Cost of living still rising - and so we're not expecting rate cut just yetpublished at 08:13 GMT 20 March 2024

Dharshini David

Dharshini David

Chief economics correspondent

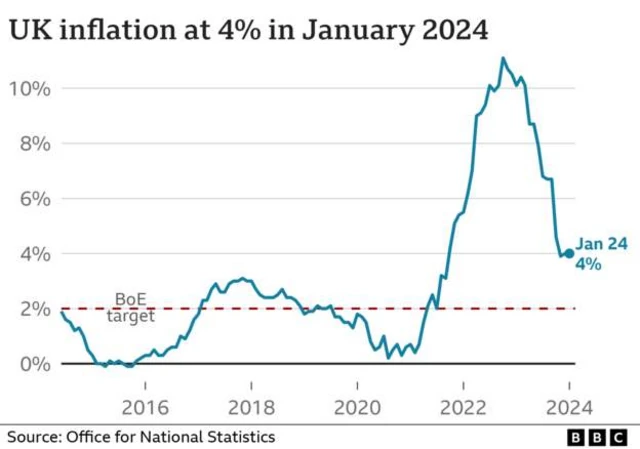

The same factors that triggered the cost of living crisis - wholesale global food and energy costs - combined with previous interest rate hikes from the Bank of England are largely behind the slowing of price rises over the last year, and should continue to fuel the decline.

The gap between the UK and the EU and the US is closing. And a drop in the domestic energy price cap should bring inflation down to below the Bank’s 2% target later this spring.

But remember: inflation still means the cost of living is still rising. Food is still 5% more expensive than a year ago, rents continue to climb. And, crucially, inflation in services - which covers the likes of hotel stays and insurance premiums - remains at 6.1%.

That concerns some members of the Bank of England’s interest rate panel.

They want to be confident that such price pressures are under control, and so inflation likely to remain around target in the longer term.

What they term "the last mile" in bringing down inflation can be the hardest. So economists don’t expect interest rate cuts to begin until the summer.

But the Bank remains also mindful of the less palatable side-effects of higher interest rates; they work by squeezing spending power, unhelpful at a time of stagnant growth.