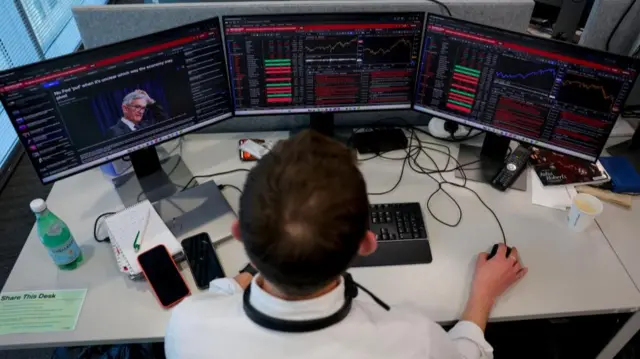

Most major Asia-Pacific markets make gains after Monday's slumppublished at 03:17 BST 8 April

Let's take a look at how major Asia-Pacific stock markets are trading this morning.

In short, most of them are up after yesterday's plunges, with the notable exceptions of mainland China, Taiwan, and Singapore.

- Shanghai Composite (China) -0.2%

- Nikkei 225 (Japan) +6.6%

- Hang Seng (Hong Kong) +1.7%

- Kospi (South Korea) +1.5%

- ASX 200 (Australia) +1.5%

- STI (Singapore) -2.2%

- TWI (Taiwan) -3.8%