India and Pakistan accuse each other of 'violations' after ceasefire dealpublished at 21:36 BST 10 May

We're pausing our live coverage of the India-Pakistan conflict, but you can stay across further updates in our main news story. In the meantime, here's what you need to know from the last few hours:

- Posting on his Truth Social platform, Donald Trump said a US-brokered ceasefire between India and Pakistan had been agreed to

- Pakistan's foreign minister then confirmed the agreement - he added that "three dozen countries" were involved in the talks

- BBC teams in Indian-administered Kashmir later reported hearing sounds of explosions in the region - it's still unclear where these are coming from

- Not long after, India's Foreign Secretary Vikram Misri said there had been "repeated violations of the understanding" the two countries had reached earlier

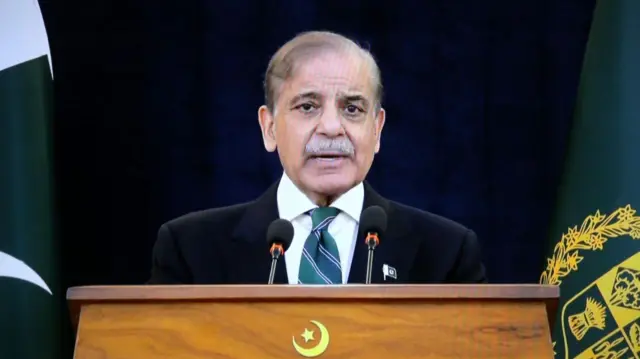

- In an address to the nation, Pakistan's Prime Minister Shehbaz Sharif hailed the "historical victory" of the ceasefire but maintained that Pakistan "will do anything for our defence"

- Pakistan's foreign ministry then accused India of "violations", but said it is committed to the ceasefire - Pakistan's forces are "handling the situation with responsibility and restraint", the FM added