Bank says inflation has 'peaked' as it holds interest rates at 4%published at 13:56 GMT

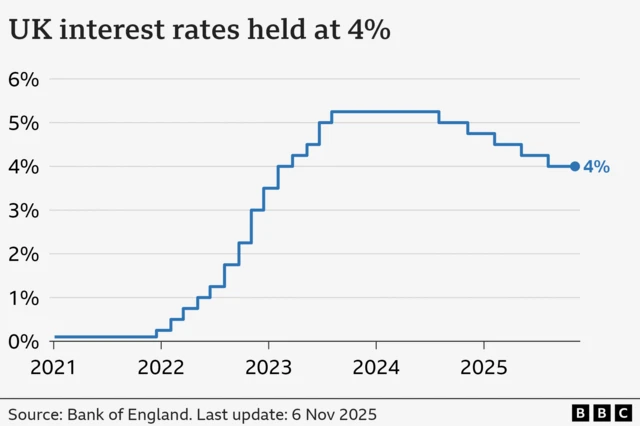

Let's recap some of the key lines from today, after the Bank of England held interest rates at 4%:

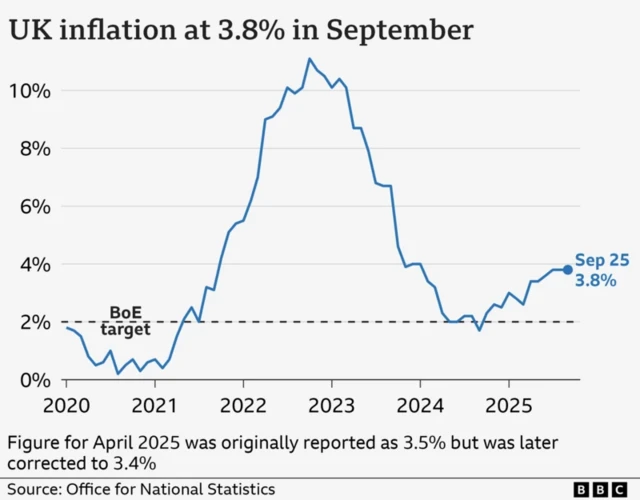

- The move did not come as a surprise. Although the inflation rate held at 3.8% in September, coming in below forecasts, most Bank watchers were not expecting a change in interest rates today

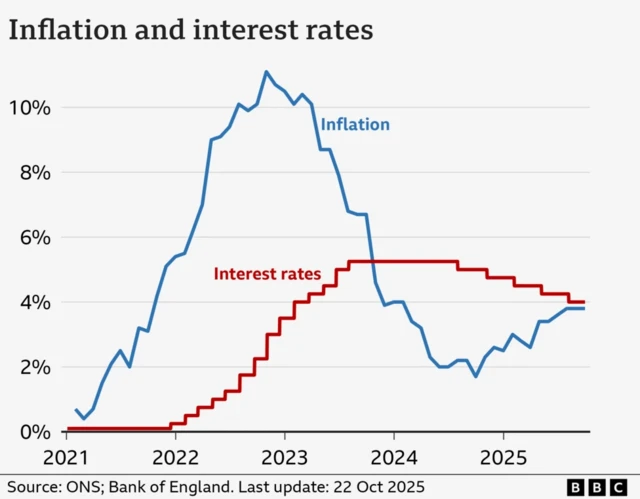

- The Bank said it judged inflation to have peaked - policymakers voted 5-4 in favour of leaving rates unchanged but said borrowing costs were "likely to continue on a gradual downward path"

- Bank governor Andrew Bailey said rather than cutting interest rates now, he would "prefer to wait and see" if price rises continued to ease this year

- The Bank's decision comes ahead of the government's Budget on 26 November, where speculation has grown that Chancellor Rachel Reeves will raise taxes

- Reeves said the latest forecast "shows that inflation is due to fall faster than previously predicted", but shadow chancellor Mel Stride said interest rates were "staying higher for longer because Rachel Reeves does not have a plan or a backbone"

We're now wrapping up our coverage, but you read more analysis in our news story.