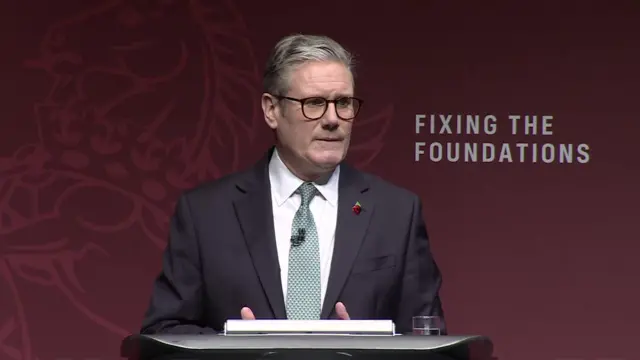

Every decision made with working people in mind - Starmerpublished at 11:23 GMT 28 October 2024

After an introduction by Richard Parker, the mayor of the West Midlands, the prime minister takes to the stage.

Sir Keir Starmer says it's great to be in Birmingham, a city at the heart of the government's plans for growth.

It is reasonable desire to want a better future for your family, he says, which is what has become the driving purpose of this government.

Starmer says trust can only be earned through actions, and that every decision will be made with working people in mind.