Millions denied car finance payouts after Supreme Court rulingpublished at 19:13 BST 1 August

Adam Goldsmith

Adam Goldsmith

Live reporter

Image source, Getty Images

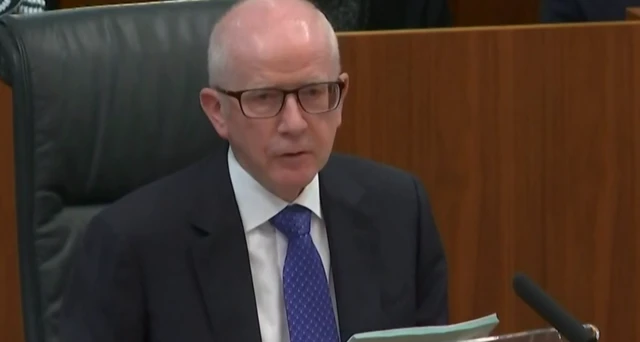

Image source, Getty ImagesThe UK Supreme Court has today ruled that lenders won’t have to pay compensation to millions of motorists over car finance loans.

In a nutshell, today’s case focused on whether or not car dealers had a duty to act in the interests of car buyers when selling a car on finance.

Reversing the decision of the Court of Appeal, Dearbail Jordan describes how the judges ruled on matters of fairness when car dealers receive commission from lenders.

One case study claimant was successful; Marcus Johnson tells BBC Wales that while he's pleased for himself, he is worried for others.

That's because, as our business correspondent writes, today’s ruling is now likely to reduce the scope for very large scale claims for compensation from millions of motorists.

There will still be some compensation awarded to car buyers - the Financial Conduct Authority says it is now deciding quickly on a potential redress scheme before Monday morning.

For now, if you think that you may be entitled to compensation, Money Saving Expert Martin Lewis has one piece of advice: “Do nothing” until a scheme is set up.

We’re ending our live coverage here for now, but our newsstory has all the details of what today’s Supreme Court judgement means for motorists.