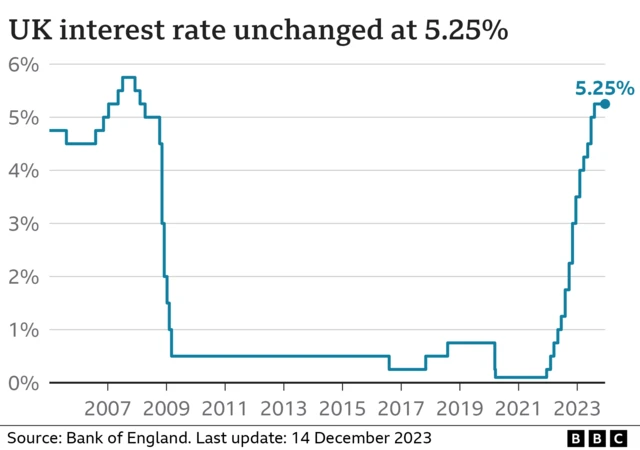

Interest rates remain at 15-year highpublished at 12:11 GMT 14 December 2023

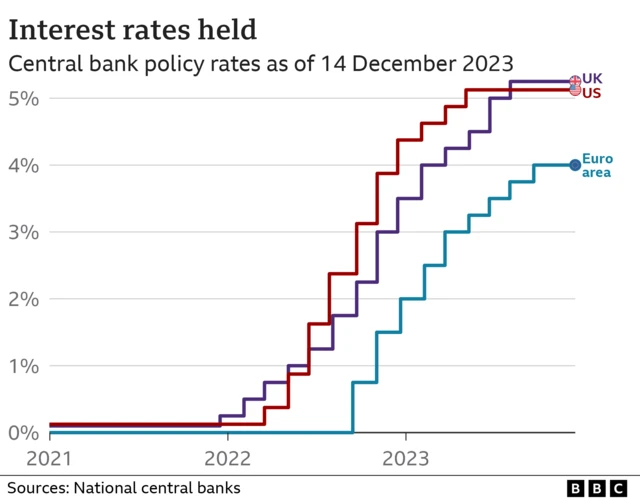

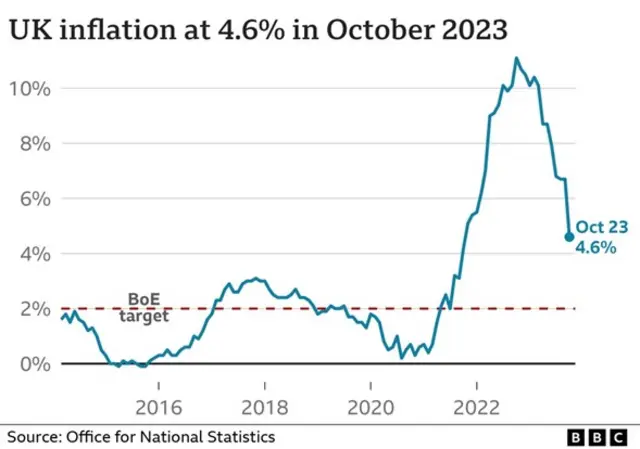

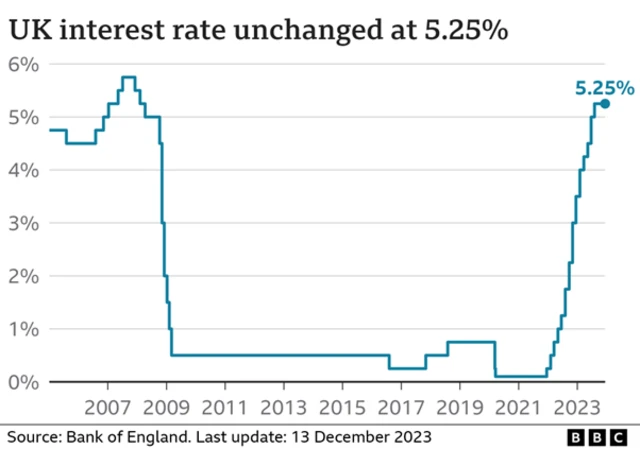

As we've just heard, the Bank of England has held interest rates and signalled there are unlikely to be cuts anytime soon.

It is the third time in a row that the UK cost of borrowing remained unchanged at 5.25% - a 15-year high.

Image source, .

Image source, .