What does this mean for you and your money?published at 15:27 GMT 6 February

Kevin Peachey

Kevin Peachey

Cost of living correspondent

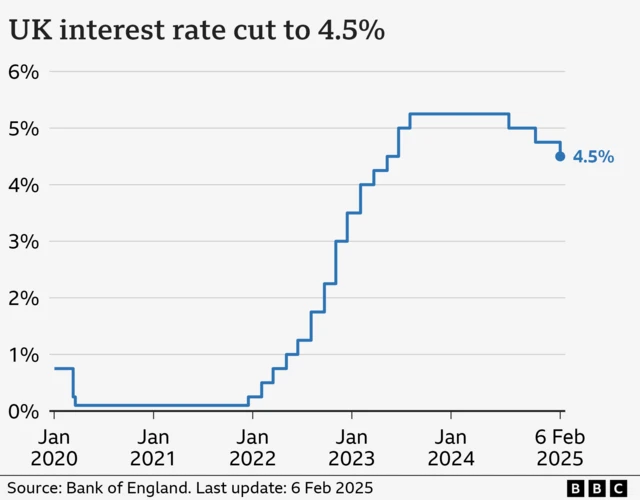

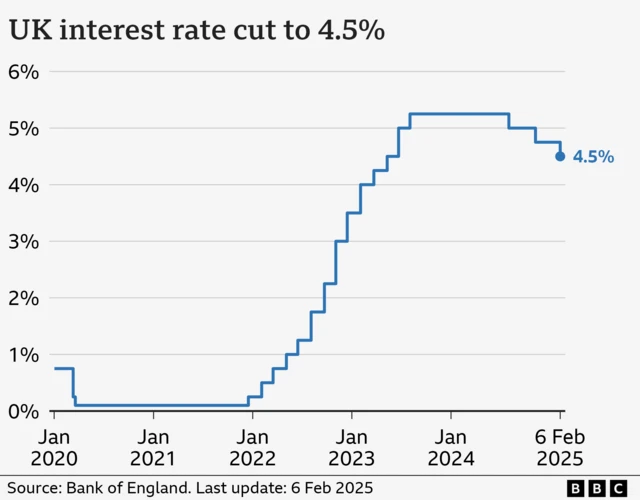

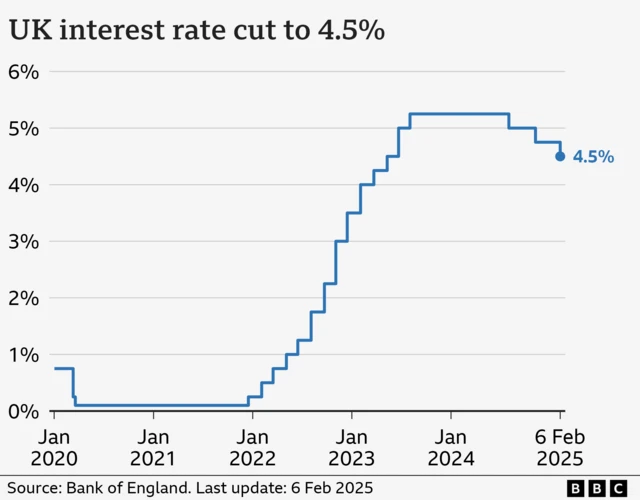

Andrew Bailey says the UK economy is facing some bumps in the road - but to ordinary billpayers they'll seem more like bollards.

Rising water bills and the prospect of higher domestic energy prices will be a worry as people continue to juggle their finances.

Even though mortgage rates may fall, a huge number of people re-mortgaging still won't get as good a fixed deal as their current rate.

The silver lining to these clouds is that Bailey says higher inflation is only temporary, and the broader trend is a slowdown in the rate of rising prices.

He also pointed to earnings rising - although it is worth noting benefit payments will see a comparatively smaller increase in April.

Overall, he says the impact of what's happening on the cost of living "concerns" him, but fears may now be heightened among those without any wriggle room in their financial situation.