What's in the Budget for pensioners this winter?published at 12:27 BST 28 October 2021

Sandie Parkin asks...

Kevin Peachey

Kevin Peachey

Personal finance correspondent

This was a tough Budget for pensioners, owing to the absence of specific policies for them.

We already knew that the state pension will go up by 3.1% next April. It would have been much higher had the government not decided to temporarily end its triple-lock promise.

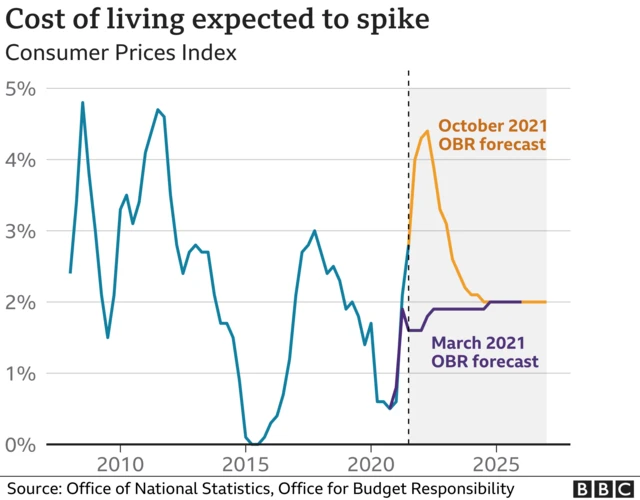

But with prices predicted to rise at a rate of 4% a year, that becomes a real-terms cut in income. Also, the chancellor chose not to extend current support for low-income pensioners with their energy bills.