Low income households continue to face inflation painpublished at 09:14 BST 17 September

Dharshini David

Dharshini David

Deputy economics editor

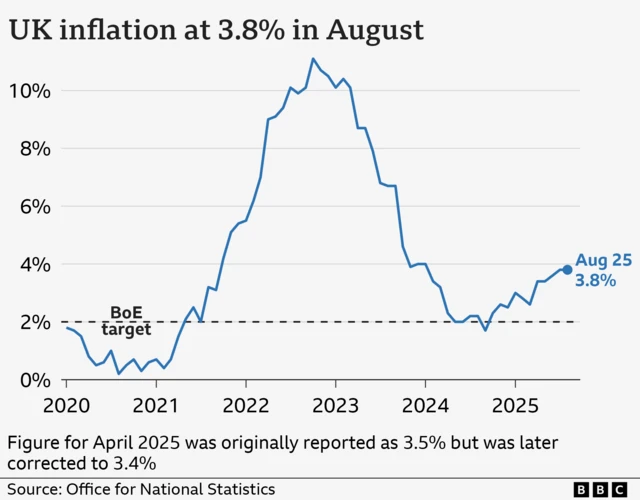

No surprises here for analysts but this morning's figures underscore the frustration many households feel.

Wages for many have risen at a faster pace than inflation - but even for those people, they are frustrated that their money is stretching a bit less further than hoped.

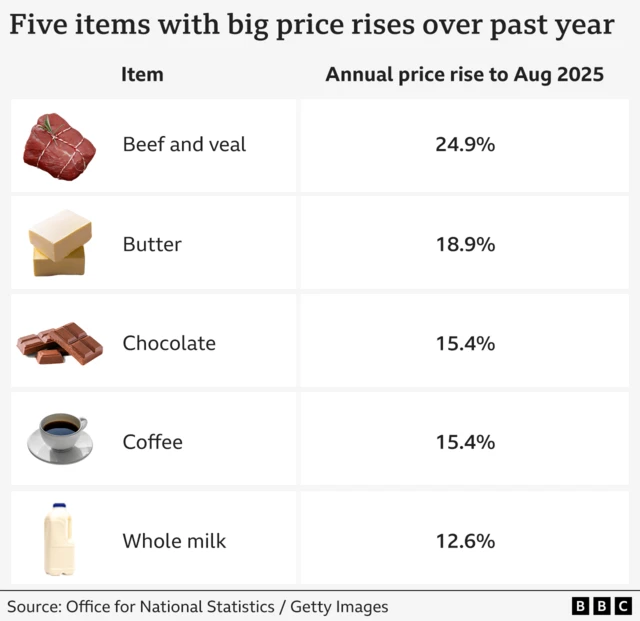

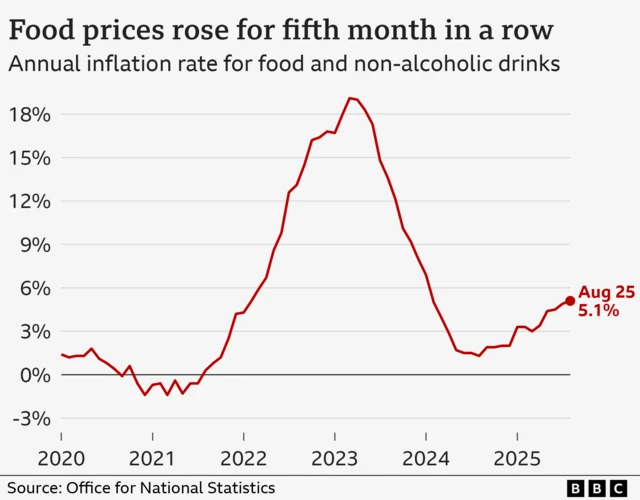

It’s particularly painful for those on lower incomes, as the resurgence of inflation has been rooted in staple products.

There’s anxiety too for homeowners or landlords, who hope that interest rate cuts later this year may be looming.

But much of the recent rise in inflation has been spurred by global commodity prices - energy and food - and many of those pressures are subsiding.

One factor that has led to food inflation outstripping rates in Europe is government policy.

The Bank of England are among economists who’ve suggested that measures such as higher National Insurance Contributions and minimum wages may have added more than 1% to food prices, while adding to cost pressures elsewhere.

Those too should pass - but could there be more? The boss of Aldi has warned that more price rises may loom, depending on Budget measures.

The government says the Budget will help to ease the cost of living pressures on consumers and businesses - we will have to wait to see exactly what that means.

We're ending our live coverage of today's inflation news but you can read our full report here.