'We welcome the Renters' Rights Act - but it's a half solution'published at 15:03 GMT

Image source, Jessica Ure/BBC

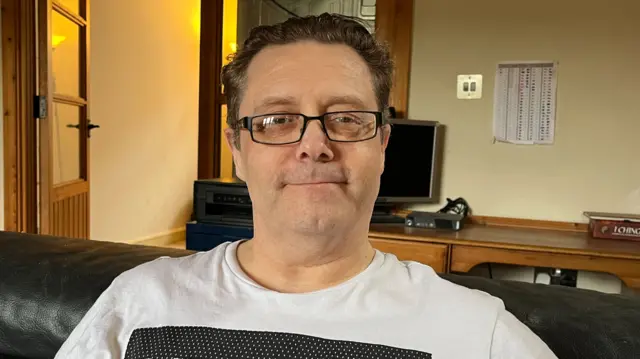

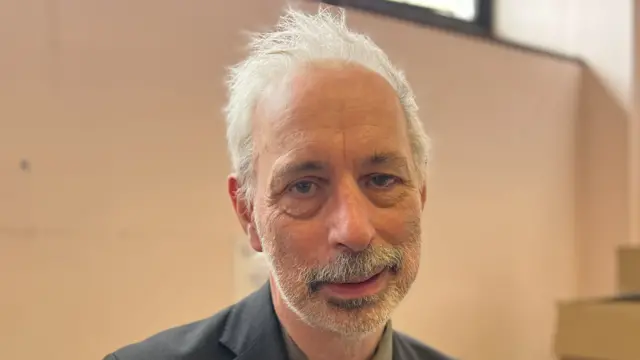

Image source, Jessica Ure/BBCAngus King, a housing solicitor from Southwark Law Centre, says solicitors are being overrun

"When I began my career, up until a few years ago, I would think to myself 'that person won't actually end up homeless'," says Angus King, a housing solicitor from Southwark Law Centre.

"I knew we would find some way to keep them from it, but now that simply isn't the case."

He says the absence of free legal aid for housing, unaffordable rents in London and a chronic lack of housing are all contributing factors.

"Even when an authority is obligated, often they cannot find the accommodation," says Angus.

"Families can be waiting for years, and very vulnerable people too".

Of the court work his centre does, he adds: "We are at capacity, we are completely overrun".

"We do welcome the Renters' Rights Act, external, but without the supply of social housing and the lack of rent controls, it could actually make things worse, with landlords withdrawing from the market and nothing to replace it.

"It's a half solution."