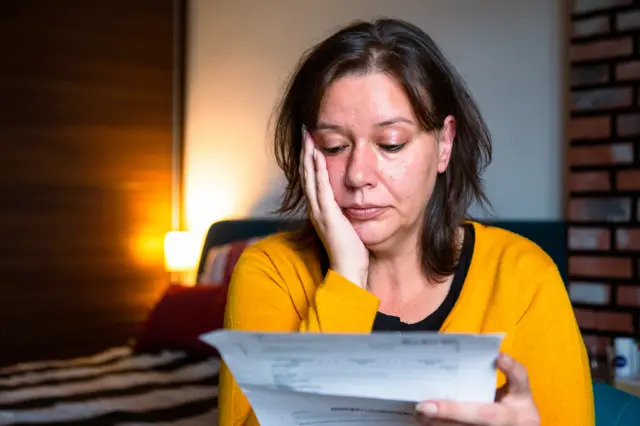

Nurse in overdraft with three weeks to paydaypublished at 15:05 BST 5 August 2022

Lucy, who is a nurse from Frome in Somerset, says she is very worried and that it is "difficult to comprehend things getting even tighter" in terms of her finances.

Speaking on BBC Radio 5 Live’s Nicky Campbell programme she explained she had cut back on things like going for coffee to help make ends meet.

But despite reducing her spending, Lucy said she was already in the overdraft of her bank account with 21 days until payday, after necessary bills and purchases ate up her regular income.

"At least in a way I’m not missing payments or I can’t pay for my energy or my mortgage at the moment, but yeah it is really tough", she said.