Getty ImagesFollowing the Bank of England's decision to raise interest rates to 1.75%, the Federation of Small Businesses National Chair Martin McTague has been talking about the impact this will have on his members.

“Moving interest rates is not without consequences. It’s removing steam from the economy at a time of meagre growth. Small businesses already face grave uncertainty as they try to recover from the impact of Covid, while contending with the cost of doing business crisis.

"First, many commercial, personal and professional loans that small businesses and sole traders hold are not protected by fixed rates and will move in line with the increase today.

"Second, attempts to get back to a functioning commercial lending market will be hampered as new products will become more expensive – and so small firms will find it harder to access affordable credit.

"We must bring down inflation, but the negative aspects of today’s hike make the case stronger for small business support as thousands upon thousands of small firms will have less financial room to manoeuvre.”

Simon Read

Simon Read

Personal Finance Reporter

Image source, Getty Images

Image source, Getty ImagesThe rate rise may not prove to be as good news for savers as it could be.

We would all welcome an extra 0.5% interest on our nest eggs but banks and building societies are extremely unlikely to be that generous.

Out of the biggest high street banks, only one has passed on all five recent base rate rises since last December, according to figures from Moneyfacts.co.uk.

So while the base rate climbed 1.15 percentage points in the last eight months before today’s increase, savings accounts languished some way behind.

Some have passed on a relatively pitiful 0.09% since December 2021 and that realisation may prompt fed up savers to look elsewhere.

“Challenger banks and building societies continue to compete in this space and the average easy access rate has risen to 0.69%, up from 0.20% in December 2021,” pointed out Rachel Springall, finance expert at Moneyfacts.co.uk.

Image source, Paola Dyboski

Image source, Paola DyboskiPaola Dyboski fears a rate rise will put her business expansion plans in jeopardy.

She runs a small manufacturing business in North Wales called Dr Zigs Extraordinary Bubbles.

"We're ambitious and currently expanding globally and finding growth in export markets," she says.

"But, with expansion on the cards we would look to borrow to increase production and outputs and manage this growth."

Higher interest rates will make this hugely more "risky and challenging", she says.

"It will bring into question the viability of our UK manufacturing base.

"I am also concerned that if our trade customers can't borrow, they will then cut on their spending and their purchases from us. We will all be affected."

Image source, EPA

Image source, EPAIn the closing remarks of his news conference Andrew Bailey says "our job is to hit the inflation target" and "in the current circumstances to return inflation to target".

He goes on to say "to be clear, there are no ifs and buts in our commitment to the 2% inflation target".

"That's our job and that's what we will do," he finishes by saying.

Simon Read

Simon Read

Personal Finance Reporter

Image source, PA Media

Image source, PA MediaNew first-time homebuyers will see their average monthly mortgage payments climb to an average of 40% of their gross salary after today's half a percentage point rate rise.

That's a level not seen for a decade, since 2012, reckons property website Rightmove.

It calculates the average monthly mortgage payment for new first-time buyers will increase to more than £1,000, up considerably from £813 in January.

Meanwhile the chance of raising a deposit is getting harder for prospective first-time buyers.

The 10% deposit on an average first-time buyer type home is now £22,494, some 57% higher than 10 years ago when it stood at £14,316.

The figures are based on the average asking price of a first-time buyer home being £224,943.

The Bank of England has warned that inflation could climb higher than 13% later this year, which will be even more devastating news for hard-pressed deposit savers already struggling with the cost-of-living squeeze.

The most significant development since its last forecast for the economy, Bailey says, has been the sharp increase in energy prices.

Wholesale gas price predictions for the end of the year have nearly doubled since May and up by nearly seven times since the end of 2021, he says.

Bailey again says this is almost entirely down to Russian restrictions of gas supplies to Europe.

He adds the consequences of this are that short term "inflationary pressures have intensified significantly".

"Returning inflation to the 2% target remains our absolute priority," says Andrew Bailey.

"All options are on the table for our September meeting and beyond that," the Bank of England governor goes on to say.

The Bank's Monetary Policy Committee meets eight times a year - roughly once every six weeks.

Image source, PA Media

Image source, PA MediaThe governor of the Bank of England Andrew Bailey has been speaking to the media.

He starts his press conference by saying the risks around the Bank's forecasts are "exceptionally large at present".

He says energy prices and the consequences of Russian actions in Ukraine mean it is hard to make predictions.

The Bank of England has tweeted a thread, external on its interest rate rise after the Monetary Policy Committee voted to increase rates to 1.75%.

The BoE says "we've put up interest rates to help return inflation to our 2% target" and says it knows "the cost of living squeeze is difficult for many people".

Inflation is expected to rise further this year to around 13%, the Bank says.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Image source, Wayne Trim

Image source, Wayne TrimWayne Trim, 38, is worried about the impact of rising interest rates on his mortgage.

