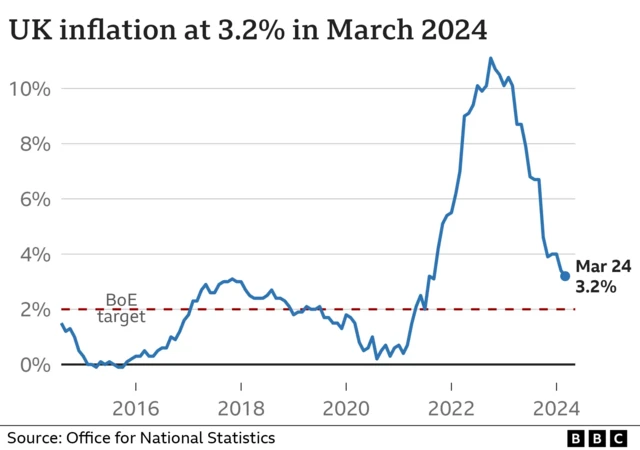

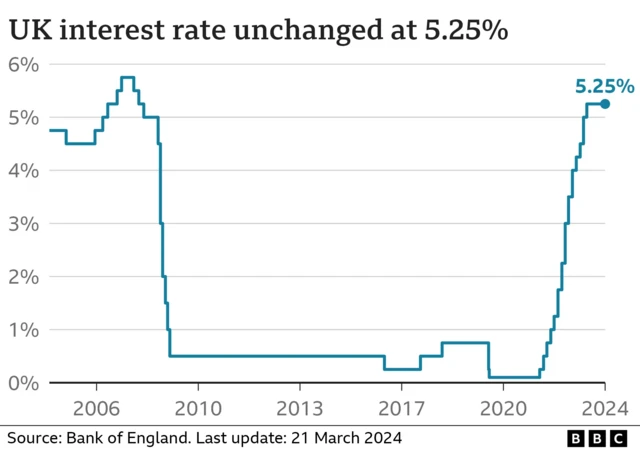

August or September likeliest time for rate cutpublished at 12:07 BST 9 May 2024

Faisal Islam

Faisal Islam

Economics editor

Today marks incremental progress towards a cut.

August or September seem to be the most likely timing, but if services inflation falls sharply in the next month, June is possible.

Elsewhere, the economy is expected to be officially confirmed as out of recession tomorrow with growth of 0.4% in the first quarter, and then 0.2% in the current quarter.

The forecast for the economy after that has improved a little, partly because of a rise in the size of the population, and some Budget measures.

But it remains a turnaround into a slow-growth recovery, rather than a post-recession boom.

Energy bills are not forecast to be cut further, given the very recent uptick in global energy prices.