Pause in tariffs as US and China set to continue negotiationspublished at 19:10 British Summer Time 12 May

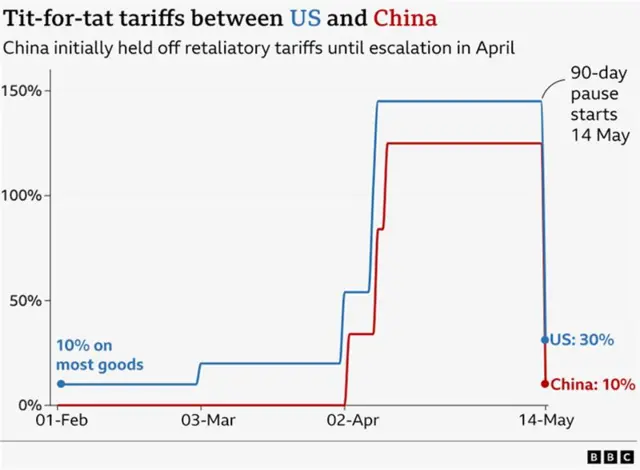

Following months of back-and-forth tariff escalation, US and Chinese officials announced this morning that they would reduce levies on each other's goods for 90 days and start a new round of trade negotiations.

Both sides are set to slash tariffs starting from Wednesday - with US tariffs on Chinese products falling to 30% and China's reciprocal tariffs on the US falling to 10%. You can read more about the deal in our earlier post.

The announcement gave global stock markets a boost, with US markets in particular seeing a significant surge. This follows major losses after Trump's initial "Liberation Day" tariff announcement last month.

Our New York Business Correspondent Natalie Sherman reports that the share prices for companies bringing goods from China are, unsurprisingly, going up.

Later in the day, Trump struck a triumphant tone in a statement from the White House, during which he said his administration had achieved a "total reset with China".

The US president described relations between the two countries as "very good" and said he did not expect US tariffs on Chinese imports to return to 145% after pause.

In Beijing, though, the mood is more sombre with Chinese businesses telling the BBC they expect more tariffs in the future.

We're ending our live coverage for the day. For more on the day's developments: What does the US-China tariff deal mean?

Update 8 July: This post was amended to delete a reference to the percentage reduction which was inaccurate

Image source, Reuters

Image source, Reuters