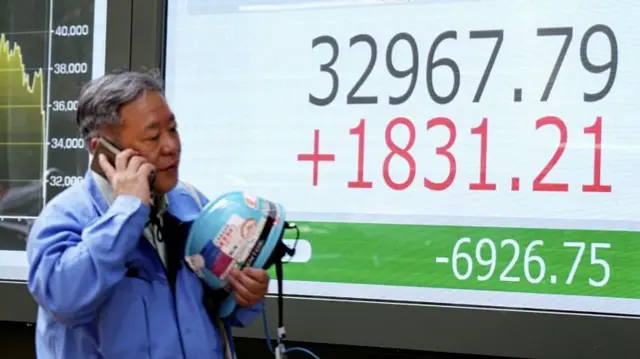

How Asia-Pacific markets are tradingpublished at 04:20 BST 10 April

Let's take a look at where stock markets are trading today in the Asia-Pacific region.

Shares are holding on to this morning's gains, with less than an hour until new Chinese tariffs on the US are due to take effect.

Here's where markets currently stand:

- Nikkei 225 (Japan) +8.3%

- Kospi (South Korea) +5.6%

- Shanghai Composite (China) +1%

- Hang Seng (Hong Kong) +2.6%

- Taiex (Taiwan) +9.2%

- ASX200 (Australia) +4.6%