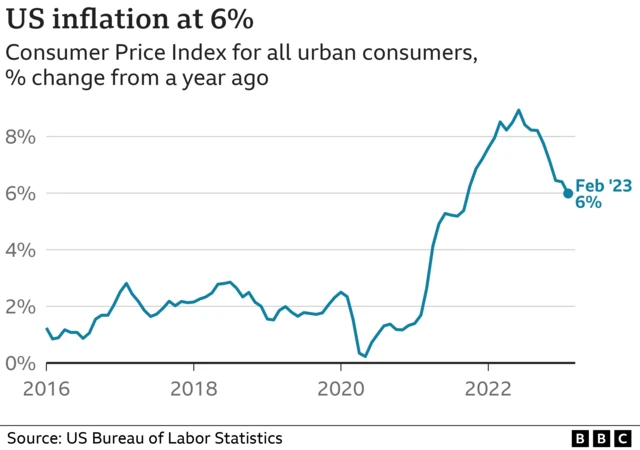

Analysts react to US price datapublished at 13:02 GMT 14 March 2023

Analysts' reactions to the inflation data are starting to pour in.

"The 0.5% m/m [month-on-month] rise in core consumer prices last month adds to the evidence that inflation remains stubbornly high, but the ongoing fallout from the SVB crisis over the coming days is still likely to have a bigger bearing on what happens at next week’s FOMC [Federal Open Market Committee] meeting," says Andrew Hunter, deputy chief US economist at Capital Economics.

“Investors will cautiously welcome today’s figures as they show inflation has slowed," says Richard Flynn, managing director of Charles Schwab UK.