Bank sees inflation falling to 3% at the start of next yearpublished at 12:21 GMT 2 February 2023

Dearbail Jordan

Business reporter

Commenting on the rate of price rises, the Bank predicts inflation will fall back to 8% in June before dropping further to about 3% at the start of next year.

However, it also warned that the rate of wage rises risked a slower fall in inflation.

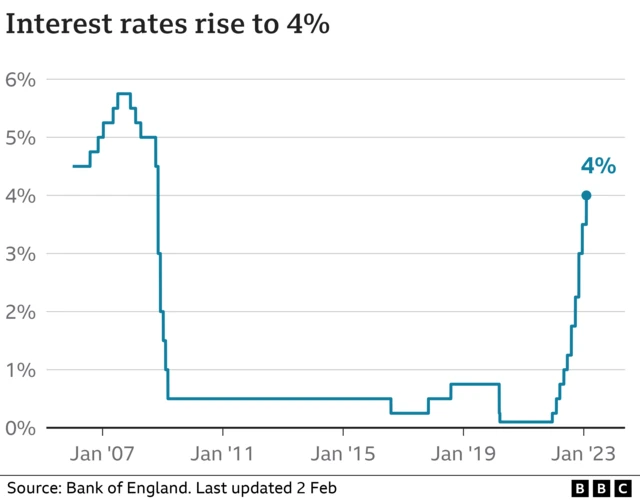

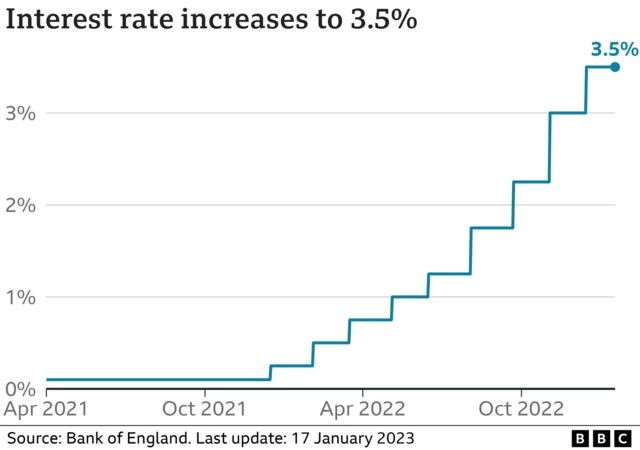

Financial markets widely expect interest rates to peak at 4.5% this year to help drive down inflation.

The Bank had previously said that it would act “forcefully” to control rising prices. But in its latest report the Bank softened its language.

“If there were to be evidence of more persistent pressures then further tightening in monetary policy would be required,” it said.