Thanks for joining uspublished at 14:18 BST 20 June 2024

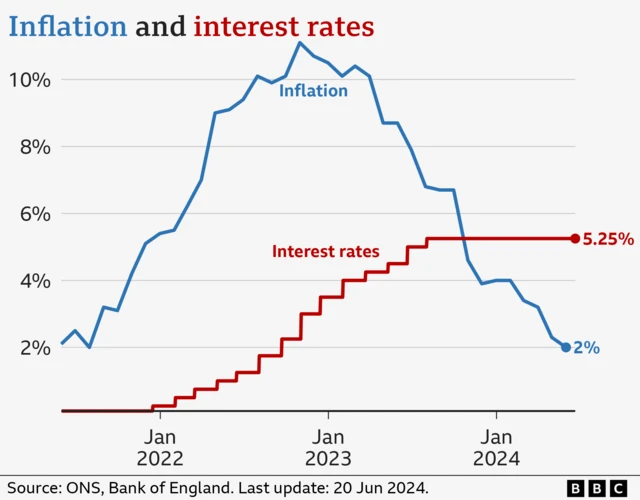

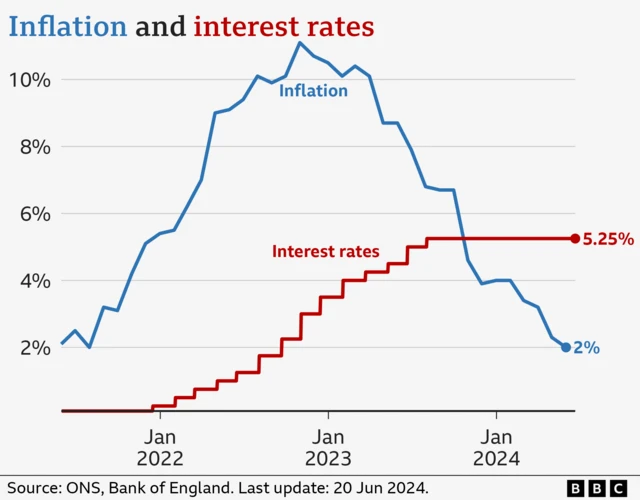

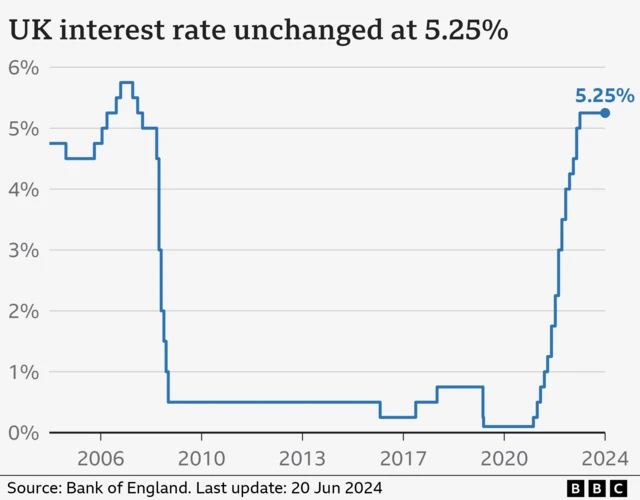

We are coming to the end of our coverage of the Bank of England's decision to hold interest rates at 5.25%.

As we have been reporting, the decision was a close-run thing and the bank has opened the door to cutting interest rates in August. That would be the first drop in borrowing costs for more than four years.

You can read more from economics editor Faisal Islam and business reporter Dearbail Jordan here.