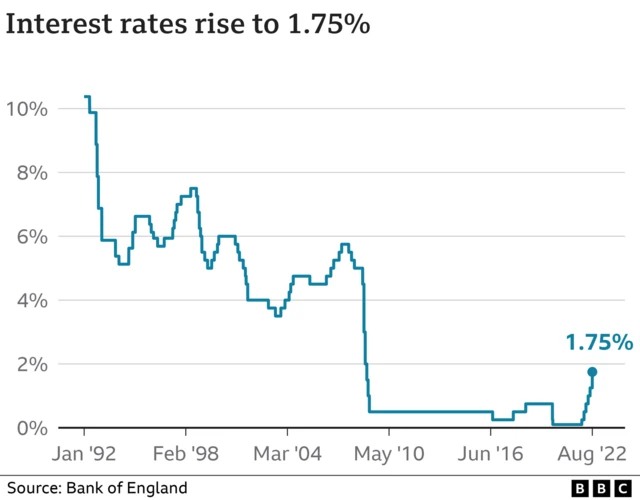

Interest rate rises to 2.25%published at 12:01 BST 22 September 2022Breaking

UK interest rates have increased to 2.25% - the seventh time in a row the Bank of England has raised rates in an attempt to tame rising prices.

The rate has been lifted by half a percentage point from 1.75% and takes borrowing costs to their highest levels since 2008 during the global financial crisis.

Interest rates have been rising since last December as inflation has swelled to its worst level in four decades.