Latest on wages - what we learnt yesterdaypublished at 06:03 BST 17 August 2022

Yesterday we told you pay has fallen further behind the rising cost of living, according to official data.

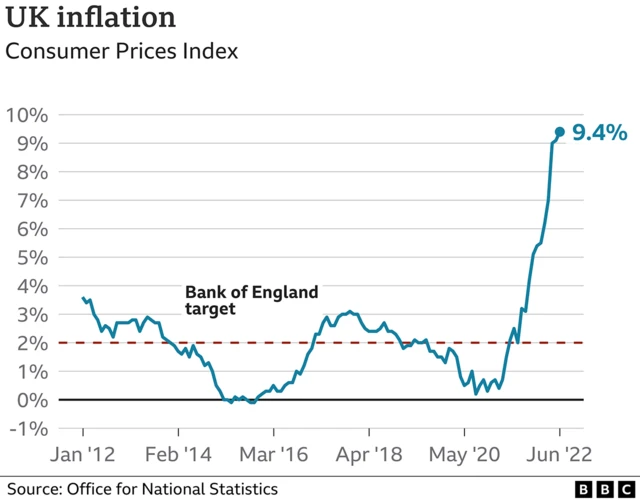

While average wages rose 4.7% between April and June, that was outpaced by inflation which is growing at a much faster pace.

As a consequence, the “real value” of pay fell by 3%, according to the Office for National Statistics. That means the average wage buys 3% less goods and services that it did the year before.

The gap between pay growth and inflation is the biggest since records began more than 20 years ago.