A calm after the stormpublished at 18:02 GMT 28 January

Mitchell Labiak

BBC Business reporter

It's just gone past 13:00 in New York (18:00 GMT) and the US stock market seems to have calmed after yesterday's sell off.

Some investors clearly feel the reaction to the sudden rise in popularity of Chinese AI app DeepSeek was overdone, so they have been buying shares in the firms that sank.

But the rebound has not been felt equally by everyone.

Microsoft has climbed over 2% today to higher than it was before Monday's sell off.

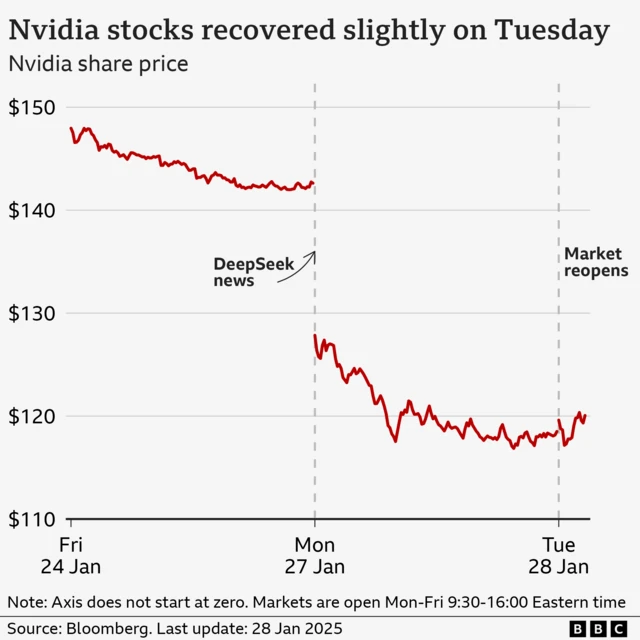

Meanwhile, though Nvidia climbed 6% today, it is still far off from recovering the value it lost yesterday - which was the biggest single-day loss in Wall Street history.

Trading on the US stock market should return to normal from tomorrow after two days of reaction to DeepSeek.

This is partly because markets are quick to react and speedily re-value stocks based on new information but also because DeepSeek has "gone quiet".

It has entered "holiday mode", according to the South China Morning Post, for the Lunar New Year holiday.

That's all for our live coverage, thank you for joining us.