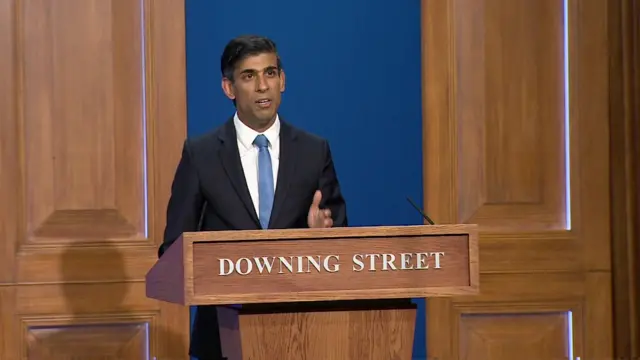

We have to be honest about costs of NHS, says chancellorpublished at 16:22 BST 7 September 2021

Sunak says the tax plans are fair, honest and "not a stealth tax".

He says they are legally ring-fenced with every pound going direct to health and social care.

No government wants to raise taxes, he says, but these are "extraordinary times and we face extraordinary circumstances".

He says the principle that the NHS is free at the point of use and funded by general taxation has wide support.

"If we are serious about defending this principle in a post-Covid world we have to be honest about the costs that brings," he says.