How much money does corporation tax raise?published at 13:58 GMT 18 November 2019

The Conservatives plan to postpone a corporation tax cut

Tom Edgington

Tom Edgington

BBC Reality Check

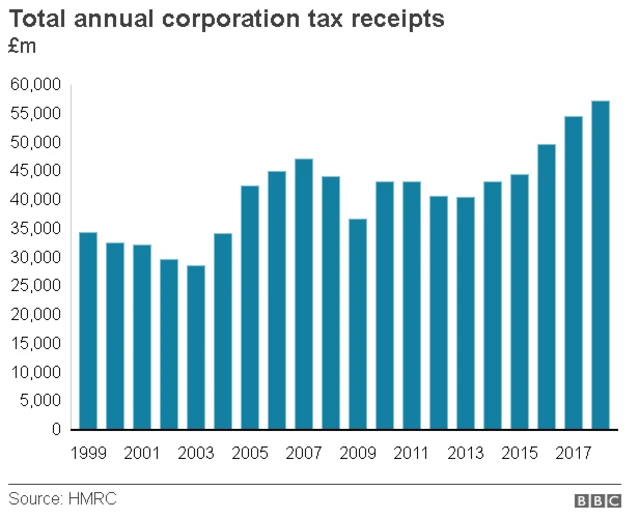

Corporation tax is paid by businesses on their profits in the UK. It's an important revenue-raiser, making up approximately 9% of the UK government's total tax take, external.

Since 2010, corporation tax has fallen from 28% to the current rate of 19%. However, Mr Johnson says a planned cut to 17% in April won't happen if the Conservatives win the election. The PM says the move would have cost the government about £6bn a year.

This estimate appears to be based on an official costing, external, produced by HM Revenue & Customs.

Before Monday's announcement, the Conservatives had been arguing that corporation tax cuts could lead to more government income.

During this summer's leadership contest, for example, Mr Johnson said: "Every time corporation tax is cut in this country it has produced more revenue."

Actually, that's not always the case. The amount raised in the two years following April 2008's rate cut actually fell, for example.

It is true that corporation tax revenue has risen by about two-thirds since 2010, despite further cuts to the headline rate. But the independent Institute for Fiscal Studies says that is unsurprising given that 2010 represented the trough of the financial crisis.

Since then firms have become more profitable, resulting in additional corporation tax revenue for government.