Your Questions Answeredpublished at 16:07 BST 26 September 2022

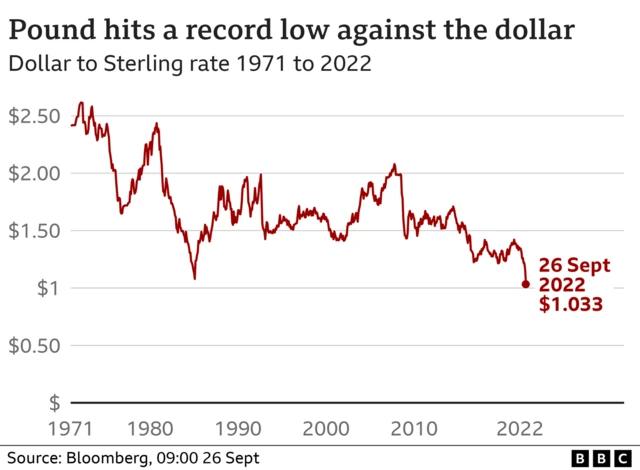

Do you have any questions about the falling pound and what it means for you?

Shortly, at 16:30 BST our colleagues on the News Channel will have a panel of experts on hand to help you understand the financial response to the chancellor's announcements last week.

You'll be able to watch by clicking the play button at the top of this page.

Dharshini David, the BBC's Economics Correspondent, will be there, along with Tom Selby, a consumer finance and pensions expert at the investment firm AJ Bell, and Patrick Reid, an expert in global currency markets.

This is your chance to ask anything to help you make sense of it all – and no question is a silly question.

You can also get in touch in the following ways:

- Email: yourquestions@bbc.co.uk

- WhatsApp: +44 7756 165803

- Tweet: @BBC_HaveYourSay, external

- Please read our terms & conditions and privacy policy

In some cases a selection of your comments and questions will be published, displaying your name and location as you provide it unless you state otherwise. Your contact details will never be published.