The sooner we grip inflation the better, says chancellorpublished at 12:15 GMT 15 December 2022

Image source, PA Media

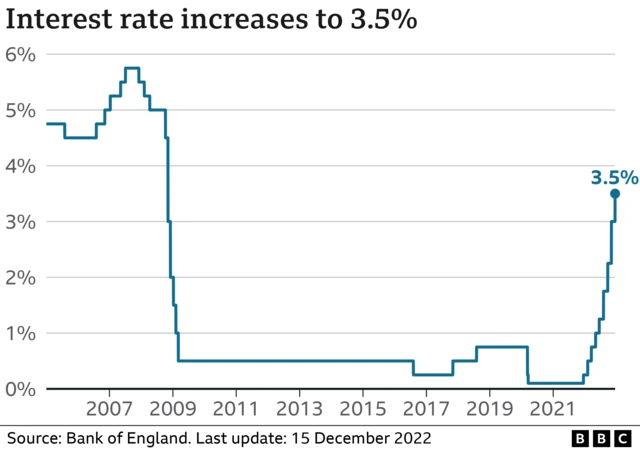

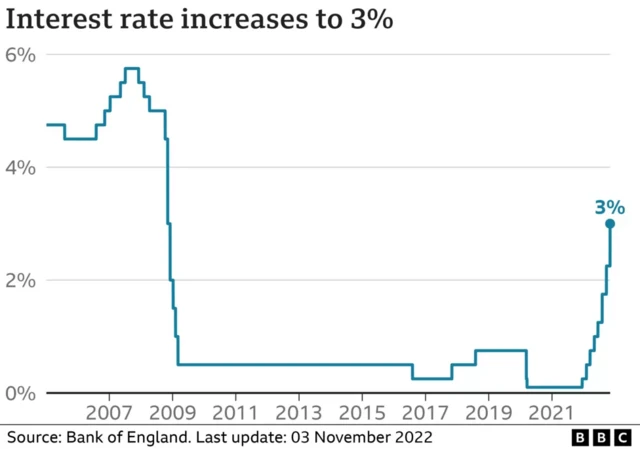

Image source, PA MediaWe've just had the chancellor's response to the Bank of England's latest interest rates rise.

Jeremy Hunt says: "High inflation, exacerbated by Putin's war in Ukraine, continues to plague countries across the world, eating into people's pay cheques and driving up food and energy prices.

"I know this is tough for people right now, but it is vital that we stick to our plan, working in lockstep with the Bank of England as they take action to return inflation to target.

"The sooner we grip inflation the better. Any action which risks permanently embedding high prices into our economy will only prolong the pain for everyone, stunting any prospect of economic recovery."