Bank of England cuts rates - and governor welcomes US-UK trade deal newspublished at 14:15 British Summer Time 8 May

Owen Amos

Owen Amos

Live page editor

It has been a busy two hours of economic news - here's what you need to know:

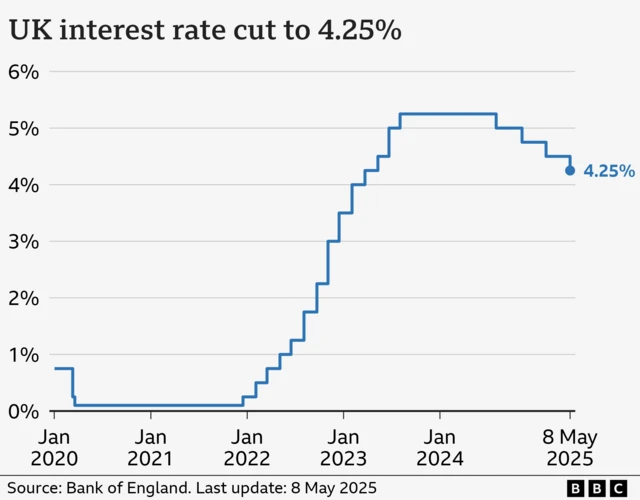

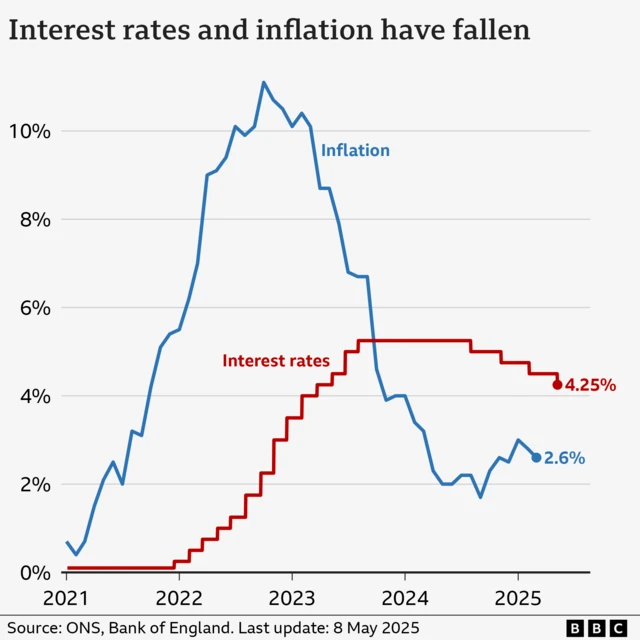

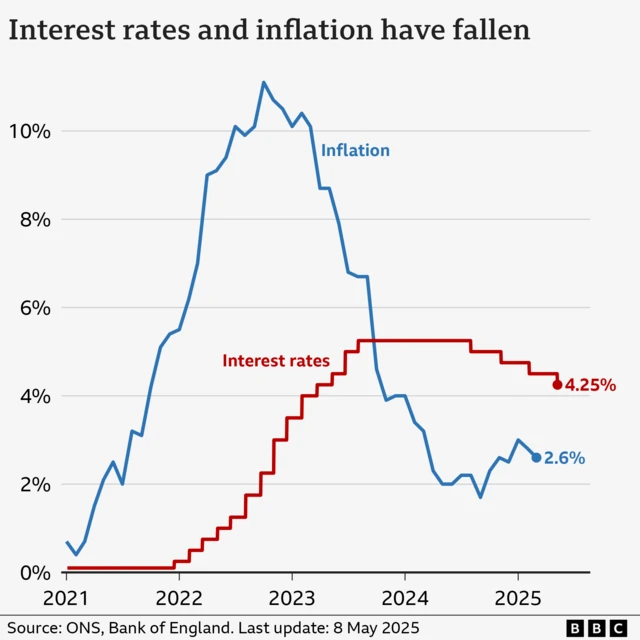

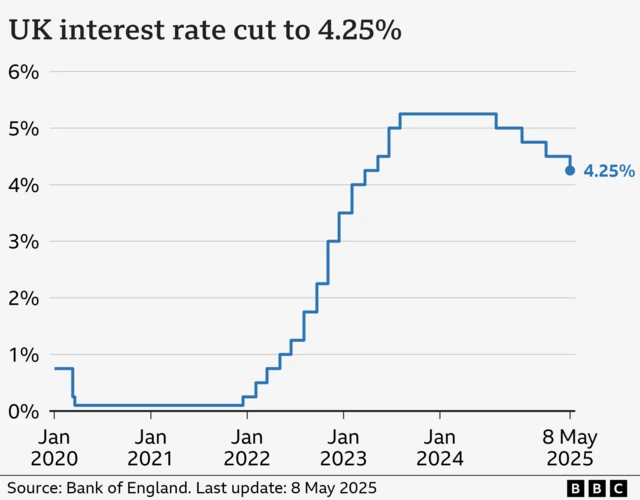

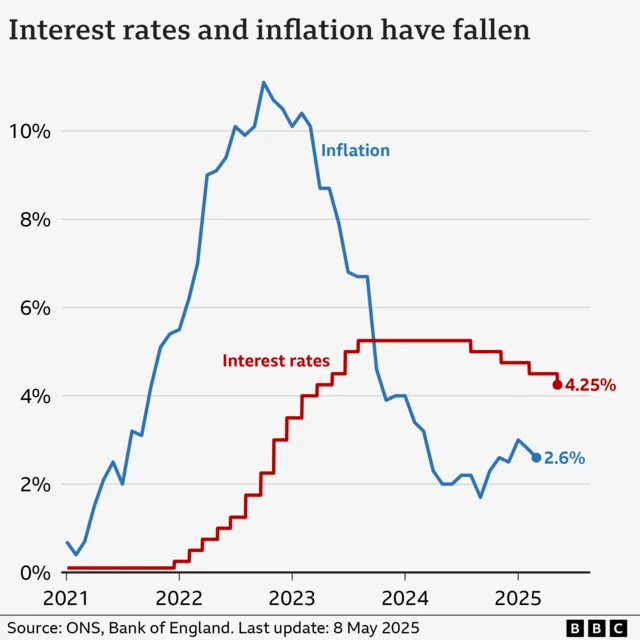

- At 12:02 BST, the Bank of England cut its base rate to 4.25%, from 4.5%

- The cut was expected, but the Bank's nine-person Monetary Policy Committee was divided

- Five voted for the cut to 4.25%, two wanted a bigger cut to 4.0%, while two wanted no change

- The Bank's governor, Andrew Bailey, says lower inflation is behind the cut, but warns inflation will increase this year

- Bailey also welcomes news of a new US-UK trade - although says he wasn't briefed on the details

We're closing our live coverage now - but for all the details, here's our main news story, while our interest rate explainer is here.

And as for that US-UK deal - being announced in the US in the next hour - our live coverage is here.