That's it from uspublished at 15:20 GMT 18 January 2023

That's it from us for today. But before we go, here's a quick recap:

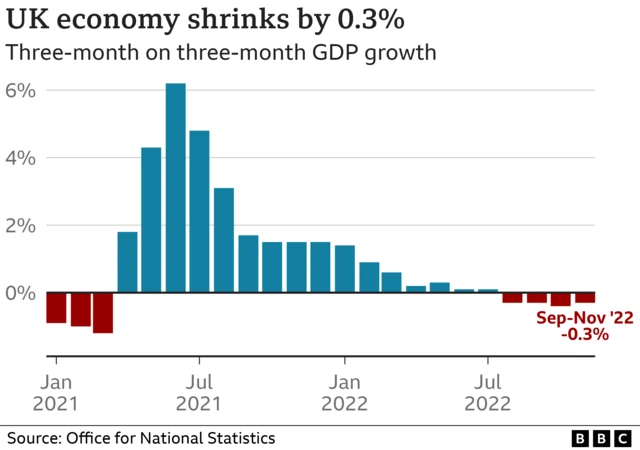

- The latest inflation figures showed a slight dip in inflation compared with last month, falling from 10.7% in November to 10.5% in December - but the rate still remains very close to a 40-year high

- Petrol and energy costs have eased, while food prices have continued to increase, the Office for National Statistics (ONS) says

- Milk, cheese and eggs are among the products costing more and more, along with jam, sugar and chocolate

- The Bank of England's former deputy governor, Sir John Gieve, told the BBC the slight dip in inflation was "encouraging," but "a lot of the pain and hard work" to bring inflation down is "still to come".

This live page was edited by Emma Owen, Jen Meierhans and Paul Gribben. Our writers were Adam Durbin, Alys Davies, Anna Boyd and Gem O'Reilly.