Sunak's measures will feel like 'small beer' to lowest earners - IFSpublished at 14:31 GMT 23 March 2022

Paul Johnson from the IFS said a lot of households would be "significantly worse off over the next year"

Further reaction now to Chancellor Rishi Sunak's Spring Statement.

Economist Paul Johnson, director of the Institute for Fiscal Studies think tanks, tells the BBC the measures announced today by the chancellor will feel like "small beer" for people on the lowest incomes.

"The thing that was completely missing from this was anything for people on universal credit or state pension," he says.

"That's only going up by 3.1% next month, when inflation will probably be around 8% - so that's going to be a big cut in living standards for those on the very lowest incomes.

"The rest of what he's done, if you put together what he did in February with what he announced today, it really is quite a big package, but unfortunately for him and for our living standards that's undone by the fact we've got this big National insurance rise coming in as well.

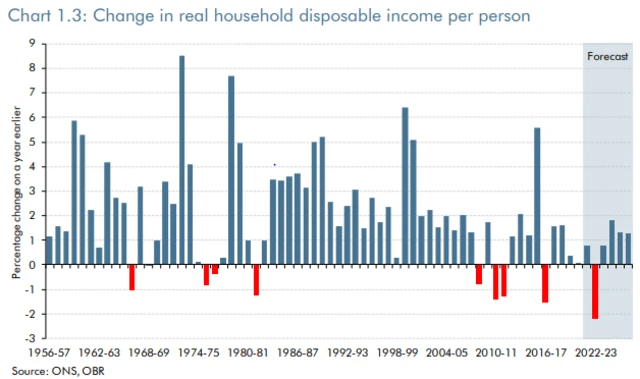

"So you put all of that together and there's still going to be a lot of households that are significantly worse off over the next year.

"But what he has done this time round is reduce that impact for low and middle-earners."