Fuel and food prices drive unexpected jump in inflation to 3.6%published at 09:41 BST 16 July

Image source, EPA

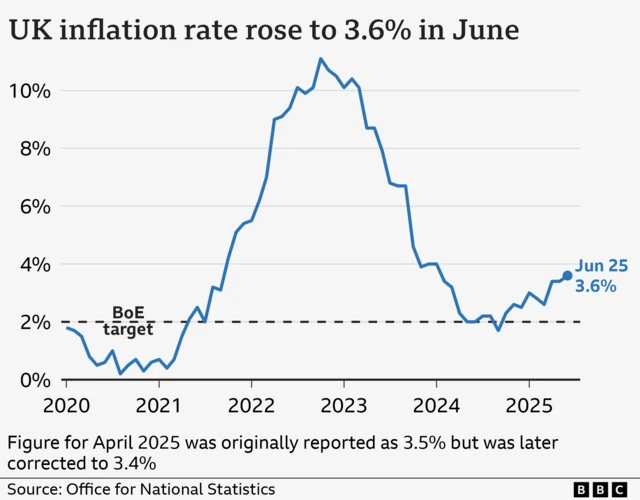

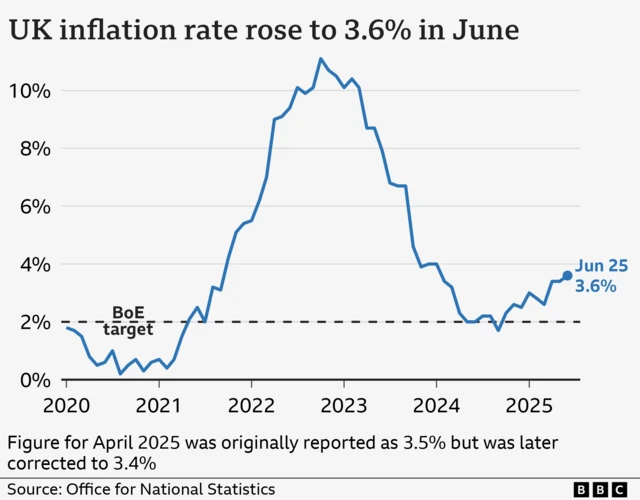

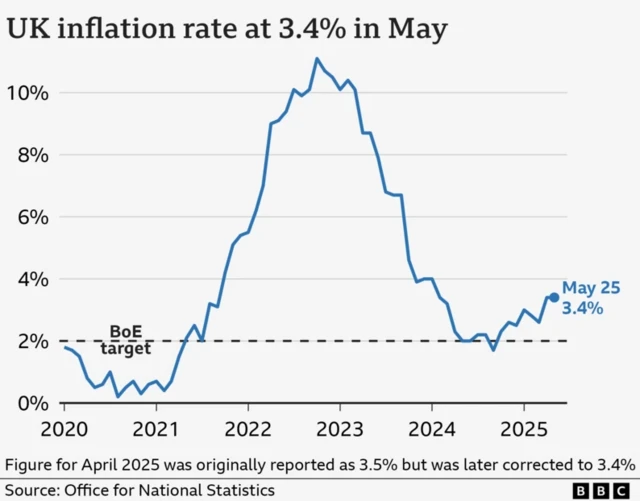

Image source, EPAThe UK's inflation rate has risen to 3.6% in the year to June, up from 3.4% in May, according to the Office for National Statistics - higher than economists had expected.

The unexpected inflation jump was mainly driven by motor fuel costs - which did not fall as much as they did this time last year - and food price inflation, which rose for the third month in a row.

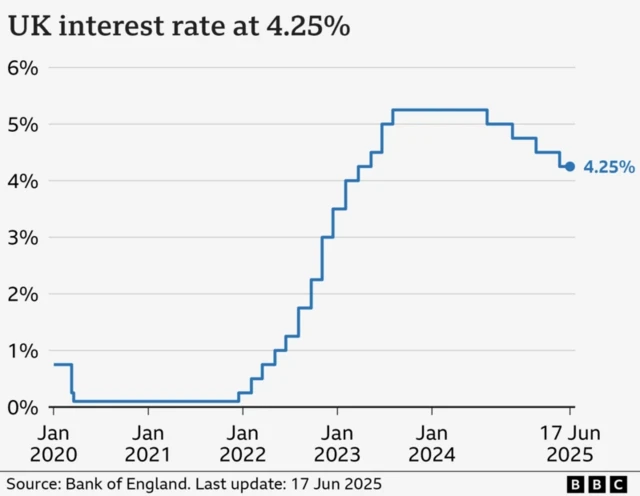

Despite the rise, our business correspondent writes the Bank of England is "still widely expected to cut interest rates later" - here's how inflation impacts interest rates.

The rate prompted reaction from politicians, businesses and people across the UK:

- Chancellor Rachel Reeves said "there is more to do" and she is determined to "deliver on our Plan for Change to put more money into people’s pockets"

- Shadow chancellor Mel Stride said the rise in inflation is "deeply worrying for families" before blaming Labour for its decision to "tax jobs and ramp up borrowing"

- The chief UK economist at Capital Economics said the UK still has an "inflation problem" while economics director at the Institute of Chartered Accountants in England and Wales warned the recent rate rise is the "start of a slight summer surge in inflation"

- A grocery business in Northern Ireland warned there will be "no respite for the consumer" as the author of a low-cost recipe book said it is no longer possible to feed the family for £20 a week

We're ending our live coverage but you can stay across this story on BBC News.