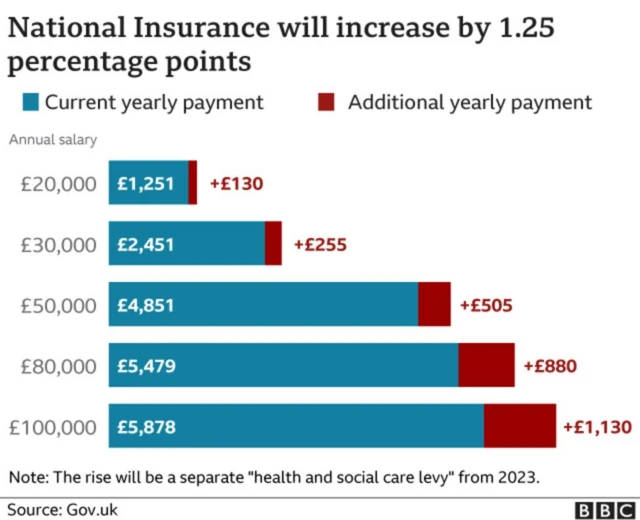

How much will the new tax cost me?published at 10:41 BST 8 September 2021

As we've been reporting, a new health and social care tax is being introduced to help the NHS recover from the Covid pandemic and improve social care in England.

But there has been criticism - including from within the Conservative Party - that it will be unfair on younger people.

The Resolution Foundation says the tax rises won't be paid by some rich retirees and will prioritise wealthy landlords over their tenants.

But the government has said people will no longer be forced to sell their own homes during their lifetime and or face "catastrophic" costs.

So what will it cost you? Read more here.