“My mortgage payments were £416 last year and now they’re £515 and will keep going up.”

It could even affect his commute to work as a customer services manager at Morrison's in Dorset. He recently moved to a new store. which is an hour's drive from his home.

"They did give me a pay rise to move stores, but I needed a new car, which took a fair chunk of my pay rise," he says.

"I bought a hybrid. I'm spending about £200 a month filling it up."

"You think you're in a position where you're financially comfortable and then all these things start. It's like a never-ending cycle of trying to make ends meet."

Wayne's also repaying some loans, which costs him about £270 a month.

He says he doesn't understand why rates are increasing.

"They tell us it's to curb borrowing but all it means for me is I'm cancelling Netflix and Amazon."

Following the Bank of England’s prediction that the UK will fall into recession in the last three months of this year, shadow chancellor Rachel Reeves has said it is “further proof that the Conservatives have lost control of the economy”.

"As families and pensioners worry about how they're going to pay their bills, the Tory leadership candidates are touring the country announcing unworkable policies that will do nothing to help people get through this crisis.”

Simon Read

Simon Read

Personal Finance Reporter

Image source, Getty Images

Image source, Getty ImagesKeep your eye on any messages from your credit card company in the coming weeks.

If they decide to increase the interest rate charged on your card they will have to give you notice.

But did you know you don’t have to accept an increase?

If it increases the interest rate on your card you should be given 60 days to reject the increase and then pay off your balance at the existing interest rate.

You won’t be able to use the card anymore but at least you’ll be repaying it at a lower charge.

But if you can afford to clear the debt and close the card, then the increased interest rate charged could be a powerful motivator to get on top of your debt.

Eight of the nine members of the Bank of England's Monetary Policy Committee (MPC) voted in favour of the rise to 1.75%.

Just one member of the committee - Prof Silvana Tenreyro from the London School of Economics - voted for a quarter point rise to 1.5%.

Faisal Islam

Faisal Islam

BBC Economics Editor

Image source, Yui Mok/PA Wire

Image source, Yui Mok/PA WireThe Bank's prediction of a recession as long as the great financial crisis and as deep as that seen in the early 1990s is the big shock here.

The Bank thinks energy bills hitting nearly £300 per month on average, treble their level of a year before, will plunge the economy in the final quarter of this year into a recession.

If global energy costs remain where they are, that recession will then last the whole of next year, with inflation barely below 10% even in a year’s time.

This is a proper full fat recession now being predicted by the Bank and at the same time a 42-year high in the rate of inflation.

It is a textbook example of the combination of stagnation of the economy and high inflation - stagflation.

It obviously will raise questions as to why rates are being hiked into a recession, at a time when consumers are already pulling back from spending.

I cannot recall the Bank of England predicting a recession of this length in advance of the event.

And that certainly has not happened in the middle of the selection of a new prime minister.

The Bank has also raised its inflation forecast to 13% and now predicts the UK will fall into recession in the last three months of this year.

The Bank of England's Monetary Policy Committee has announced interest rates are rising from 1.25% to 1.75%.

Interest rates are now at their highest level since December 2008 after the biggest single rise since 1995.

The Bank of England will make its announcement on interest rates in the next few minutes.

Will they go up, and if so, by how much?

We'll find out in a couple of minutes, so stay with us.

As we've been reporting, we expect the Bank of England (BoE) to raise interest rates at midday - with some hints that it could be by up to as much as half a percent to 1.75%.

This would be be the largest single increase in the cost of borrowing in 27 years. But how does this compare to similar central banks efforts to curb soaring global inflation?

The US Federal Reserve (the Fed) also announced another massive interest rate hike last week, increasing its key rate by three quarters of a percentage point to a range of 2.25% to 2.5%.

It was the fourth increase since March and the second month in a row that it raised rates significantly, following an identical increase to a range of 1.5% to 1.75% in June.

Some experts say the more drastic action taken by the Fed since June has increased the scrutiny on the BoE's decision making, given its much lower rises so far this year.

Meanwhile, the European Central Bank (ECB) has also recently hiked its own key interest rate by half a per cent and plans further rises this year, but the overall rate remains much lower at 0.0% .

This is because the Eurozone's interest rate had been negative since 2014, a monetary policy strategy designed to encourage spending and increase economic growth when there are fears of stagnation.

Image source, .

Image source, .Torsten Bell - chief executive of independent think tank the Resolution Foundation - has told BBC Radio 4’s Today programme inflation is heading “over 10%, and that peak won’t come until the early part of 2023”.

He says inflation was previously expected to peak in autumn at around 10% but it could reach levels “well in excess of 10%” if the historical relationships between different prices continue.

“There’s obviously lots of different shocks happening at once here to our economy and to inflation,” he says.

“Some of those wider shocks are easing but others are getting worse”.

However, Bell does say he’d be surprised if the Bank of England decided to raise interest rates by half a percentage point regularly.