Minister challenged on cost of government borrowingpublished at 14:52 BST 11 October 2022

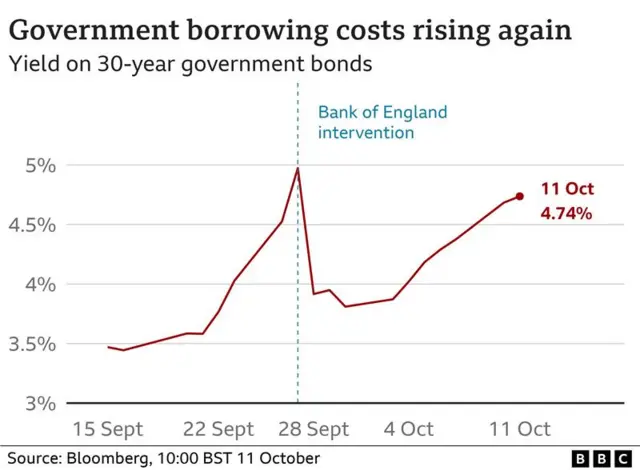

Shadow chief secretary to the Treasury Pat McFadden asks how much more government borrowing will cost next year as a result of the mini-budget.

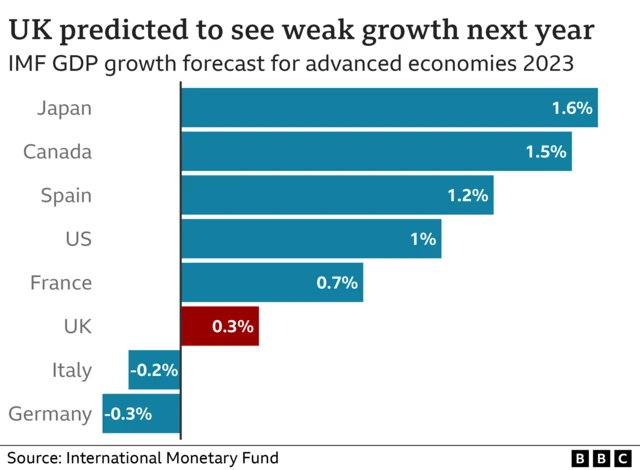

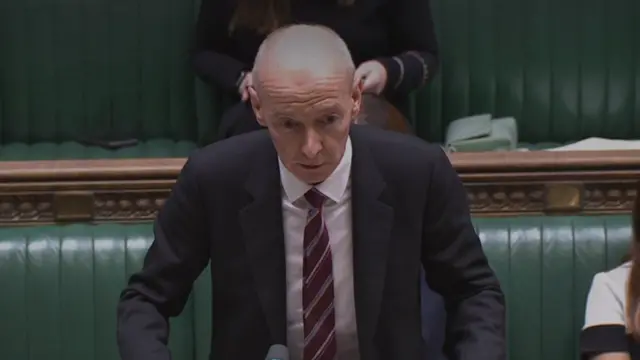

Financial Secretary to the Treasury Andrew Griffith responds: "We're seeing interest rates rise in every major economy.

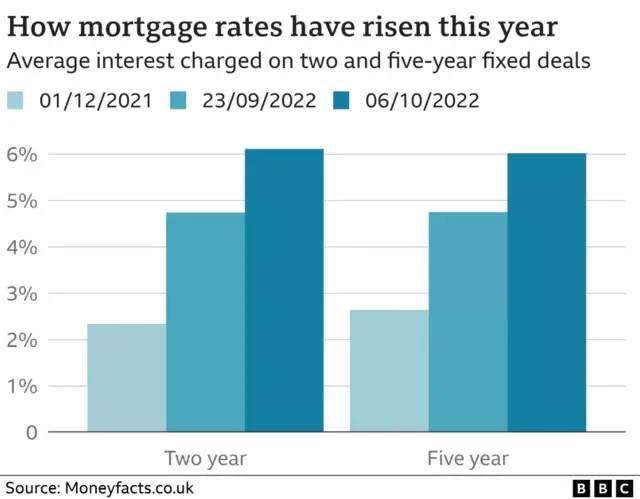

"What's more important is that we are protecting households and consumers through the difficult winter ahead."